Lotus Cars SPAC Presentation Deck

INDICATIVE TRANSACTION TERMS AND STRUCTURE

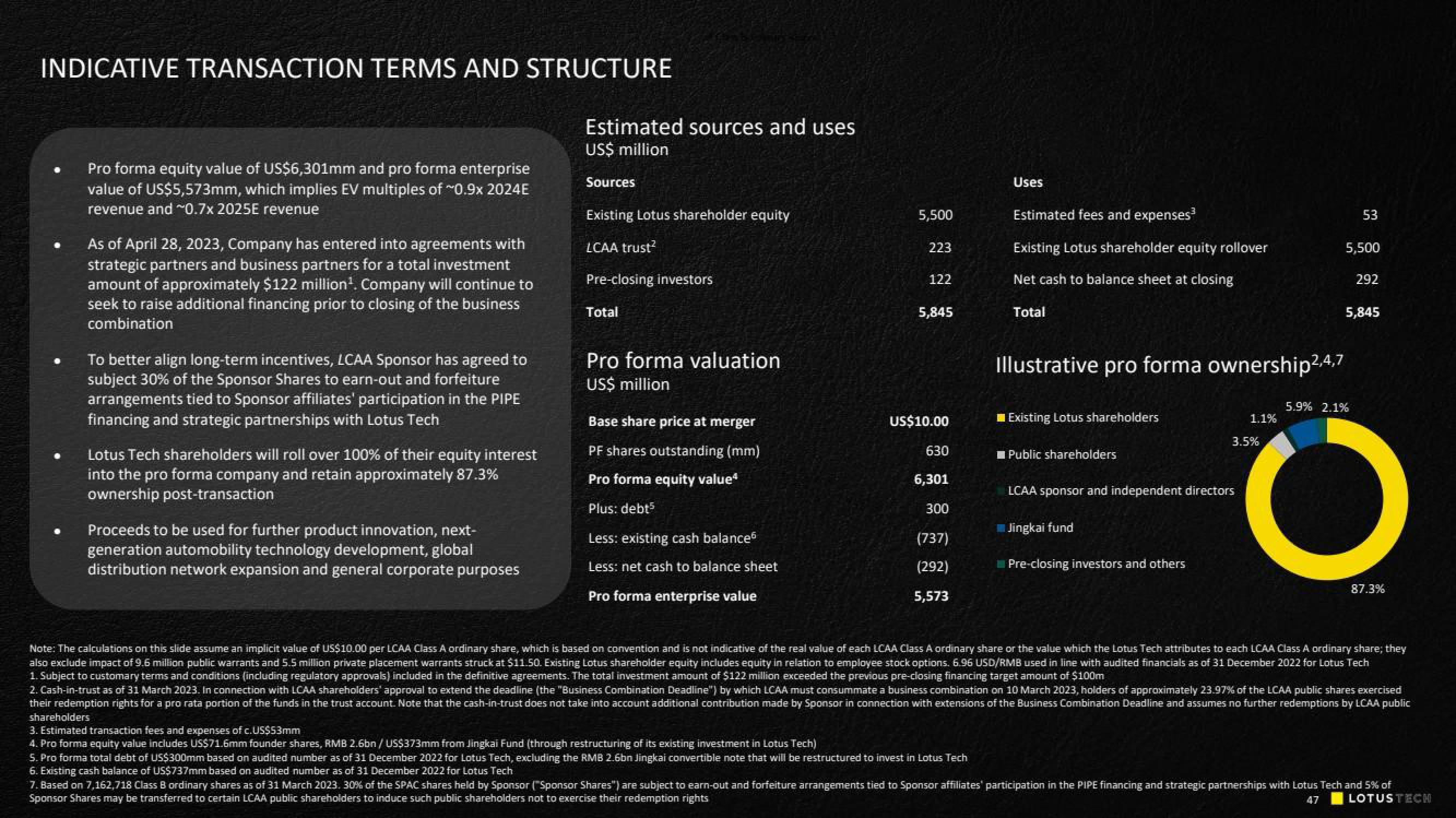

Pro forma equity value of US$6,301mm and pro forma enterprise

value of US$5,573mm, which implies EV multiples of 0.9x 2024E

revenue and ~0.7x 2025E revenue

As of April 28, 2023, Company has entered into agreements with

strategic partners and business partners for a total investment

amount of approximately $122 million¹. Company will continue to

seek to raise additional financing prior to closing of the business

combination

To better align long-term incentives, LCAA Sponsor has agreed to

subject 30% of the Sponsor Shares to earn-out and forfeiture

arrangements tied to Sponsor affiliates' participation in the PIPE

financing and strategic partnerships with Lotus Tech

Lotus Tech shareholders will roll over 100% of their equity interest

into the pro forma company and retain approximately 87.3%

ownership post-transaction

Proceeds to be used for further product innovation, next-

generation automobility technology development, global

distribution network expansion and general corporate purposes

Estimated sources and uses

US$ million

Sources

Existing Lotus shareholder equity

LCAA trust²

Pre-closing investors

Total

Pro forma valuation

US$ million

Base share price at merger

PF shares outstanding (mm)

Pro forma equity value*

Plus: debt5

Less: existing cash balance

Less: net cash to balance sheet

Pro forma enterprise value

5,500

223

122

5,845

US$10.00

630

6,301

300

(737)

(292)

5,573

Uses

Estimated fees and expenses³

Existing Lotus shareholder equity rollover

Net cash to balance sheet at closing

Total

Illustrative pro forma ownership2,4,7

Existing Lotus shareholders

Public shareholders

LCAA sponsor and independent directors

Jingkai fund

Pre-closing investors and others

1.1%

3.5%

53

5,500

5.9% 2.1%

292

5,845

87.3%

Note: The calculations on this slide assume an implicit value of US$10.00 per LCAA Class A ordinary share, which is based on convention and is not indicative of the real value of each LCAA Class A ordinary share or the value which the Lotus Tech attributes to each LCAA Class A ordinary share; they

