Melrose Results Presentation Deck

Summary of results

Melrose

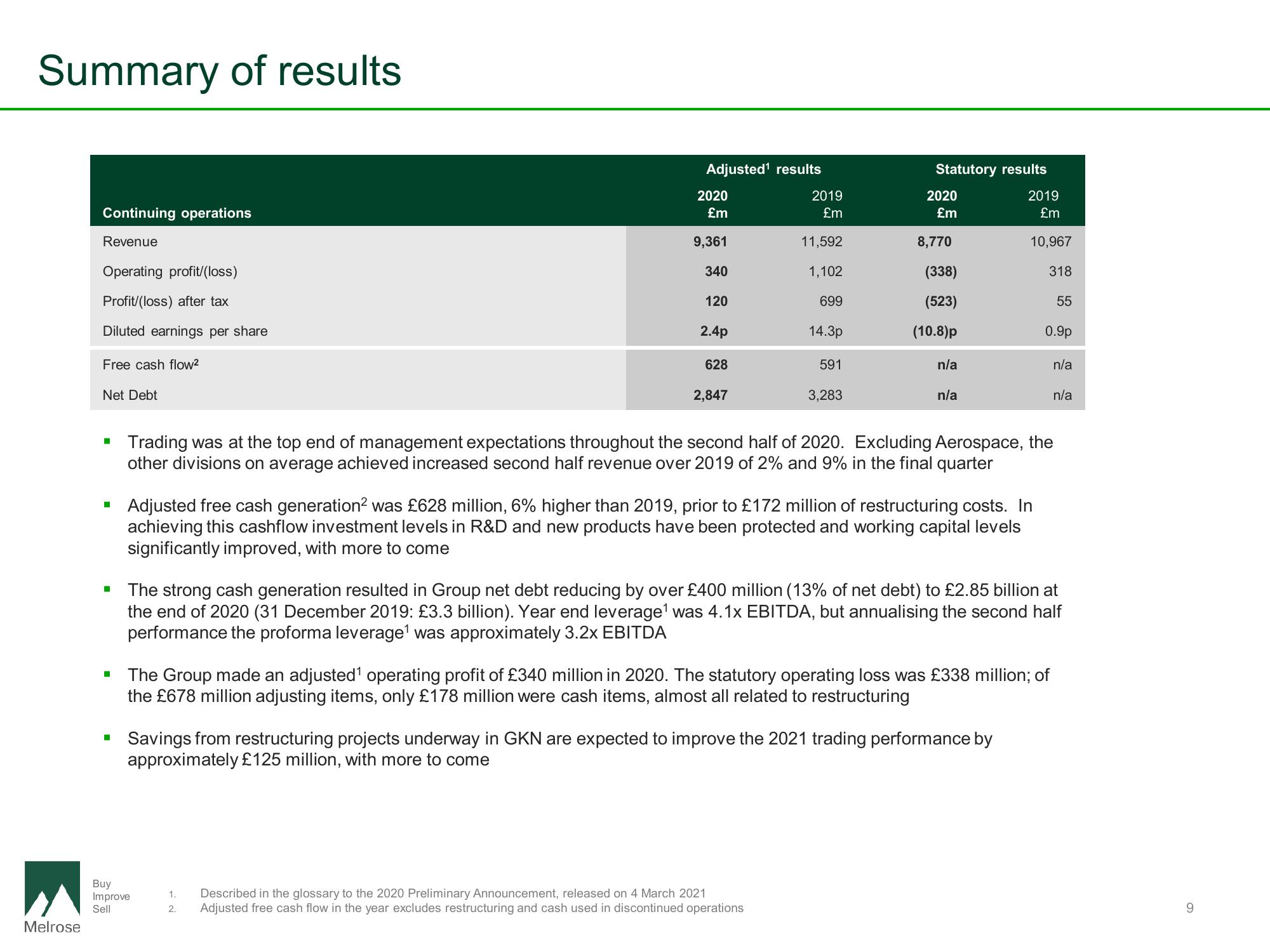

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) after tax

Diluted earnings per share

Free cash flow²

Net Debt

I

Adjusted¹ results

2020

£m

9,361

340

120

2.4p

Buy

Improve

Sell

628

2,847

2019

£m

11,592

1,102

699

14.3p

591

3,283

1.

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

2. Adjusted free cash flow in the year excludes restructuring and cash used in discontinued operations

Statutory results

2020

£m

8,770

(338)

(523)

(10.8)p

n/a

n/a

Adjusted free cash generation² was £628 million, 6% higher than 2019, prior to £172 million of restructuring costs. In

achieving this cashflow investment levels in R&D and new products have been protected and working capital levels

significantly improved, with more to come

2019

£m

10,967

318

Trading was at the top end of management expectations throughout the second half of 2020. Excluding Aerospace, the

other divisions on average achieved increased second half revenue over 2019 of 2% and 9% in the final quarter

▪ Savings from restructuring projects underway in GKN are expected to improve the 2021 trading performance by

approximately £125 million, with more to come

The Group made an adjusted¹ operating profit of £340 million in 2020. The statutory operating loss was £338 million; of

the £678 million adjusting items, only £178 million were cash items, almost all related to restructuring

0.9p

55

The strong cash generation resulted in Group net debt reducing by over £400 million (13% of net debt) to £2.85 billion at

the end of 2020 (31 December 2019: £3.3 billion). Year end leverage¹ was 4.1x EBITDA, but annualising the second half

performance the proforma leverage¹ was approximately 3.2x EBITDA

n/a

n/a

9View entire presentation