Affirm Results Presentation Deck

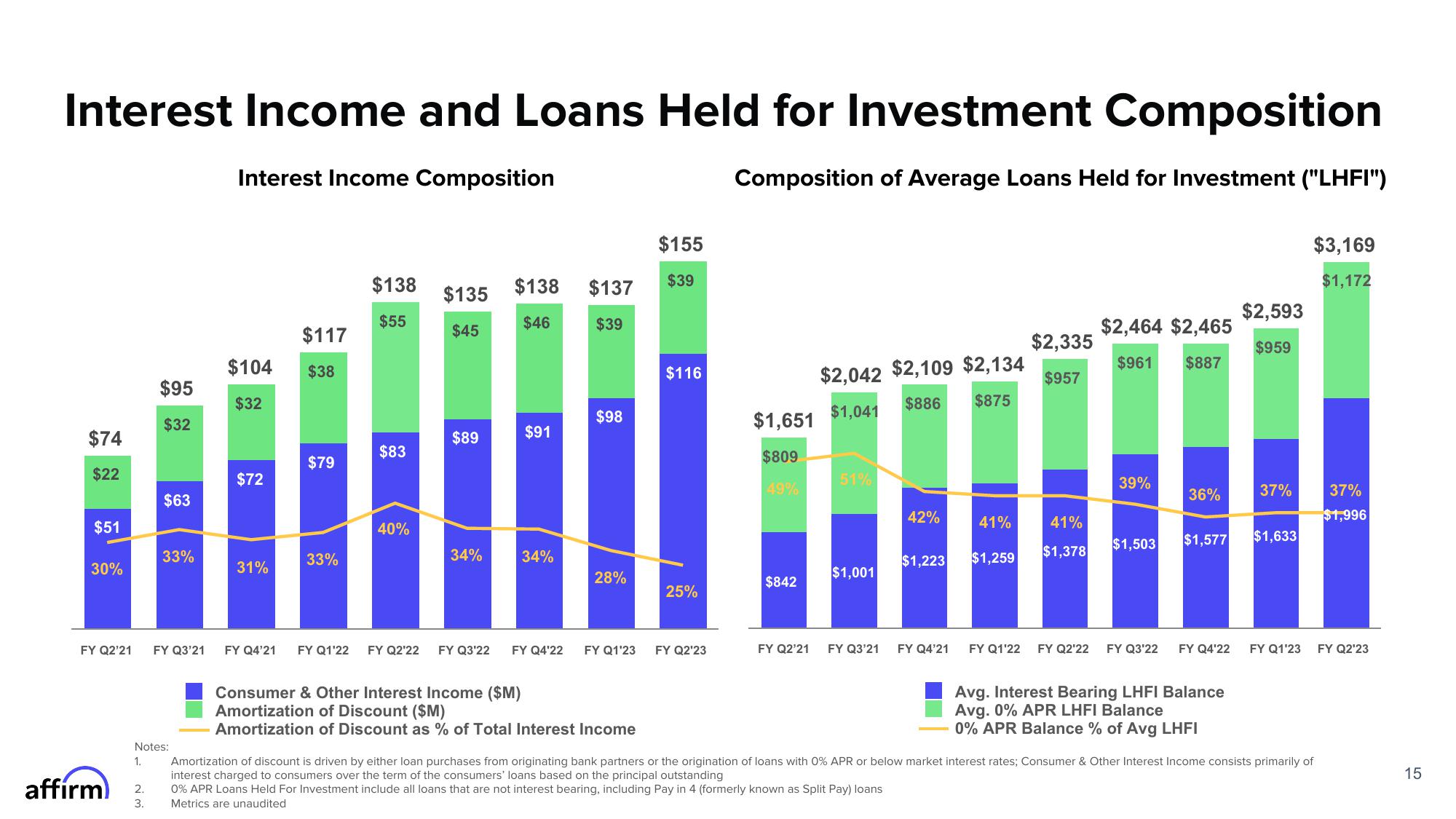

Interest Income and Loans Held for Investment Composition

Interest Income Composition

Composition of Average Loans Held for Investment ("LHFI")

$74

$22

$51

30%

affirm

$95

$32

$63

FY Q2'21 FY Q3'21

2.

3.

33%

Notes:

1.

$104

$32

$72

31%

$117

$38

$79

33%

$138

$55

$83

40%

$135

$45

$89

34%

$138

$46

$91

34%

$137

$39

$98

28%

FY Q4'21 FY Q1'22 FY Q2'22 FY Q3'22 FY Q4'22 FY Q1'23

Consumer & Other Interest Income ($M)

Amortization of Discount ($M)

Amortization of Discount as % of Total Interest Income

$155

$39

$116

25%

FY Q2'23

$1,651

$809

49%

$842

$2,042 $2,109 $2,134

$886 $875

$1,041

51%

$1,001

42%

$1,223

FY Q2'21 FY Q3'21 FY Q4'21

41%

$1,259

FY Q1'22

$2,335

$957

41%

$1,378

$2,464 $2,465

$961 $887

39%

36%

$1,503 $1,577

FY Q2'22 FY Q3'22

FY Q4'22

Avg. Interest Bearing LHFI Balance

Avg. 0% APR LHFI Balance

0% APR Balance % of Avg LHFI

$2,593

$959

37%

$1,633

$3,169

$1,172

37%

$1,996

FY Q1'23 FY Q2'23

Amortization of discount is driven by either loan purchases from originating bank partners or the origination of loans with 0% APR or below market interest rates; Consumer & Other Interest Income consists primarily of

interest charged to consumers over the term of the consumers' loans based on the principal outstanding

0% APR Loans Held For Investment include all loans that are not interest bearing, including Pay in 4 (formerly known as Split Pay) loans

Metrics are unaudited

15View entire presentation