Tudor, Pickering, Holt & Co Investment Banking

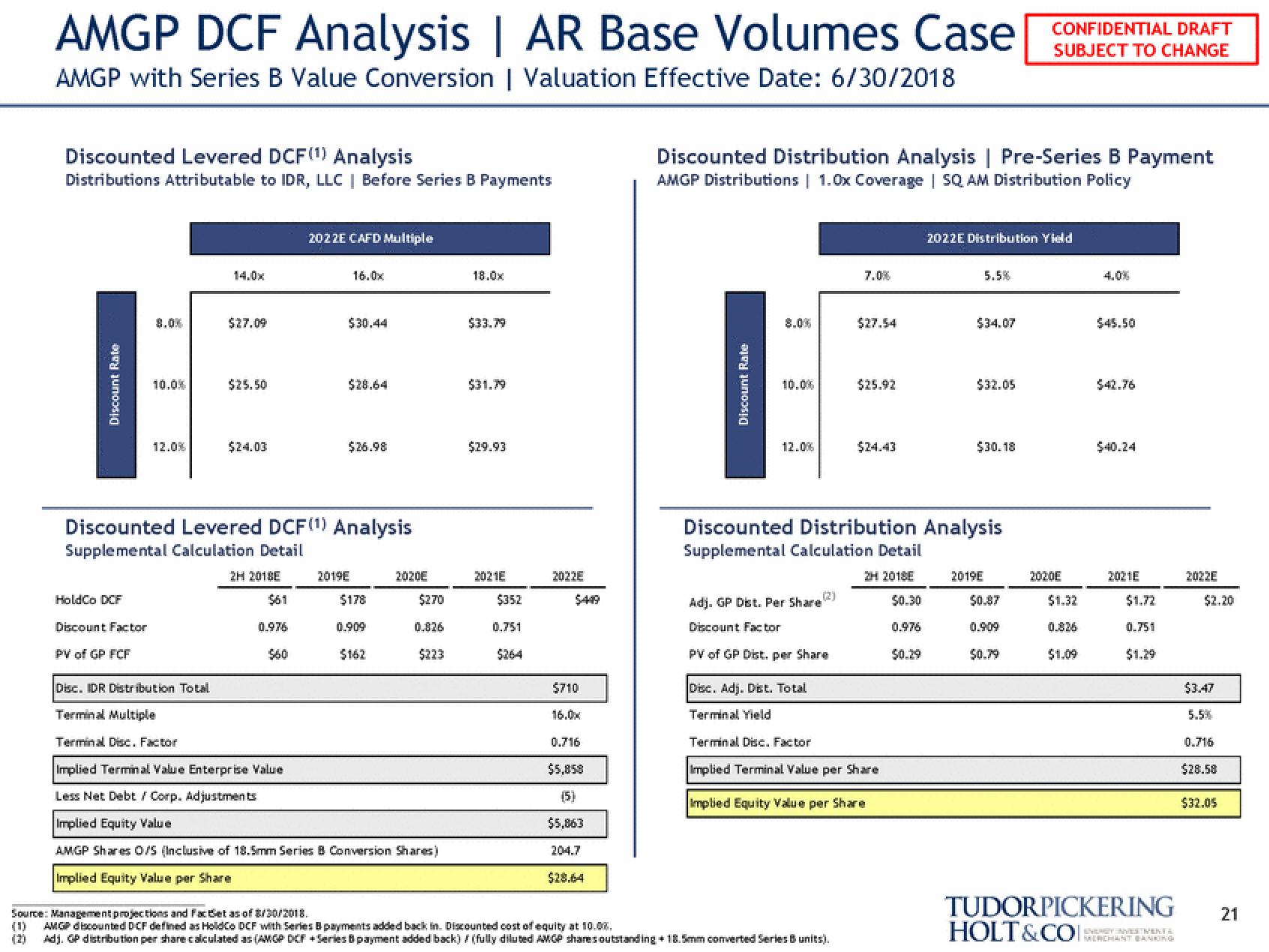

AMGP DCF Analysis | AR Base Volumes Case CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

AMGP with Series B Value Conversion | Valuation Effective Date: 6/30/2018

Discounted Levered DCF(1) Analysis

Distributions Attributable to IDR, LLC | Before Series B Payments

Discount Rate

HoldCo DCF

10.0%

Discount Factor

PV of GP FCF

12.0%

14.0x

$27.09

$25.50

$24.03

2H 2018E

2022E CAFD Multiple

$61

0.976

$60

Discounted Levered DCF(1) Analysis

Supplemental Calculation Detail

16.0x

$30.44

$28.64

$26.98

2019E

$178

0.909

$162

2020E

$270

0.826

$223

Disc. IDR Distribution Total

Terminal Multiple

Terminal Disc. Factor

Implied Terminal Value Enterprise Value

Less Net Debt / Corp. Adjustments

Implied Equity Value

AMGP Shares 0/5 (Inclusive of 18.5mm Series B Conversion Shares)

Implied Equity Value per Share

18.0x

$33.79

$31.79

$29.93

2021E

$352

0.751

2022E

$710

16.0x

0.716

$5,858

(5)

$5,863

204.7

$28.64

Discounted Distribution Analysis | Pre-Series B Payment

AMGP Distributions | 1.0x Coverage | SQ AM Distribution Policy

Discount Rate

8.0%

10.0%

12.0%

(2)

Adj. GP Dist. Per Share

Discount Factor

PV of GP Dist. per Share

7.0%

$27.54

Source: Management projections and FacBet as of 8/30/2018.

(1) AMGP discounted DCF defined as HoldCo DCF with Series B payments added back in. Discounted cost of equity at 10.08.

Adj. GP distribution per share calculated as (AMGP DCF Series B payment added back) / (fully diluted AMGP shares outstanding + 18.5mm converted Series & units).

$25.92

$24.43

Disc. Adj. Dist. Total

Terminal Yield

Terminal Disc. Factor

Implied Terminal Value per Share

Implied Equity Value per Share

2022E Distribution Yield

$0.30

0.976

50.29

Discounted Distribution Analysis

Supplemental Calculation Detail

2H 2018E

5.5%

$34.07

$32.05

$30.18

2019E

$0.87

0.909

$0.79

2020E

$1.32

0.826

$1.09

4.0%

$45.50

$42.76

$40.24

2021E

$1.72

0.751

$1.29

TUDORPICKERING

HOLT&COCHANT BANKING

PINTA

2022E

$2.20

$3.47

5.5%

0.716

$28.58

$32.05

21View entire presentation