Q2 FY24 Earnings Presentation

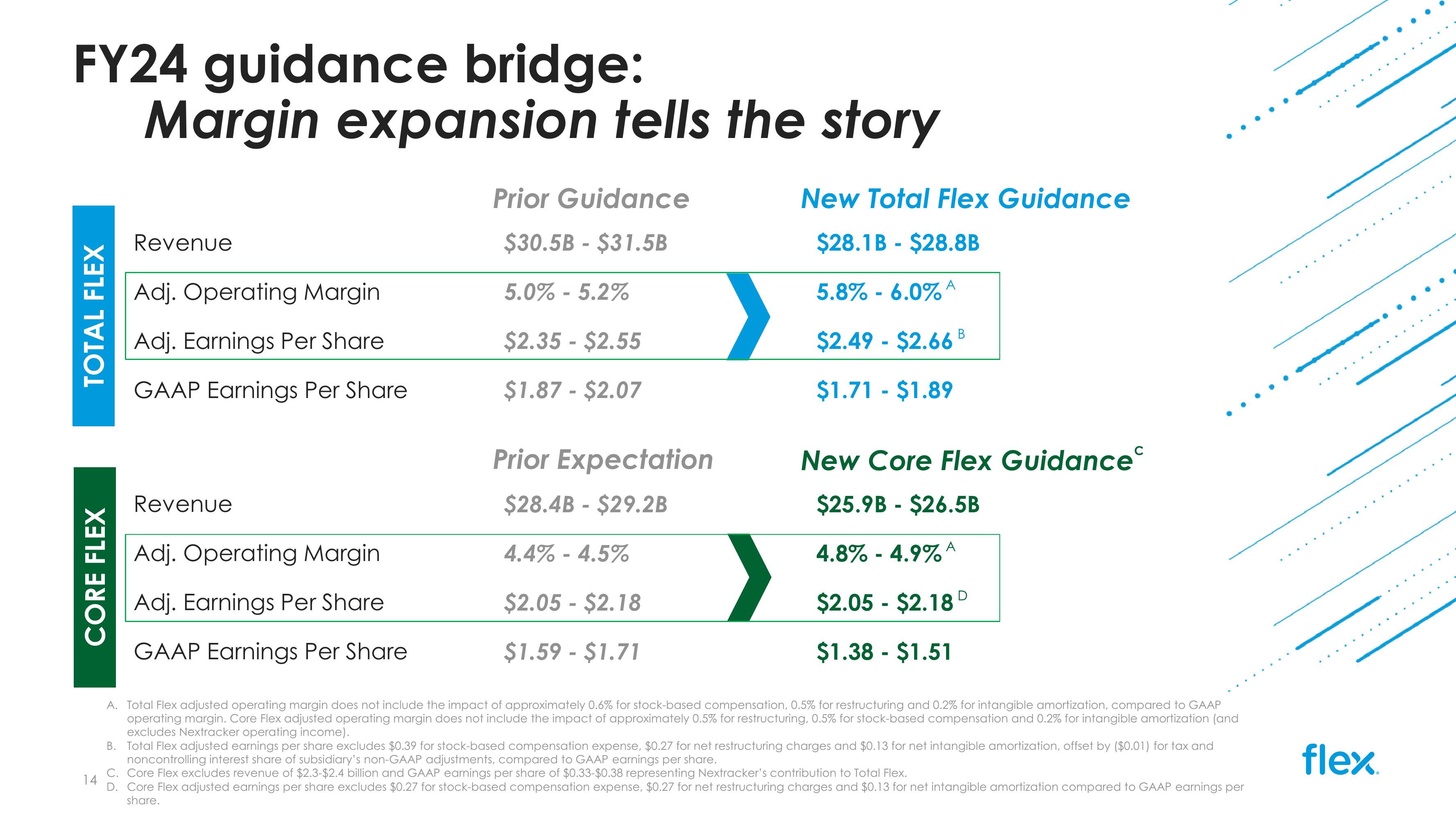

FY24 guidance bridge:

Margin expansion tells the story

TOTAL FLEX

CORE FLEX

Revenue

Adj. Operating Margin

Prior Guidance

$30.5B - $31.5B

5.0%-5.2%

$2.35 - $2.55

Adj. Earnings Per Share

GAAP Earnings Per Share

$1.87 - $2.07

Revenue

Adj. Operating Margin

Adj. Earnings Per Share

GAAP Earnings Per Share

Prior Expectation

$28.4B $29.2B

-

4.4% - 4.5%

$2.05 - $2.18

$1.59 - $1.71

New Total Flex Guidance

$28.1B - $28.8B

5.8% -6.0% A

$2.49 - $2.66 B

$1.71 - $1.89

New Core Flex Guidance

$25.9B $26.5B

-

4.8% -4.9% A

$2.05 - $2.18 D

$1.38 - $1.51

14

A. Total Flex adjusted operating margin does not include the impact of approximately 0.6% for stock-based compensation, 0.5% for restructuring and 0.2% for intangible amortization, compared to GAAP

operating margin. Core Flex adjusted operating margin does not include the impact of approximately 0.5% for restructuring, 0.5% for stock-based compensation and 0.2% for intangible amortization (and

excludes Nextracker operating income).

B. Total Flex adjusted earnings per share excludes $0.39 for stock-based compensation expense, $0.27 for net restructuring charges and $0.13 for net intangible amortization, offset by ($0.01) for tax and

noncontrolling interest share of subsidiary's non-GAAP adjustments, compared to GAAP earnings per share.

C. Core Flex excludes revenue of $2.3-$2.4 billion and GAAP earnings per share of $0.33-$0.38 representing Nextracker's contribution to Total Flex.

D. Core Flex adjusted earnings per share excludes $0.27 for stock-based compensation expense, $0.27 for net restructuring charges and $0.13 for net intangible amortization compared to GAAP earnings per

share.

flex.View entire presentation