First Merchants Results Presentation Deck

Highlights

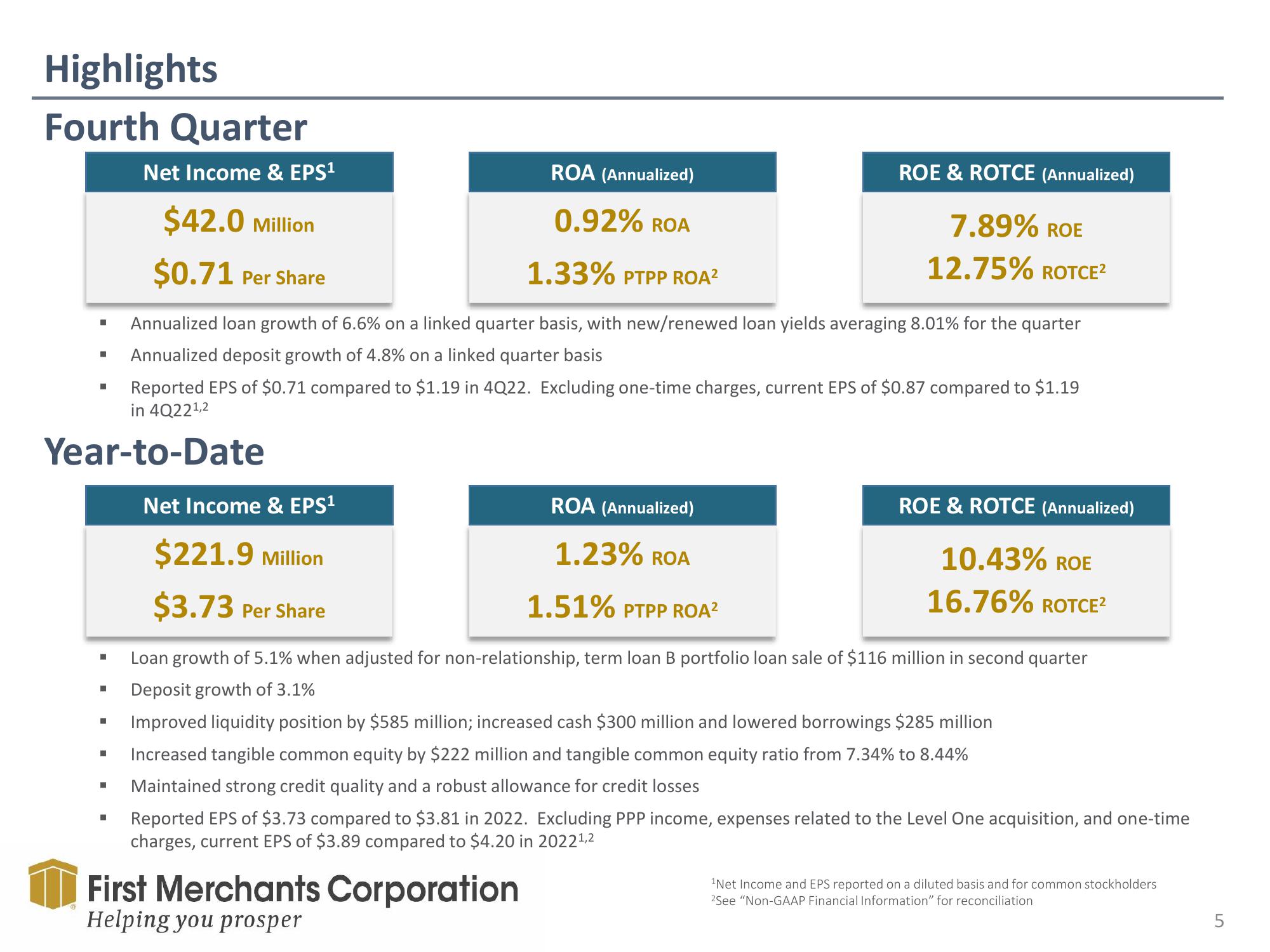

Fourth Quarter

Net Income & EPS¹

ROA (Annualized)

$42.0 Million

0.92% ROA

$0.71 Per Share

1.33% PTPP ROA²

Annualized loan growth of 6.6% on a linked quarter basis, with new/renewed loan yields averaging 8.01% for the quarter

Annualized deposit growth of 4.8% on a linked quarter basis

Reported EPS of $0.71 compared to $1.19 in 4Q22. Excluding one-time charges, current EPS of $0.87 compared to $1.19

in 4Q22¹,2

Year-to-Date

I

■

■

■

■

■

■

■

Net Income & EPS¹

$221.9 Million

$3.73 Per Share

ROA (Annualized)

1.23% ROA

First Merchants Corporation

Helping you prosper

ROE & ROTCE (Annualized)

7.89% ROE

12.75% ROTCE²

ROE & ROTCE (Annualized)

10.43% ROE

16.76% ROTCE²

1.51% PTPP ROA²

Loan growth of 5.1% when adjusted for non-relationship, term loan B portfolio loan sale of $116 million in second quarter

Deposit growth of 3.1%

Improved liquidity position by $585 million; increased cash $300 million and lowered borrowings $285 million

Increased tangible common equity by $222 million and tangible common equity ratio from 7.34% to 8.44%

Maintained strong credit quality and a robust allowance for credit losses

Reported EPS of $3.73 compared to $3.81 in 2022. Excluding PPP income, expenses related to the Level One acquisition, and one-time

charges, current EPS of $3.89 compared to $4.20 in 2022¹,2

¹Net Income and EPS reported on a diluted basis and for common stockholders

2See "Non-GAAP Financial Information" for reconciliationView entire presentation