Boxed SPAC Presentation Deck

Proposed Transaction Summary

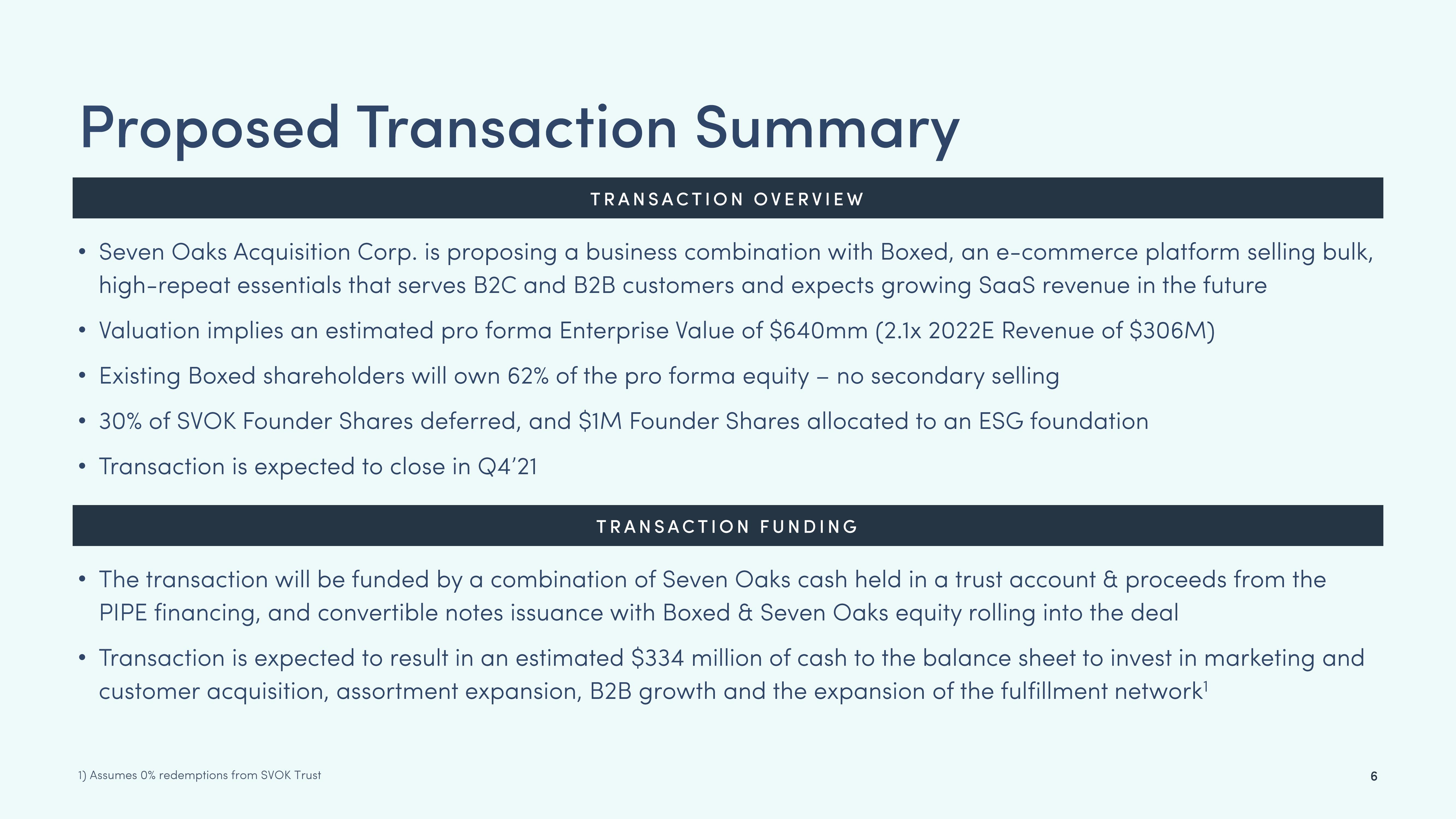

Seven Oaks Acquisition Corp. is proposing a business combination with Boxed, an e-commerce platform selling bulk,

high-repeat essentials that serves B2C and B2B customers and expects growing SaaS revenue in the future

• Valuation implies an estimated pro forma Enterprise Value of $640mm (2.1x 2022E Revenue of $306M)

Existing Boxed shareholders will own 62% of the pro forma equity - no secondary selling

• 30% of SVOK Founder Shares deferred, and $1M Founder Shares allocated to an ESG foundation

Transaction is expected to close in Q4'21

●

●

TRANSACTION OVERVIEW

TRANSACTION FUNDING

The transaction will be funded by a combination of Seven Oaks cash held in a trust account & proceeds from the

PIPE financing, and convertible notes issuance with Boxed & Seven Oaks equity rolling into the deal

1) Assumes 0% redemptions from SVOK Trust

Transaction is expected to result in an estimated $334 million of cash to the balance sheet to invest in marketing and

customer acquisition, assortment expansion, B2B growth and the expansion of the fulfillment network¹

6View entire presentation