also exclude impact of 9.6 million public warrants and 5.5 million private placement warrants struck at $11.50. Existing Lotus shareholder equity includes equity in relation to employee stock options. 6.96 USD/RMB used in line with audited financials as of 31 December 2022 for Lotus Tech

1. Subject to customary terms and conditions (including regulatory approvals) included in the definitive agreements. The total investment amount of $122 million exceeded the previous pre-closing financing target amount of $100m

2. Cash-in-trust as of 31 March 2023. In connection with LCAA shareholders' approval to extend the deadline (the "Business Combination Deadline") by which LCAA must consummate a business combination on 10 March 2023, holders of approximately 23.97% of the LCAA public shares exercised

their redemption rights for a pro rata portion of the funds in the trust account. Note that the cash-in-trust does not take into account additional contribution made by Sponsor in connection with extensions of the Business Combination Deadline and assumes no further redemptions by LCAA public

shareholders

3. Estimated transaction fees and expenses of c.US$53mm

4. Pro forma equity value includes US$71.6mm founder shares, RMB 2.6bn / US$373mm from Jingkai Fund (through restructuring of its existing investment in Lotus Tech)

5. Pro forma total debt of US$300mm based on audited number as of 31 December 2022 for Lotus Tech, excluding the RMB 2.6bn Jingkai convertible note that will be restructured to invest in Lotus Tech

6. Existing cash balance of US$737mm based on audited number as of 31 December 2022 for Lotus Tech

7. Based on 7,162,718 Class B ordinary shares as of 31 March 2023. 30% of the SPAC shares held by Sponsor ("Sponsor Shares") are subject to earn-out and forfeiture arrangements tied to Sponsor affiliates' participation in the PIPE financing and strategic partnerships with Lotus Tech and 5% of

Sponsor Shares may be transferred to certain LCAA public shareholders to induce such public shareholders not to exercise their redemption rights

LOTUSTECHView entire presentation