Trian Partners Activist Presentation Deck

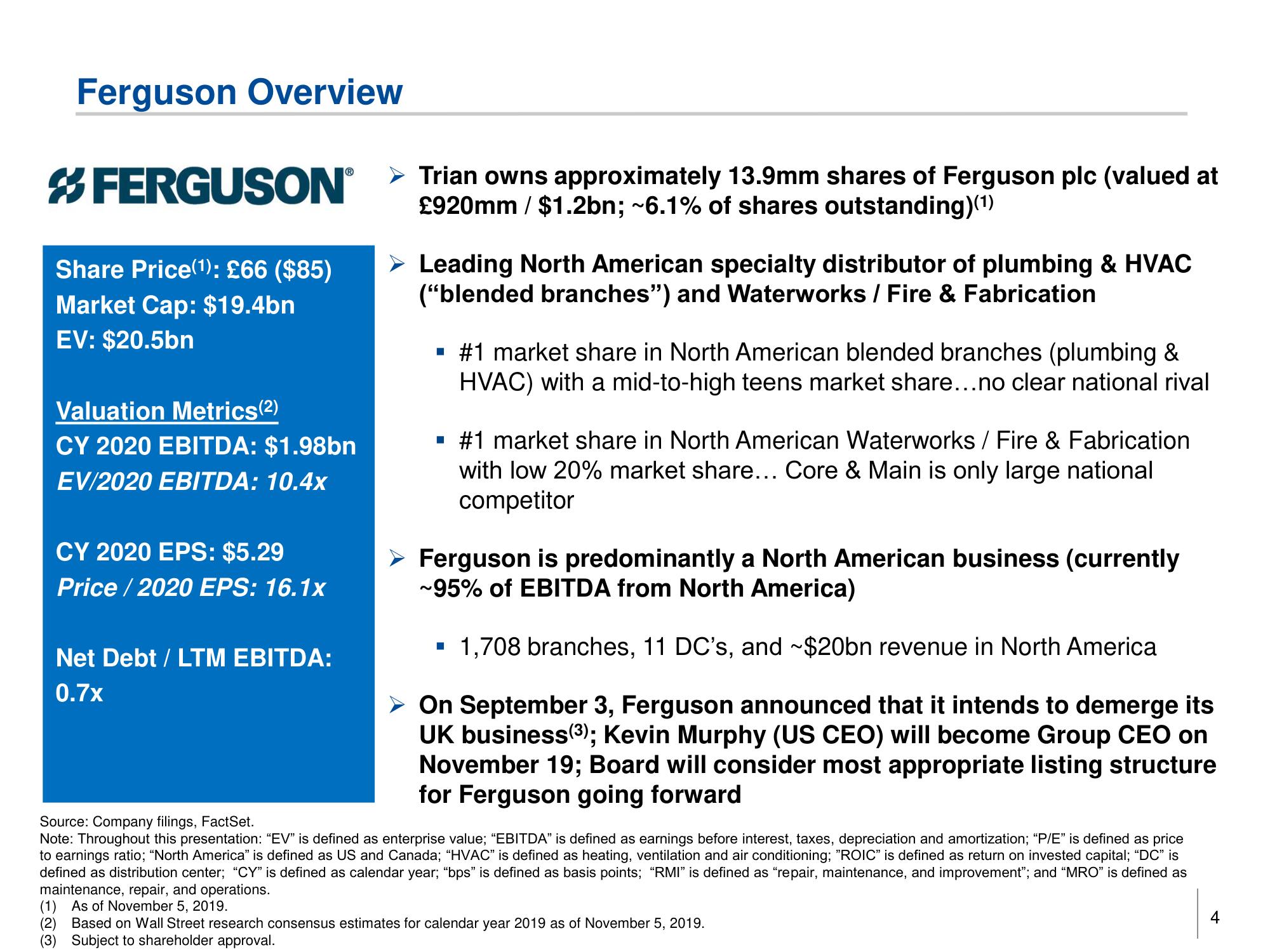

Ferguson Overview

FERGUSONⓇ

Share Price(1): £66 ($85)

Market Cap: $19.4bn

EV: $20.5bn

Valuation Metrics(²)

CY 2020 EBITDA: $1.98bn

EV/2020 EBITDA: 10.4x

CY 2020 EPS: $5.29

Price / 2020 EPS: 16.1x

Net Debt / LTM EBITDA:

0.7x

> Trian owns approximately 13.9mm shares of Ferguson plc (valued at

£920mm / $1.2bn; ~6.1% of shares outstanding)(¹)

Leading North American specialty distributor of plumbing & HVAC

("blended branches") and Waterworks / Fire & Fabrication

▪ #1 market share in North American blended branches (plumbing &

HVAC) with a mid-to-high teens market share...no clear national rival

▪ #1 market share in North American Waterworks / Fire & Fabrication

with low 20% market share... Core & Main is only large national

competitor

Ferguson is predominantly a North American business (currently

~95% of EBITDA from North America)

▪ 1,708 branches, 11 DC's, and ~$20bn revenue in North America

> On September 3, Ferguson announced that it intends to demerge its

UK business (³); Kevin Murphy (US CEO) will become Group CEO on

November 19; Board will consider most appropriate listing structure

for Ferguson going forward

Source: Company filings, FactSet.

Note: Throughout this presentation: "EV" is defined as enterprise value; "EBITDA" is defined as earnings before interest, taxes, depreciation and amortization; "P/E" is defined as price

to earnings ratio; "North America" is defined as US and Canada; "HVAC" is defined as heating, ventilation and air conditioning; "ROIC" is defined as return on invested capital; “DC" is

defined as distribution center; "CY" is defined as calendar year; "bps" is defined as basis points; "RMI" is defined as "repair, maintenance, and improvement"; and "MRO" is defined as

maintenance, repair, and operations.

(1) As of November 5, 2019.

(2) Based on Wall Street research consensus estimates for calendar year 2019 as of November 5, 2019.

(3) Subject to shareholder approval.

4View entire presentation