Goldman Sachs Investment Banking Pitch Book

Goldman

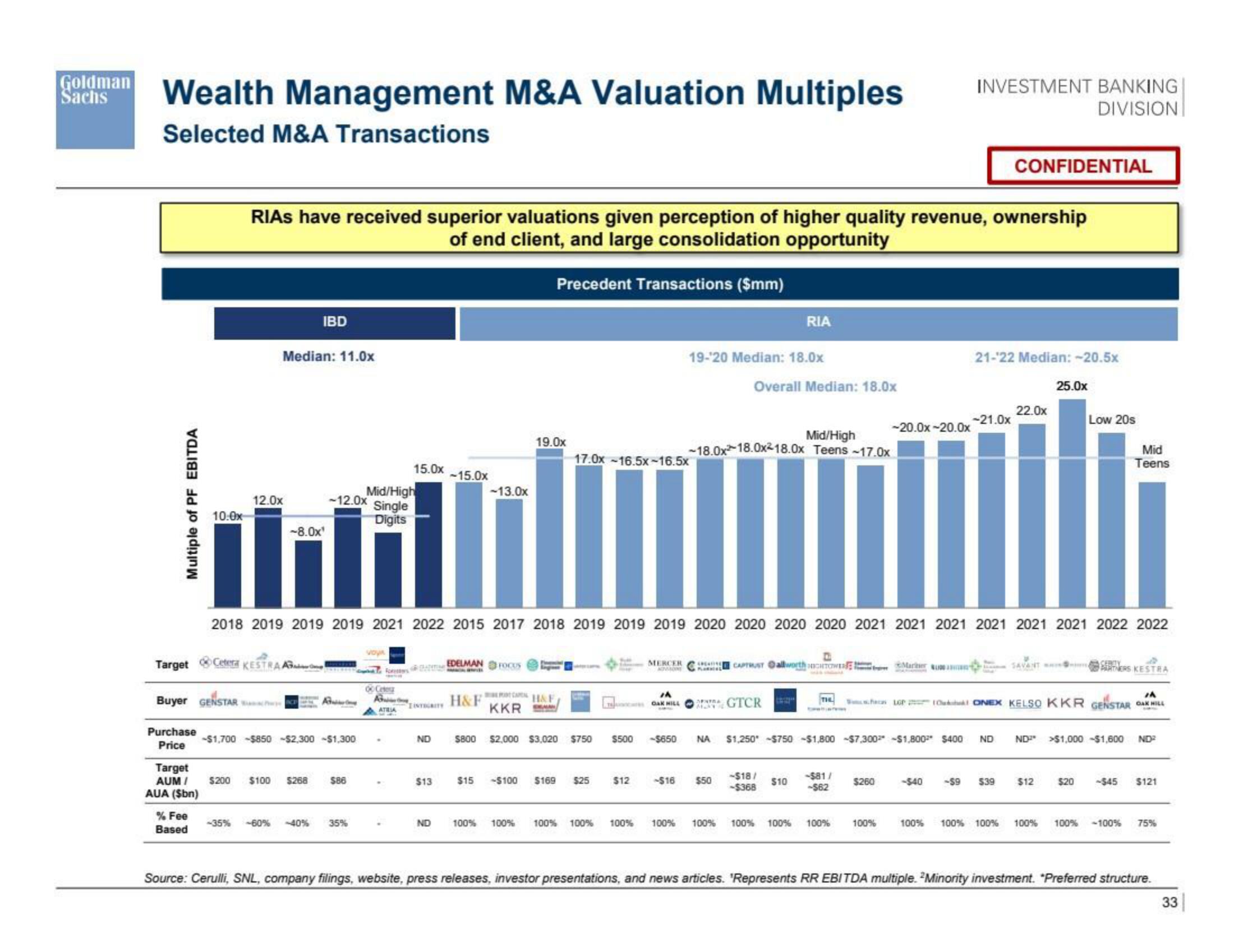

Sachs Wealth Management M&A Valuation Multiples

Selected M&A Transactions

Multiple of PF EBITDA

Purchase

Price

Target Cetera

Buyer GENSTAR

Target

AUM /

AUA ($bn)

10:0x

% Fee

Based

RIAS have received superior valuations given perception of higher quality revenue, ownership

of end client, and large consolidation opportunity

Precedent Transactions ($mm)

Median: 11.0x

12.0x

IBD

KESTRA A

-8.0x¹

$200 $100 $268

Mid/High

-12.0x Single

Digits

A

-$1,700 -$850 -$2,300 $1,300

$86

-35% -60% -40% 35%

15.0x

voya

ATRIA

ND

$13

-15.0x

ND

-13.0x

EDELMAN FOCUS

H&F

19.0x

2018 2019 2019 2019 2021 2022 2015 2017 2018 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021 2021 2021 2021 2022 2022

KKR

H&F

17.0x -16.5x-16.5x

$800 $2,000 $3,020 $750

$15 <-$100 $169 $25

L OAK HILL

$500

$12

MERCER

ACTVORONE

100% 100% 100% 100% 100%

-$650

19-20 Median: 18.0x

-$16

Mid/High

-18.0x18.0x²18.0x Teens -17.0x

SENTRA

Overall Median: 18.0x

ΝΑ

RIA

AREATINE | CAPTRUST Oallworth CHTOWER Marier u

PLAN

$50

GTCR

-$18/

-$368

$10

-20.0x-20.0x

-$81/

-562

INVESTMENT BANKING

DIVISION

$1,250 $750 -$1,800 -$7,300 $1,800 $400 ND

$260

100% 100% 100% 100% 100% 100%

21-¹22 Median: -20.5x

-21.0x

CONFIDENTIAL

100%

-$40 -$9 $39

22.0x

THE SLOP (ONEX KELSO KKR GENSTAR OAK HILL

SAVANT

25.0x

Low 20s

Mid

Teens

$12

CERITY

ARTNERS KESTRA

ND² >$1,000 $1,600 ND²

$20 -$45 $121

100% 100% 100% 100% -100% 75%

Source: Cerulli, SNL, company filings, website, press releases, investor presentations, and news articles. 'Represents RR EBITDA multiple. Minority investment. "Preferred structure.

33View entire presentation