Baird Investment Banking Pitch Book

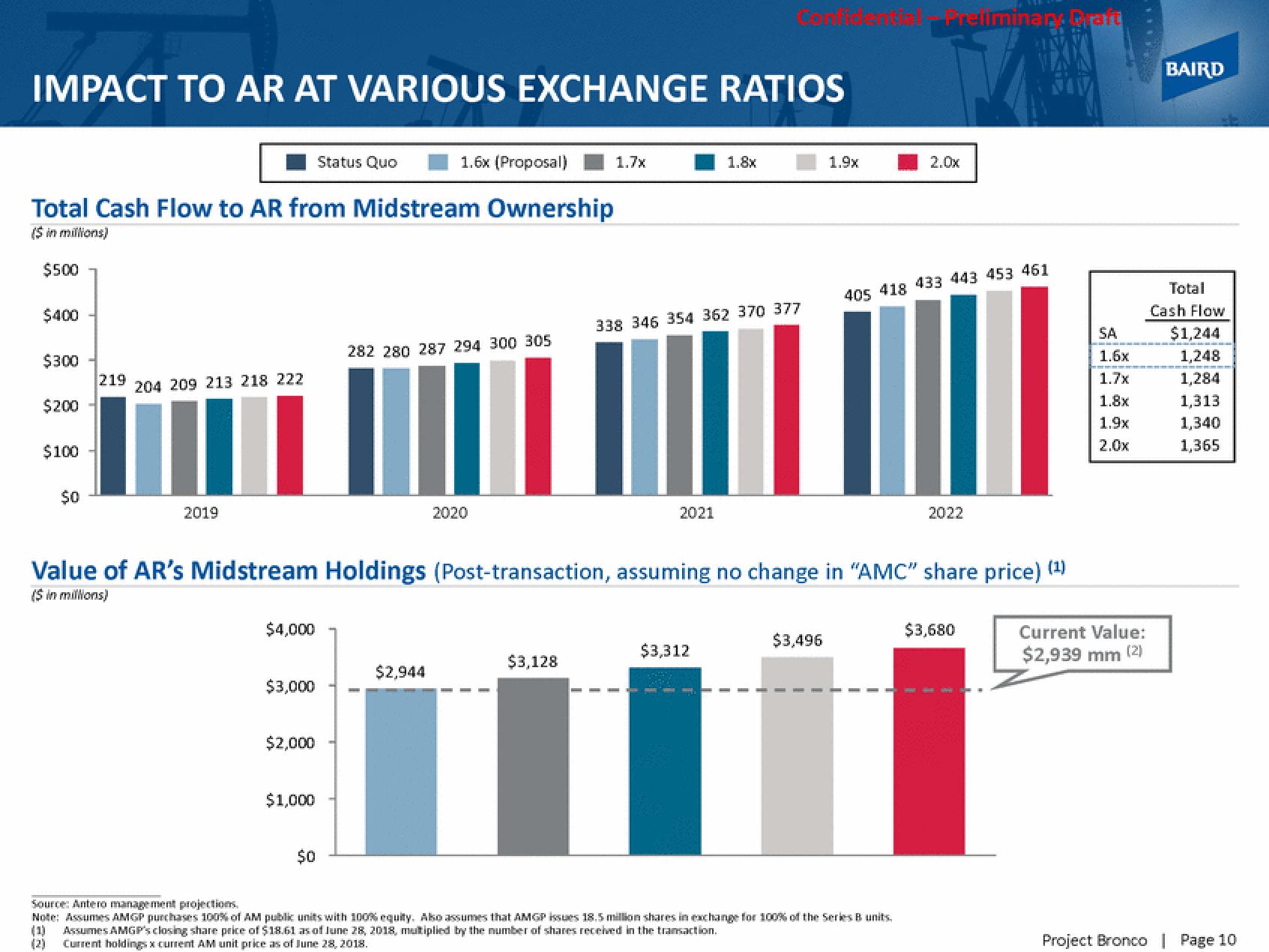

IMPACT TO AR AT VARIOUS EXCHANGE RATIOS

$400

Total Cash Flow to AR from Midstream Ownership

($ in millions)

$500

$300

$200

$100

$0

219

204 209 213 218 222

2019

$4,000

$3,000

$2,000

Status Quo

$1,000

$0

1.6x (Proposal)

282 280 287 294 300 305

$2,944

2020

1.7x

$3,128

338 346 354 362 370 377

2021

Value of AR's Midstream Holdings (Post-transaction, assuming no change in "AMC" share price) (¹)

($ in millions)

1.8x

$3,312

1.9x

$3,496

Trellminary Draft

2.0x

405 418 433 443 453 461

Source: Antero management projections.

Note: Assumes AMGP purchases 100% of AM public units with 100% equity. Also assumes that AMGP issues 18.5 million shares in exchange for 100% of the Series B units.

(1) Assumes AMGP's closing share price of $18.61 as of June 28, 2018, multiplied by the number of shares received in the transaction.

Current holdings x current AM unit price as of June 28, 2018.

2022

$3,680

SA

1.6x

1.7x

1.8x

1.9x

2.0x

Current Value:

$2,939 mm (2)

BAIRD

Total

Cash Flow

$1,244

1,248

1,284

1,313

1,340

1,365

Project Bronco | Page 10View entire presentation