Sale of a 19.9% Ownership Interest in NIPSCO

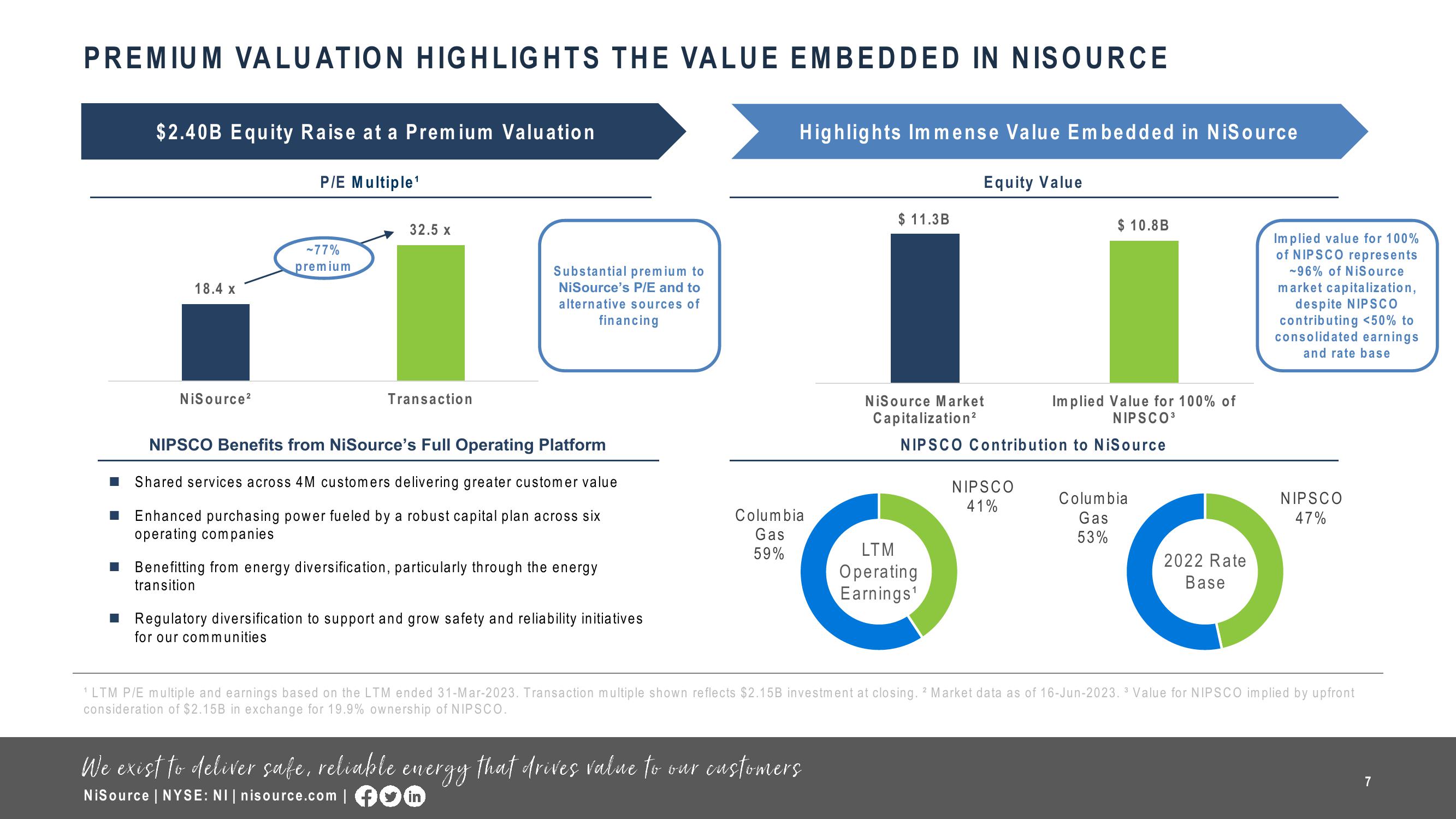

PREMIUM VALUATION HIGHLIGHTS THE VALUE EMBEDDED IN NISOURCE

$2.40B Equity Raise at a Premium Valuation

18.4 x

NiSource²

P/E Multiple¹

-77%

premium

32.5 X

Transaction

Substantial premium to

NiSource's P/E and to

alternative sources of

financing

NIPSCO Benefits from NiSource's Full Operating Platform

■ Shared services across 4M customers delivering greater customer value

Enhanced purchasing power fueled by a robust capital plan across six

operating companies

Benefitting from energy diversification, particularly through the energy

transition

■ Regulatory diversification to support and grow safety and reliability initiatives

for our communities

Highlights Immense Value Embedded in NiSource

Columbia

Gas

59%

$ 11.3B

We exist to deliver safe, reliable energy that drives value to our customers

NiSource | NYSE: NI| nisource.com | ♥M

Equity Value

NiSource Market

Capitalization²

LTM

Operating

Earnings¹

$ 10.8B

NIPSCO Contribution to NiSource

NIPSCO

41%

Implied Value for 100% of

NIPSCO³

Columbia

Gas

53%

2022 Rate

Base

Implied value for 100%

of NIPSCO represents

-96% of NiSource

market capitalization,

despite NIPSCO

contributing <50% to

consolidated earnings

and rate base

NIPSCO

47%

¹LTM P/E multiple and earnings based on the LTM ended 31-Mar-2023. Transaction multiple shown reflects $2.15B investment at closing. 2 Market data as of 16-Jun-2023.3 Value for NIPSCO implied by upfront

consideration of $2.15B in exchange for 19.9% ownership of NIPSCO.

7View entire presentation