Mondi Mergers and Acquisitions Presentation Deck

MONDI GROUP KEY FINANCIALS

€M

700

600

500

400

300

200

100

0

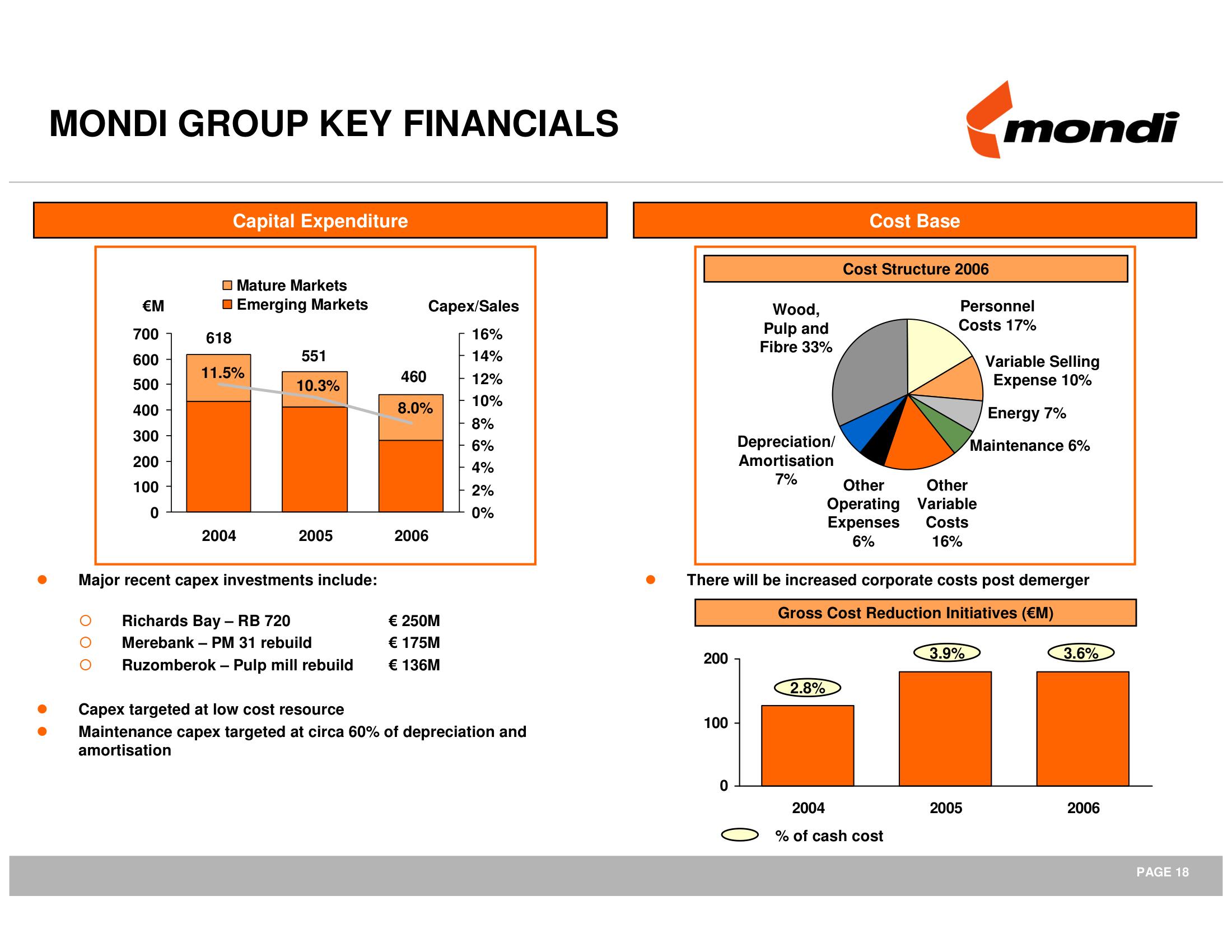

Capital Expenditure

Mature Markets

☐ Emerging Markets

618

11.5%

2004

551

10.3%

2005

Major recent capex investments include:

Richards Bay - RB 720

Merebank - PM 31 rebuild

Ruzomberok - Pulp mill rebuild

Capex/Sales

16%

14%

460

8.0%

2006

€ 250M

€ 175M

€ 136M

12%

10%

8%

6%

4%

2%

0%

Capex targeted at low cost resource

Maintenance capex targeted at circa 60% of depreciation and

amortisation

200

Wood,

Pulp and

Fibre 33%

100

Depreciation/

Amortisation

7%

Cost Base

2.8%

Cost Structure 2006

Other

Operating

Expenses

6%

There will be increased corporate costs post demerger

Gross Cost Reduction Initiatives (€M)

2004

% of cash cost

Personnel

Costs 17%

Other

Variable

Costs

16%

mondi

3.9%

Variable Selling

Expense 10%

Energy 7%

Maintenance 6%

2005

3.6%

2006

PAGE 18View entire presentation