Evercore Investment Banking Pitch Book

Financial Analysis

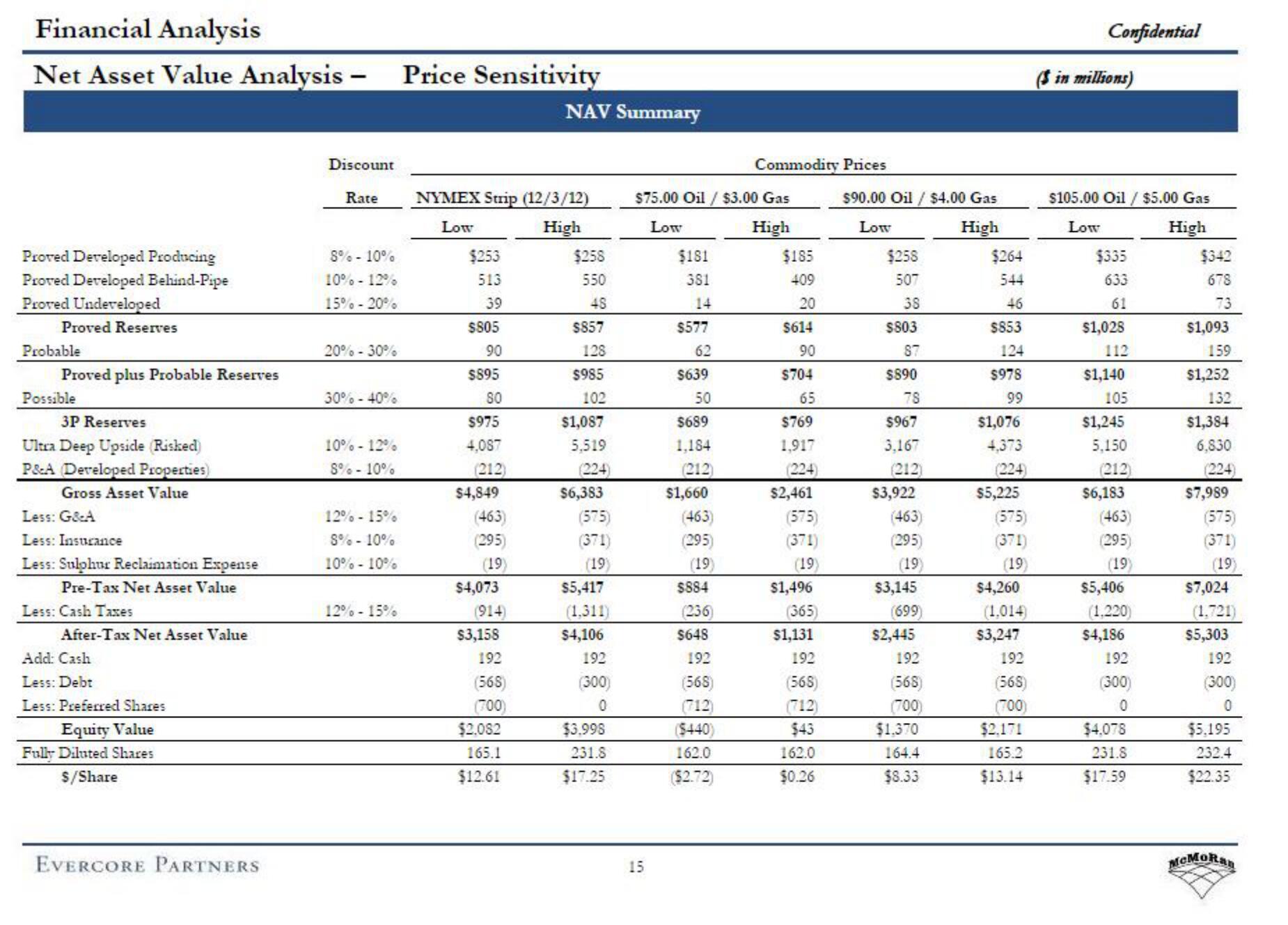

Net Asset Value Analysis -

Proved Developed Producing

Proved Developed Behind-Pipe

Proved Undeveloped

Proved Reserves

Probable

Proved plus Probable Reserves

Possible

3P Reserves

Ultra Deep Upside (Risked)

P&A Developed Properties)

Gross Asset Value

Less: G&A

Less: Insurance

Less: Sulphur Reclaimation Expense

Pre-Tax Net Asset Value

Less: Cash Taxes

After-Tax Net Asset Value

Add: Cash

Less: Debt

Less: Preferred Shares

Equity Value

Fully Diluted Shares

$/Share

EVERCORE PARTNERS

Discount

Rate

8% - 10%

10% -12%

15%-20%

20% - 30%

30% -40%

10% -12%

8% - 10%

12%-15%

8% - 10%

10% - 10%

12%-15%

Price Sensitivity

NYMEX Strip (12/3/12)

Low

High

$253

513

39

$805

90

$895

80

$975

4,087

(212)

$4,849

(463)

(295)

(19)

$4,073

(914)

$3,158

192

(568)

(700)

NAV Summary

$2.082

165.1

$12.61

$258

550

48

$857

128

$985

102

$1,087

5,519

(224)

$6,383

(575)

(371)

(19)

$5,417

(1.311)

$4,106

192

(300)

0

$3.998

231.8

$17.25

$75.00 Oil / $3.00 Gas

Low

High

15

$181

381

14

$577

62

$639

50

$689

1.184

(212)

$1,660

(463)

(295)

(19)

$884

(236)

$648

192

(568)

(712)

Commodity Prices

($440)

162.0

($2.72)

$185

409

20

$614

90

$704

65

$769

1,917

$2,461

(575)

(371)

(19)

$1,496

(365)

$1,131

192

(568)

(712)

$43

162.0

$0.26

$90.00 Oil / $4.00 Gas

Low

High

$258

507

38

$803

87

$890

78

$967

3.167

(212)

$3,922

(463)

(295)

(19)

$3,145

(699)

$2,445

192

(568)

(700)

$1.370

164.4

$8.33

$264

544

46

$853

124

$978

99

$1,076

4,373

(224)

$5,225

(575)

(371)

(19)

$4,260

(1.014)

$3,247

192

(568)

(700)

$2.171

165.2

$13.14

Confidential

($in millions)

$105.00 Oil / $5.00 Gas

Low

High

$335

633

61

$1,028

112

$1,140

105

$1,245

5,150

(212)

$6,183

(463)

(295)

(19)

$5,406

(1.220)

$4,186

192

(300)

0

$4.078

231.8

$17.59

$342

678

73

$1,093

159

$1,252

132

$1,384

6,830

(224)

$7,989

(575)

(371)

(19)

$7,024

(1.721)

$5,303

192

(300)

0

$5.195

232.4

$22.35

MCMoRanView entire presentation