GlobalFoundries Results Presentation Deck

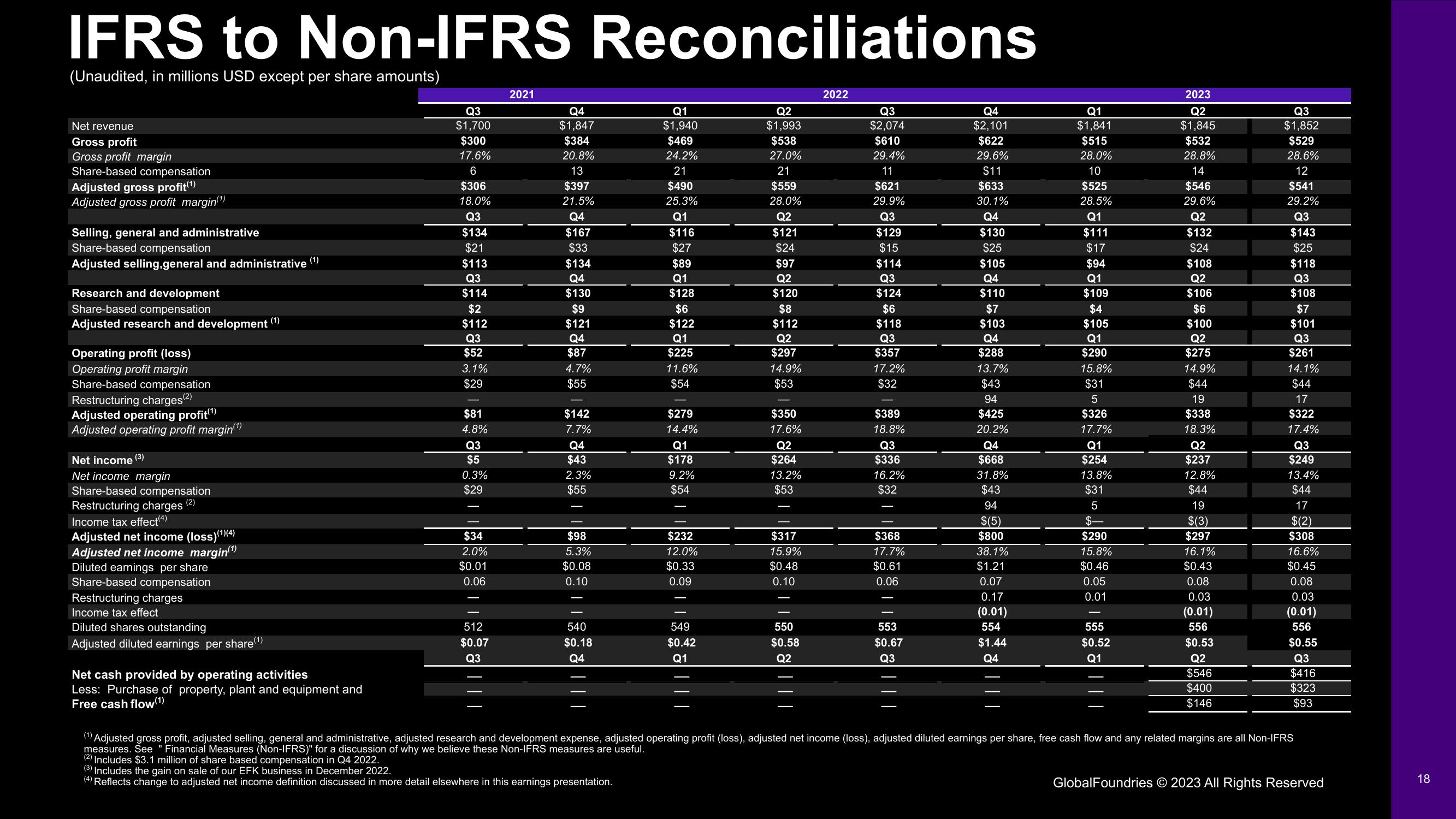

IFRS to Non-IFRS Reconciliations

(Unaudited, in millions USD except per share amounts)

Net revenue

Gross profit

Gross profit margin

Share-based compensation

Adjusted gross profit(¹)

Adjusted gross profit margin(¹)

