Netstreit IPO Presentation Deck

5 Balance Sheet Strategy

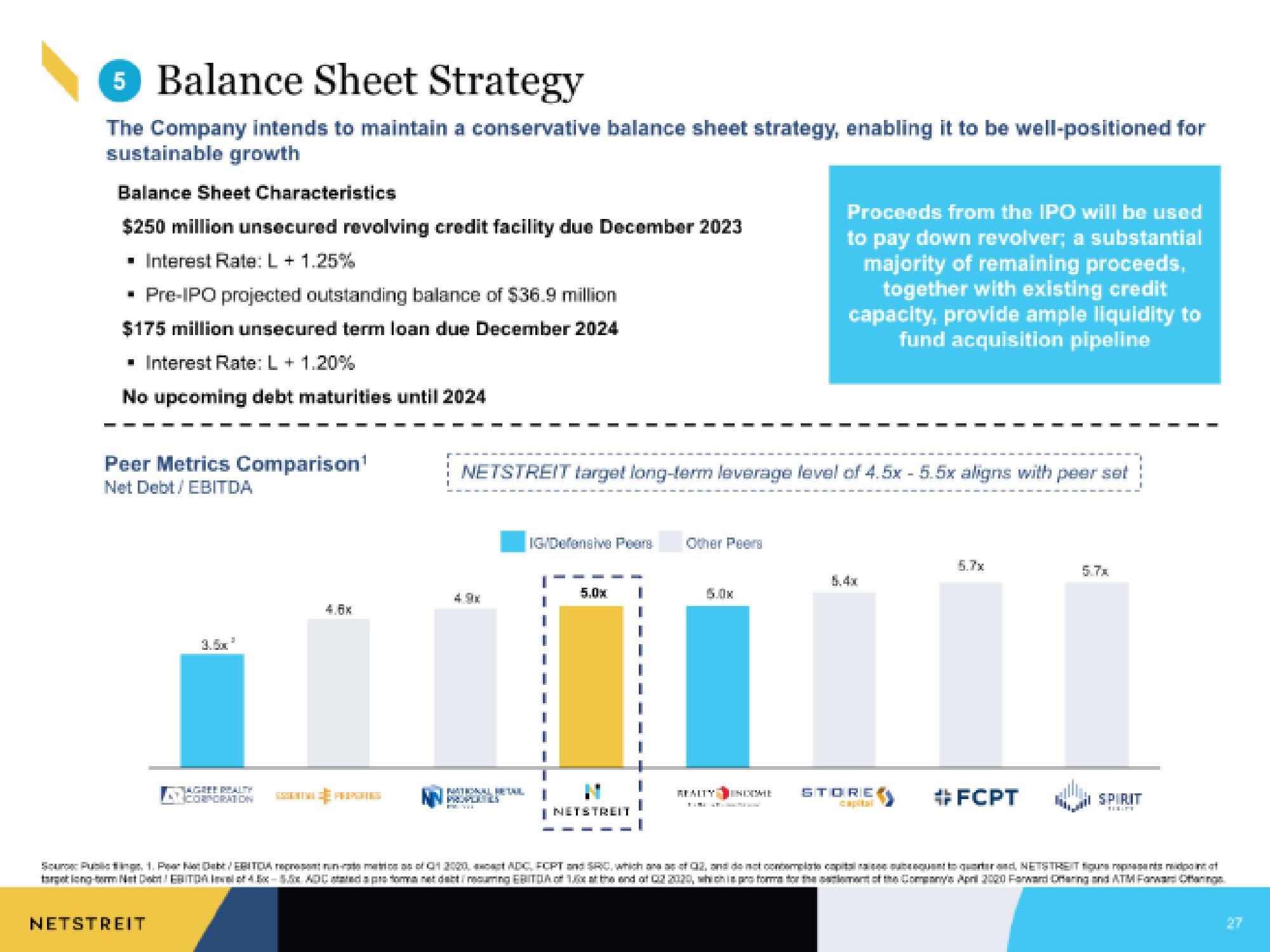

The Company intends to maintain a conservative balance sheet strategy, enabling it to be well-positioned for

sustainable growth

Balance Sheet Characteristics

$250 million unsecured revolving credit facility due December 2023

■ Interest Rate: L + 1.25%

* Pre-IPO projected outstanding balance of $36.9 million

$175 million unsecured term loan due December 2024

▪ Interest Rate: L + 1.20%

No upcoming debt maturities until 2024

Peer Metrics Comparison¹

Net Debt / EBITDA

MAGHEMBALITY

CORPORATION

NETSTREIT

MAINE PUPOIS

NETSTREIT target long-term leverage level of 4.5x - 5.5x aligns with peer set

PATIONAL RETAIL

PROPLE LY

IG/Defensive Peers Other Peers

5.0x

| NETSTREIT

Proceeds from the IPO will be used

to pay down revolver; a substantial

majority of remaining proceeds,

together with existing credit

capacity, provide ample liquidity to

fund acquisition pipeline

HEALTY

STORE

5.7x

#FCPT

5.7x

SPIRIT

HUA

Sour Public, 1. ParNo Debe/ERITOA represent run-rate matice of 01 2000 ADC, FCPT and SRC, which are of 02, and do not contemplaris capital na see sube equant to quarter and, NETSTREIT ou represents point at

target long-termNet Debt! EBITDA Inval of 4 5x – 15.5x ADC sted a pro forma net debt resuming EBITOA of 15x at the end of 02 2020, which in pro form for the salomont of the Company's April 2020 Forward Oraning and ATM Forward Offerings

27View entire presentation