Evotec ESG Presentation Deck

evotec

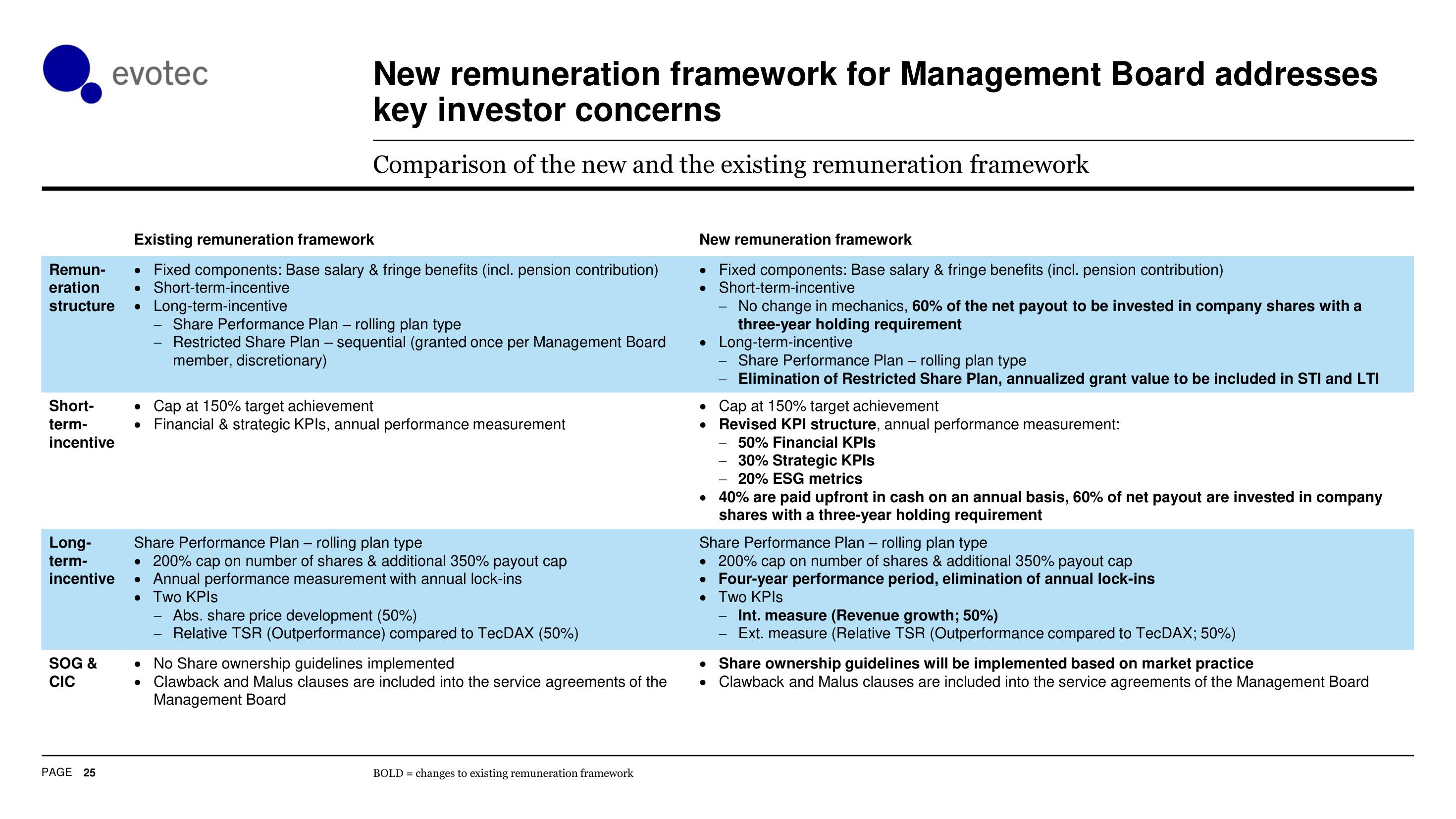

Existing remuneration framework

●

Remun-

Fixed components: Base salary & fringe benefits (incl. pension contribution)

eration • Short-term-incentive

structure ●

Long-term-incentive

Short-

term-

incentive

Long-

term-

incentive

SOG &

CIC

PAGE 25

New remuneration framework for Management Board addresses

key investor concerns

Comparison of the new and the existing remuneration framework

●

Share Performance Plan - rolling plan type

Restricted Share Plan – sequential (granted once per Management Board

member, discretionary)

Cap at 150% target achievement

Financial & strategic KPIs, annual performance measurement

Share Performance Plan - rolling plan type

• 200% cap on number of shares & additional 350% payout cap

• Annual performance measurement with annual lock-ins

• Two KPIs

Abs. share price development (50%)

Relative TSR (Outperformance) compared to TecDAX (50%)

No Share ownership guidelines implemented

Clawback and Malus clauses are included into the service agreements of the

Management Board

BOLD= changes to existing remuneration framework

New remuneration framework

Fixed components: Base salary & fringe benefits (incl. pension contribution)

• Short-term-incentive

No change in mechanics, 60% of the net payout to be invested in company shares with a

three-year holding requirement

• Long-term-incentive

●

-

• Cap at 150% target achievement

●

Revised KPI structure, annual performance measurement:

50% Financial KPIs

Share Performance Plan - rolling plan type

Elimination of Restricted Share Plan, annualized grant value to be included in STI and LTI

●

30% Strategic KPIs

20% ESG metrics

40% are paid upfront in cash on an annual basis, 60% of net payout are invested in company

shares with a three-year holding requirement

Share Performance Plan - rolling plan type

●

200% cap on number of shares & additional 350% payout cap

• Four-year performance period, elimination of annual lock-ins

•

Two KPIs

Int. measure (Revenue growth; 50%)

Ext. measure (Relative TSR (Outperformance compared to TecDAX; 50%)

Share ownership guidelines will be implemented based on market practice

Clawback and Malus clauses are included into the service agreements of the Management BoardView entire presentation