J.P.Morgan Shareholder Engagement Presentation Deck

Notes

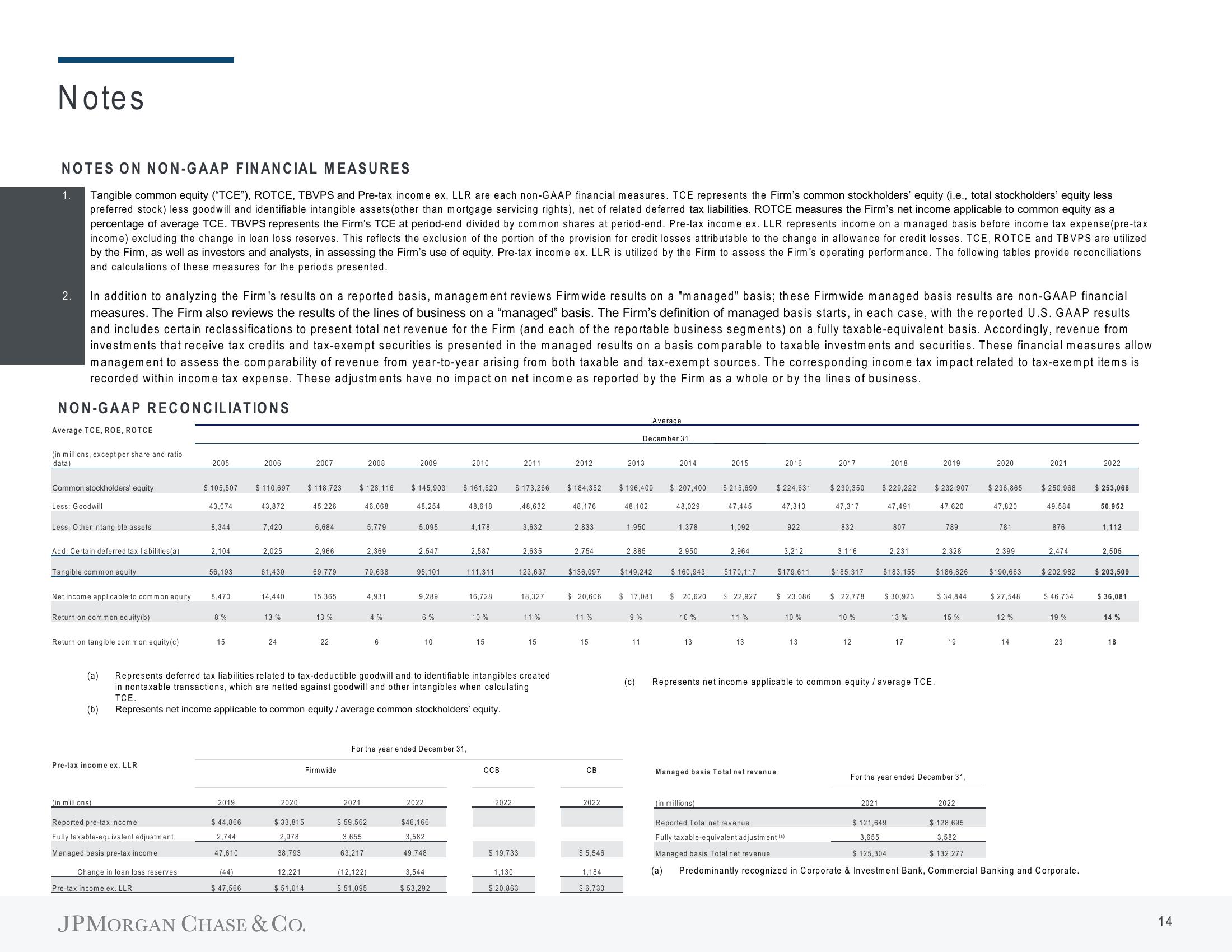

NOTES ON NON-GAAP FINANCIAL MEASURES

Tangible common equity ("TCE"), ROTCE, TBVPS and Pre-tax income ex. LLR are each non-GAAP financial measures. TCE represents the Firm's common stockholders' equity (i.e., total stockholders' equity less

preferred stock) less goodwill and identifiable intangible assets (other than mortgage servicing rights), net of related deferred tax liabilities. ROTCE measures the Firm's net income applicable to common equity as a

percentage of average TCE. TBVPS represents the Firm's TCE at period-end divided by common shares at period-end. Pre-tax income ex. LLR represents income on a managed basis before income tax expense (pre-tax

income) excluding the change in loan loss reserves. This reflects the exclusion of the portion of the provision for credit losses attributable to the change in allowance for credit losses. TCE, ROTCE and TBVPS are utilized

by the Firm, as well as investors and analysts, in assessing the Firm's use of equity. Pre-tax income ex. LLR is utilized by the Firm to assess the Firm's operating performance. The following tables provide reconciliations

and calculations of these measures for the periods presented.

