AngloAmerican Investor Day Presentation Deck

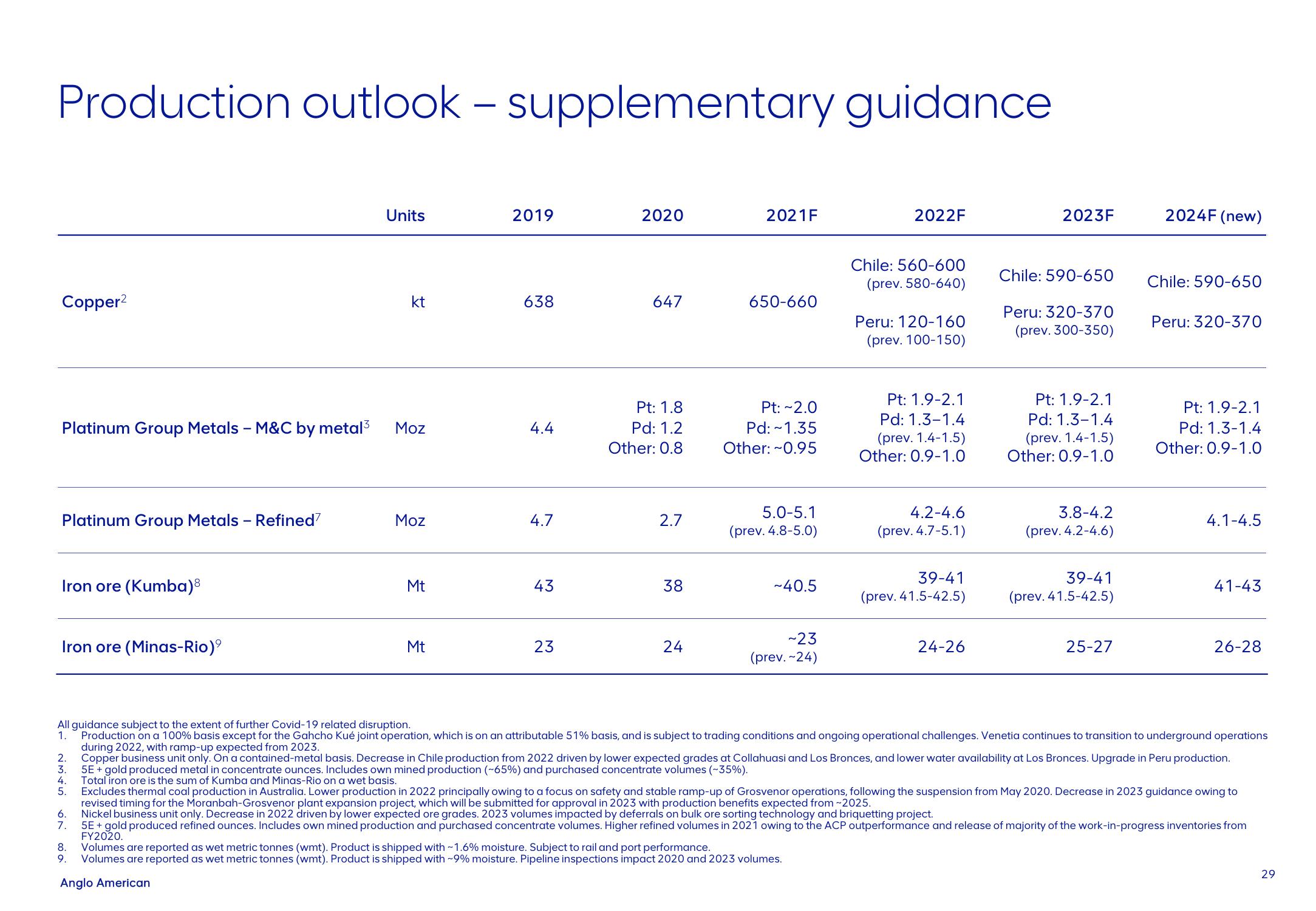

Production outlook - supplementary guidance

Copper²

Platinum Group Metals - Refined

Platinum Group Metals - M&C by metal³ Moz

Iron ore (Kumba)8

Iron ore (Minas-Rio)⁹

Units

4.

5.

kt

6.

7.

Moz

Mt

Mt

2019

638

4.4

4.7

43

23

2020

647

Pt: 1.8

Pd: 1.2

Other: 0.8

2.7

38

24

2021F

650-660

Pt:~2.0

Pd: 1.35

Other:~0.95

5.0-5.1

(prev. 4.8-5.0)

~40.5

~23

(prev.-24)

2022F

Chile: 560-600

(prev. 580-640)

Peru: 120-160

(prev. 100-150)

Pt: 1.9-2.1

Pd: 1.3-1.4

(prev. 1.4-1.5)

Other: 0.9-1.0

4.2-4.6

(prev. 4.7-5.1)

39-41

(prev. 41.5-42.5)

24-26

2023F

Chile: 590-650

Peru: 320-370

(prev. 300-350)

Pt: 1.9-2.1

Pd: 1.3-1.4

(prev. 1.4-1.5)

Other: 0.9-1.0

3.8-4.2

(prev. 4.2-4.6)

39-41

(prev. 41.5-42.5)

25-27

2024F (new)

Chile: 0-650

Peru: 320-370

Pt: 1.9-2.1

Pd: 1.3-1.4

Other: 0.9-1.0

4.1-4.5

41-43

All guidance subject to the extent of further Covid-19 related disruption.

1. Production on a 100% basis except for the Gahcho Kué joint operation, which is on an attributable 51% basis, and is subject to trading conditions and ongoing operational challenges. Venetia continues to transition to underground operations

during 2022, with ramp-up expected from 2023.

2.

Copper business unit only. On a contained-metal basis. Decrease in Chile production from 2022 driven by lower expected grades at Collahuasi and Los Bronces, and lower water availability at Los Bronces. Upgrade in Peru production.

5E + gold produced metal in concentrate ounces. Includes own mined production (~65%) and purchased concentrate volumes (~35%).

3.

Total iron ore is the sum of Kumba and Minas-Rio on a wet basis.

Excludes thermal coal production in Australia. Lower production in 2022 principally owing to a focus on safety and stable ramp-up of Grosvenor operations, following the suspension from May 2020. Decrease in 2023 guidance owing to

revised timing for the Moranbah-Grosvenor plant expansion project, which will be submitted for approval in 2023 with production benefits expected from -2025.

Nickel business unit only. Decrease in 2022 driven by lower expected ore grades. 2023 volumes impacted by deferrals on bulk ore sorting technology and briquetting project.

5E + gold produced refined ounces. Includes own mined production and purchased concentrate volumes. Higher refined volumes in 2021 owing to the ACP outperformance and release of majority of the work-in-progress inventories from

FY2020.

8. Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~1.6% moisture. Subject to rail and port performance.

9.

Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~9% moisture. Pipeline inspections impact 2020 and 2023 volumes.

Anglo American

26-28

29View entire presentation