Selling, general and administrative

Share-based compensation

Adjusted selling,general and administrative

Research and development

Share-based compensation

Adjusted research and development (1)

Operating profit (loss)

Operating profit margin

Share-based compensation

Restructuring charges(²)

Adjusted operating profit (¹)

Adjusted operating profit margin(¹)

Net income (3)

Net income margin

Share-based compensation

(2)

Restructuring charges

Income tax effect(4)

Adjusted net income (loss)(¹)(4)

Adjusted net income margin(¹)

Diluted earnings per share

Share-based compensation

Restructuring charges

Income tax effect

Diluted shares outstanding

Adjusted diluted earnings per share(1)

(1)

Net cash provided by operating activities

Less: Purchase of property, plant and equipment and

Free cash flow (1)

Q3

$1,700

$300

17.6%

6

$306

18.0%

Q3

$134

$21

$113

Q3

$114

$2

$112

Q3

$52

3.1%

$29

$81

4.8%

Q3

$5

0.3%

$29

$34

2.0%

$0.01

0.06

512

$0.07

Q3

2021

Q4

$1,847

$384

20.8%

13

$397

21.5%

Q4

$167

$33

$134

Q4

$130

$9

$121

Q4

$87

4.7%

$55

$142

7.7%

Q4

$43

2.3%

$55

$98

5.3%

$0.08

0.10

540

$0.18

Q4

Q1

$1,940

$469

24.2%

21

$490

25.3%

Q1

$116

$27

$89

Q1

$128

$6

$122

Q1

$225

11.6%

$54

$279

14.4%

Q1

$178

9.2%

$54

I

$232

12.0%

$0.33

0.09

549

$0.42

Q1

Q2

$1,993

$538

27.0%

21

$559

28.0%

Q2

$121

$24

$97

Q2

$120

$8

$112

Q2

$297

14.9%

$53

$350

17.6%

Q2

$264

13.2%

$53

T

$317

15.9%

$0.48

0.10

550

$0.58

Q2

2022

Q3

$2,074

$610

29.4%

11

$621

29.9%

Q3

$129

$15

$114

Q3

$124

$6

$118

Q3

$357

17.2%

$32

$389

18.8%

Q3

$336

16.2%

$32

$368

17.7%

$0.61

0.06

553

$0.67

Q3

Q4

$2,101

$622

29.6%

$11

$633

30.1%

Q4

$130

$25

$105

Q4

$110

$7

$103

Q4

$288

13.7%

$43

94

$425

20.2%

Q4

$668

31.8%

$43

94

$(5)

$800

38.1%

$1.21

0.07

0.17

(0.01)

554

$1.44

Q4

Q1

$1,841

$515

28.0%

10

$525

28.5%

Q1

$111

$17

$94

Q1

$109

$4

$105

Q1

$290

15.8%

$31

5

$326

17.7%

Q1

$254

13.8%

$31

5

$-

$290

15.8%

$0.46

0.05

0.01

555

$0.52

Q1

2023

Q2

$1,845

$532

28.8%

14

$546

29.6%

Q2

$132

$24

$108

Q2

$106

$6

$100

Q2

$275

14.9%

$44

19

$338

18.3%

Q2

$237

12.8%

$44

19

$(3)

$297

16.1%

$0.43

0.08

0.03

(0.01)

556

$0.53

Q2

$546

$400

$146

Q3

$1,852

$529

28.6%

12

$541

29.2%

Q3

$143

$25

$118

Q3

$108

$7

$101

Q3

$261

14.1%

$44

17

$322

17.4%

Q3

$249

13.4%

$44

17

$(2)

$308

16.6%

$0.45

0.08

0.03

(0.01)

556

$0.55

Q3

$416

$323

$93

(1) Adjusted gross profit, adjusted selling, general and administrative, adjusted research and development expense, adjusted operating profit (loss), adjusted net income (loss), adjusted diluted earnings per share, free cash flow and any related margins are all Non-IFRS

measures. See "Financial Measures (Non-IFRS)" for a discussion of why we believe these Non-IFRS measures are useful.

(2) Includes $3.1 million of share based compensation in Q4 2022.

(3) Includes the gain on sale of our EFK business in December 2022.

(4) Reflects change to adjusted net income definition discussed in more detail elsewhere in this earnings presentation.

GlobalFoundries © 2023 All Rights Reserved

18View entire presentation