MoneyLion Results Presentation Deck

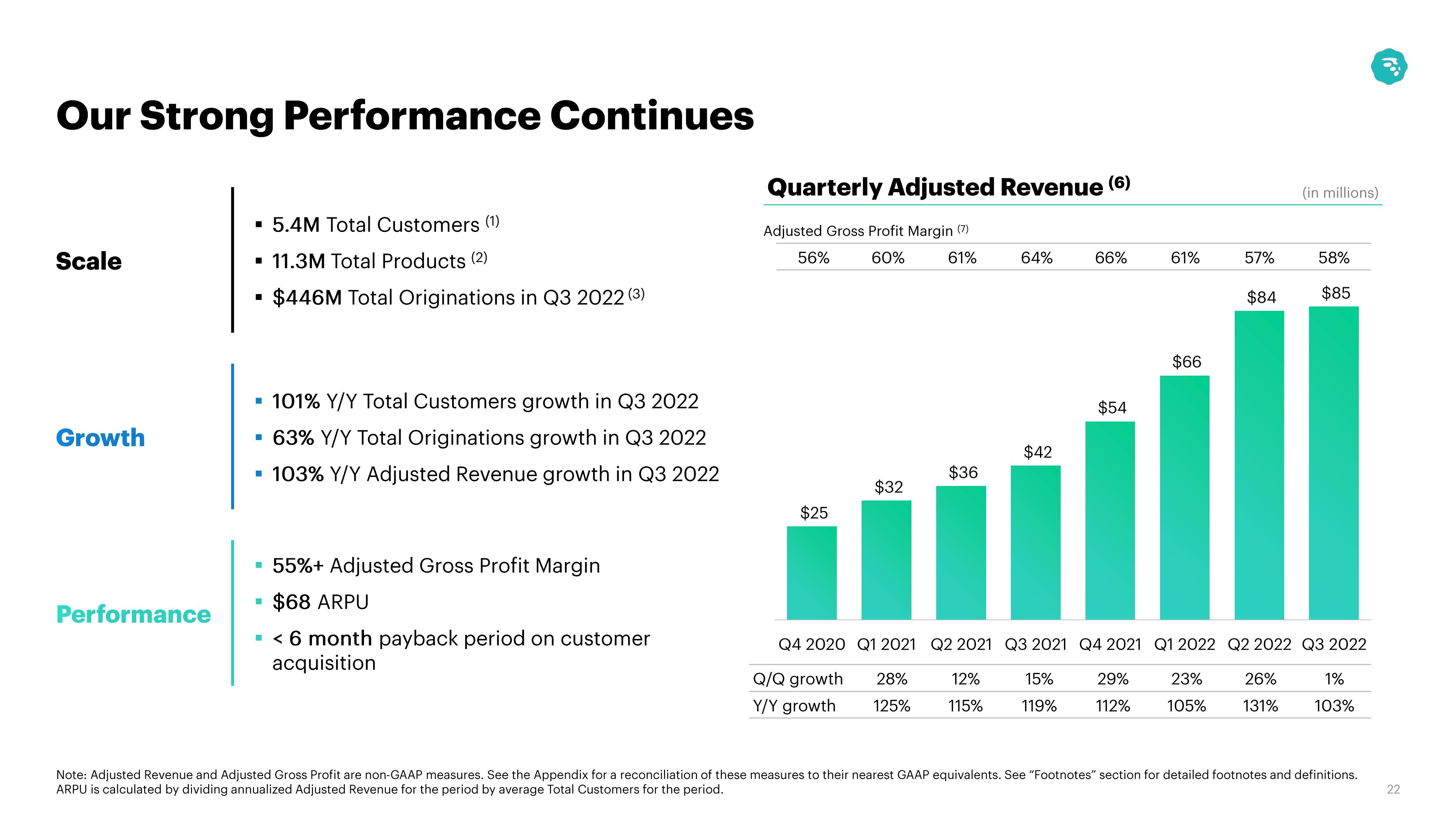

Our Strong Performance Continues

Scale

Growth

Performance

▪ 5.4M Total Customers (1)

11.3M Total Products (2)

$446M Total Originations in Q3 2022 (³)

■

▪ 101% Y/Y Total Customers growth in Q3 2022

▪ 63% Y/Y Total Originations growth in Q3 2022

▪ 103% Y/Y Adjusted Revenue growth in Q3 2022

▪ 55%+ Adjusted Gross Profit Margin

$68 ARPU

▪ < 6 month payback period on customer

acquisition

I

Quarterly Adjusted Revenue (6)

Adjusted Gross Profit Margin (7)

56% 60%

61%

$25

$32

$36

64%

$42

66%

$54

61%

$66

57%

$84

(in millions)

26%

131%

58%

$85

Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022

Q/Q growth

Y/Y growth

28%

125%

12%

115%

15%

119%

29%

112%

23%

105%

1%

103%

Note: Adjusted Revenue and Adjusted Gross Profit are non-GAAP measures. See the Appendix for a reconciliation of these measures to their nearest GAAP equivalents. See "Footnotes" section for detailed footnotes and definitions.

ARPU is calculated by dividing annualized Adjusted Revenue for the period by average Total Customers for the period.

22View entire presentation