Appreciate SPAC Presentation Deck

E HO

BUSINESS COMBINATION OVERVIEW

Business Combination Summary

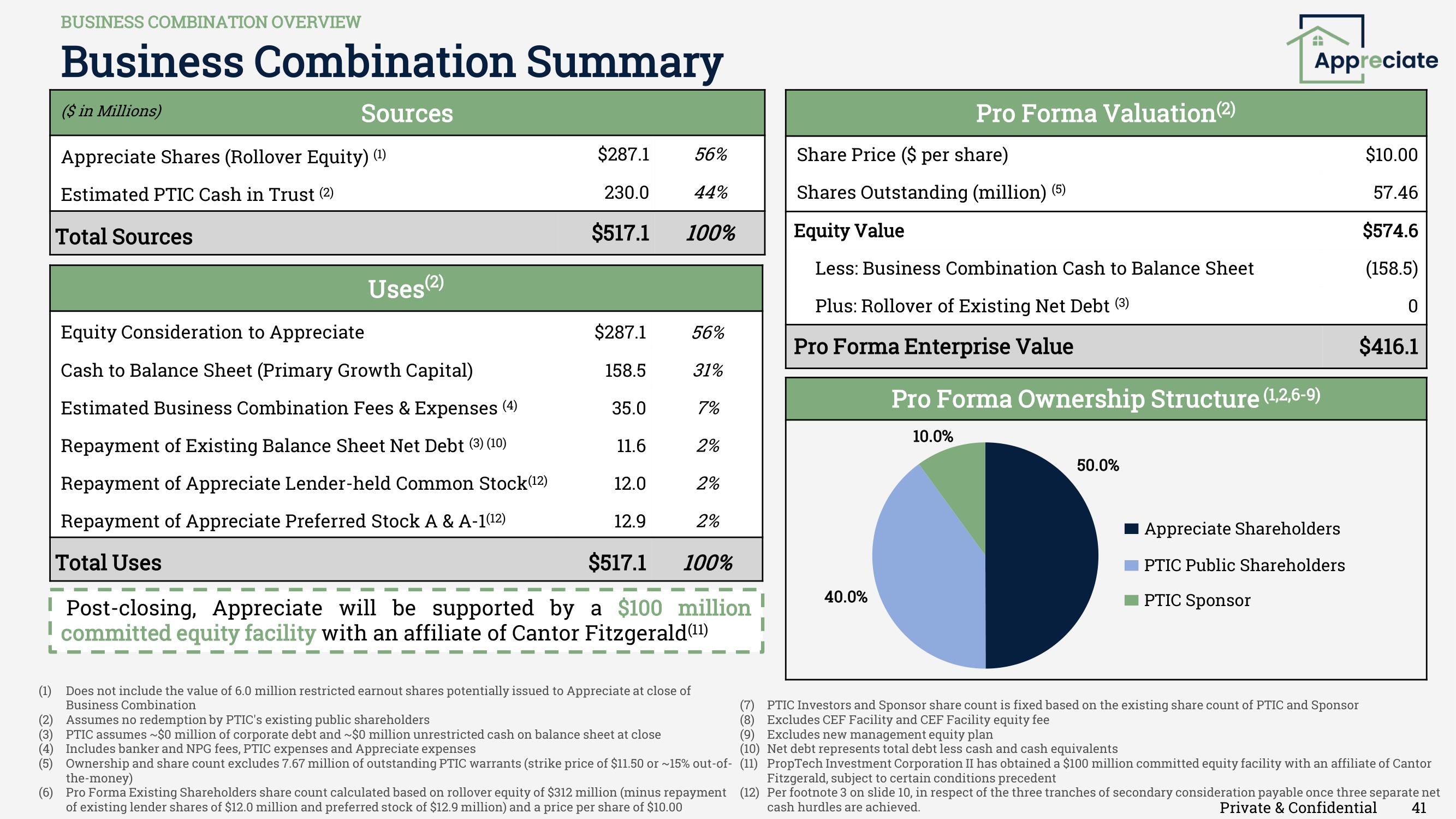

Sources

($ in Millions)

Appreciate Shares (Rollover Equity) (¹)

Estimated PTIC Cash in Trust (2)

Total Sources

Uses (2)

Equity Consideration to Appreciate

Cash to Balance Sheet (Primary Growth Capital)

Estimated Business Combination Fees & Expenses (4)

Repayment of Existing Balance Sheet Net Debt (3) (10)

Repayment of Appreciate Lender-held Common Stock (¹2)

Repayment of Appreciate Preferred Stock A & A-1(12)

Total Uses

$287.1

230.0

$517.1

$287.1

158.5

35.0

11.6

12.0

12.9

56%

44%

100%

56%

31%

7%

2%

2%

2%

$517.1 100%

Post-closing, Appreciate will be supported by a $100 million

committed equity facility with an affiliate of Cantor Fitzgerald (¹1)

(1) Does not include the value of 6.0 million restricted earnout shares potentially issued to Appreciate at close of

Business Combination

(2) Assumes no redemption by PTIC's existing public shareholders

(3) PTIC assumes ~$0 million of corporate debt and ~$0 million unrestricted cash on balance sheet at close

(4) Includes banker and NPG fees, PTIC expenses and Appreciate expenses

(5) Ownership and share count excludes 7.67 million of outstanding PTIC warrants (strike price of $11.50 or ~15% out-of-

the-money)

Pro Forma Existing Shareholders share count calculated based on rollover equity of $312 million (minus repayment

of existing lender shares of $12.0 million and preferred stock of $12.9 million) and a price per share of $10.00

Pro Forma Valuation (2)

Share Price ($ per share)

Shares Outstanding (million) (5)

Equity Value

Less: Business Combination Cash to Balance Sheet

Plus: Rollover of Existing Net Debt (3)

Pro Forma Enterprise Value

40.0%

4

50.0%

Appreciate

Pro Forma Ownership Structure (1,2,6-9)

10.0%

Appreciate Shareholders

PTIC Public Shareholders

PTIC Sponsor

$10.00

57.46

$574.6

(158.5)

PTIC Investors and Sponsor share count is fixed based on the existing share count of PTIC and Sponsor

(8) Excludes CEF Facility and CEF Facility equity fee

(9) Excludes new management equity plan

Net debt represents total debt less cash and cash equivalents

0

$416.1

(10)

(11)

PropTech Investment Corporation II has obtained a $100 million committed equity facility with an affiliate of Cantor

Fitzgerald, subject to certain conditions precedent

(12)

Per footnote 3 on slide 10, in respect of the three tranches of secondary consideration payable once three separate net

cash hurdles are achieved.

Private & Confidential 41View entire presentation