Allwyn Results Presentation Deck

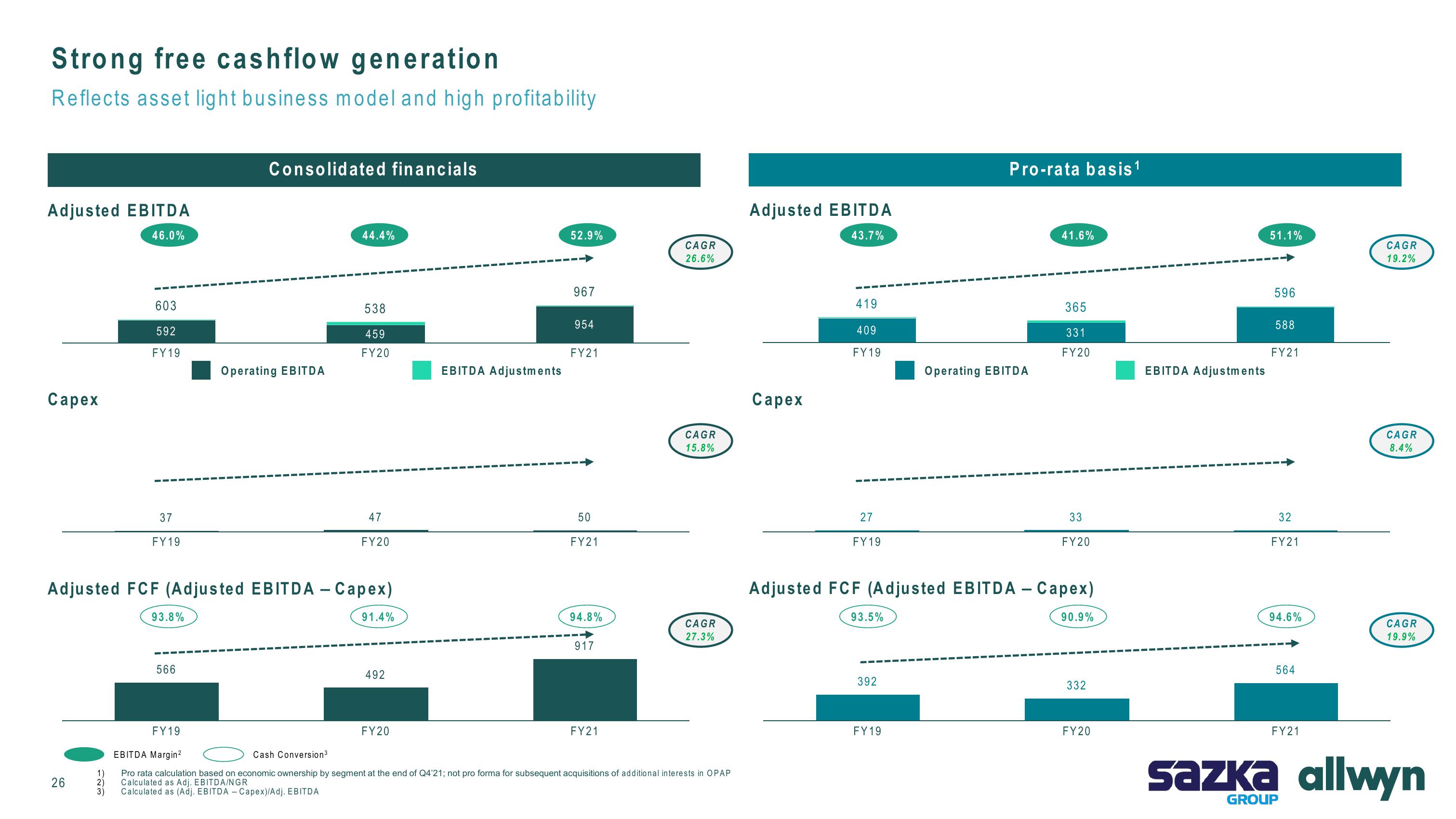

Strong free cashflow generation

Reflects asset light business model and high profitability

Adjusted EBITDA

46.0%

Capex

26

603

1)

2)

3)

592

FY 19

37

FY19

93.8%

Consolidated financials

566

Operating EBITDA

Adjusted FCF (Adjusted EBITDA - Capex)

91.4%

44.4%

538

459

FY20

47

FY20

492

FY20

EBITDA Adjustments

52.9%

967

954

FY21

50

FY21

94.8%

917

FY21

CAGR

26.6%

CAGR

15.8%

CAGR

27.3%

FY19

EBITDA Margin²

Cash Conversion³

Pro rata calculation based on economic ownership by segment at the end of Q4'21; not pro forma for subsequent acquisitions of additional interests in OPAP

Calculated as Adj. EBITDA/NGR

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

Adjusted EBITDA

43.7%

Capex

419

409

FY19

27

FY19

93.5%

392

Pro-rata basis ¹

FY 19

Operating EBITDA

41.6%

Adjusted FCF (Adjusted EBITDA - Capex)

90.9%

365

331

FY20

33

FY20

332

FY20

EBITDA Adjustments

51.1%

596

588

FY21

32

FY21

94.6%

564

FY21

CAGR

19.2%

GROUP

CAGR

8.4%

CAGR

19.9%

sazka allwynView entire presentation