1.

2.

In addition to analyzing the Firm's results on a reported basis, management reviews Firm wide results on a "managed" basis; these Firm wide managed basis results are non-GAAP financial

measures. The Firm also reviews the results of the lines of business on a "managed" basis. The Firm's definition of managed basis starts, in each case, with the reported U.S. GAAP results

and includes certain reclassifications to present total net revenue for the Firm (and each of the reportable business segments) on a fully taxable-equivalent basis. Accordingly, revenue from

investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and securities. These financial measures allow

management to assess the comparability of revenue from year-to-year arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is

recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business.

NON-GAAP RECONCILIATIONS

Average TCE, ROE, ROTCE

(in millions, except per share and ratio

data)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities(a)

Tangible common equity

Net income applicable to common equity

Return on common equity (b)

Return on tangible common equity(c)

(a)

(b)

Pre-tax income ex. LLR

(in millions)

Reported pre-tax income

Fully taxable-equivalent adjustment

Managed basis pre-tax income

Change in loan loss reserves

2005

Pre-tax income ex. LLR

$ 105,507

43,074

8,344

2,104

56,193

8,470

8%

15

2019

$44,866

2,744

47,610

2006

(44)

$ 47,566

$ 110,697

43,872

7,420

2,025

61,430

14,440

13%

24

2020

$ 33,815

2,978

38,793

12,221

$51,014

2007

$ 118,723 $ 128,116

45,226

JPMORGAN CHASE & CO.

6,684

2,966

69,779

15,365

13%

22

Firmwide

2008

46,068

2021

5,779

2,369

79,638

4,931

$ 59,562

3,655

63,217

(12,122)

$ 51,095

4%

6

2009

$145,903

48,254

5,095

2,547

95,101

9,289

6%

10

For the year ended December 31,

2022

Represents deferred tax liabilities related to tax-deductible goodwill and to identifiable intangibles created

in nontaxable transactions, which are netted against goodwill and other intangibles when calculating

TCE.

Represents net income applicable to common equity / average common stockholders' equity.

$46,166

3,582

49,748

2010

$ 161,520

3,544

$53,292

48,618

4,178

2,587

111,311

16,728

10%

15

CCB

2022

2011

$ 173,266

$19,733

1,130

$ 20,863

,48,632

3,632

2,635

123,637

18,327

11%

15

2012

$ 184,352

48,176

2,833

2,754

$136.097

$ 20,606

11%

15

CB

2022

$5,546

1,184

$6,730

2013

Average

December 31,

$ 196,409

48,102

1,950

2,885

$149,242

$ 17,081

9%

11

2014

$ 207,400

48,029

1,378

2,950

$ 160,943

$ 20,620

10%

13

2015

$215,690

47,445

1,092

2,964

$170,117

$ 22,927

11%

13

2016

$ 224,631

47,310

Managed basis Total net revenue

922

3,212

$179,611

$ 23,086

10%

13

2017

$ 230,350

47,317

832

3,116

$185,317

$ 22,778

10 %

12

2018

$ 229,222

2021

47,491

807

2,231

$183,155

$ 30,923

$ 121,649

3,655

$ 125,304

13 %

17

(c) Represents net income applicable to common equity / average TCE.

2019

$ 232,907

47,620

789

2,328

$186,826

$ 34,844

15%

For the year ended December 31,

19

2020

2022

$ 236,865

47,820

781

2,399

$190,663

$ 27,548

12%

14

2021

$ 250,968

49,584

876

2,474

$ 202,982

$46,734

(in millions)

Reported Total net revenue

$ 128,695

3,582

Fully taxable-equivalent adjustment (a)

Managed basis Total net revenue

$ 132,277

(a) Predominantly recognized in Corporate & Investment Bank, Commercial Banking and Corporate.

19 %

23

2022

$ 253,068

50,952

1,112

2,505

$ 203,509

$ 36,081

14%

18

14View entire presentation