Carlyle Investor Conference Presentation Deck

We Are Confident Our Portfolio Is Well Positioned Amidst A Challenging Market

Environment

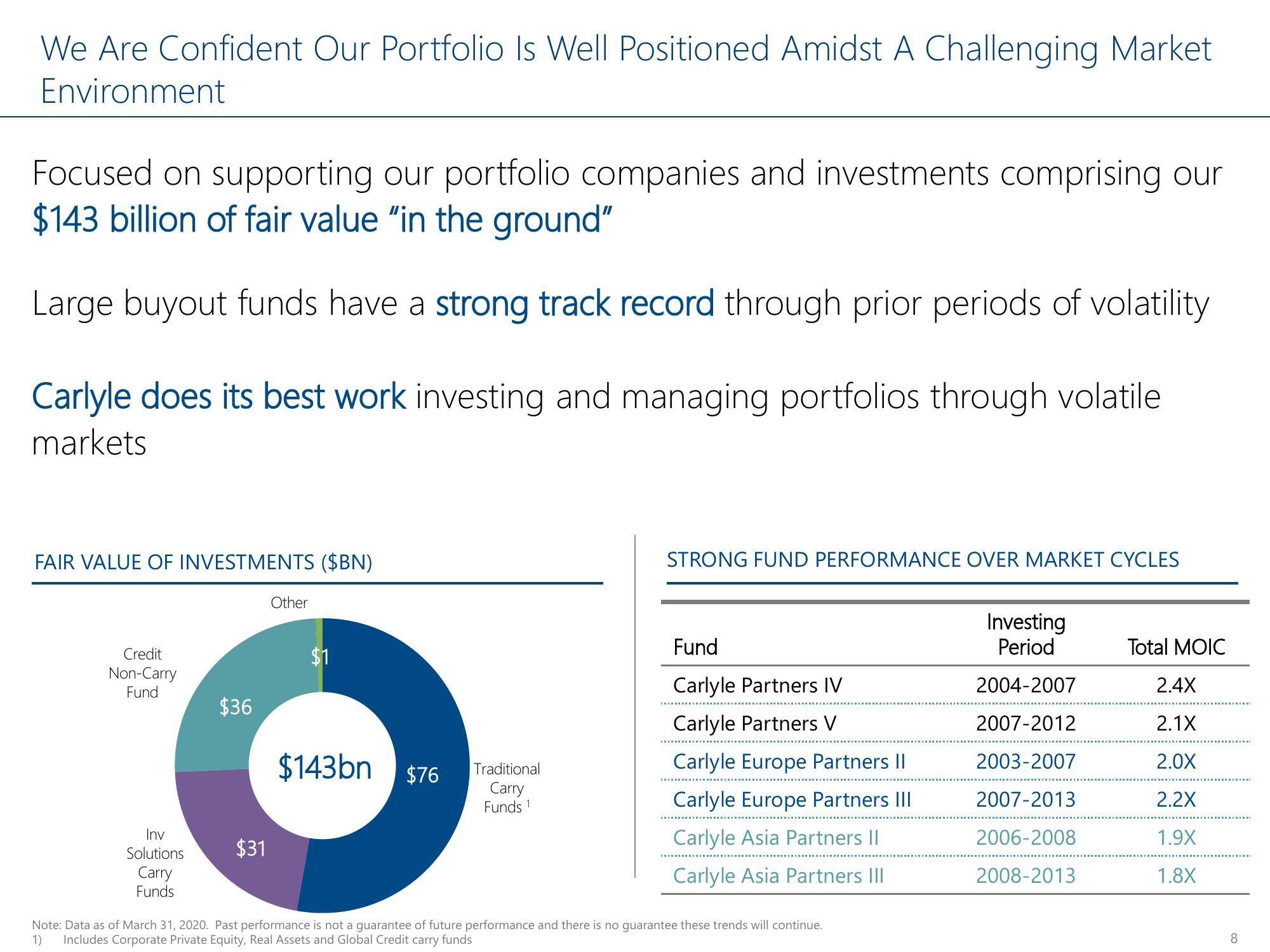

Focused on supporting our portfolio companies and investments comprising our

$143 billion of fair value "in the ground"

Large buyout funds have a strong track record through prior periods of volatility

Carlyle does its best work investing and managing portfolios through volatile

markets

FAIR VALUE OF INVESTMENTS ($BN)

Credit

Non-Carry

Fund

Inv

Solutions

Carry

Funds

$36

$31

Other

$1

$143bn $76

Traditional

Carry

Funds 1

STRONG FUND PERFORMANCE OVER MARKET CYCLES

Fund

Carlyle Partners IV

Carlyle Partners V

Carlyle Europe Partners II

Carlyle Europe Partners III

Carlyle Asia Partners II

Carlyle Asia Partners III

Note: Data as of March 31, 2020. Past performance is not a guarantee of future performance and there is no guarantee these trends will continue.

1) Includes Corporate Private Equity, Real Assets and Global Credit carry funds

Investing

Period

2004-2007

2007-2012

2003-2007

2007-2013

2006-2008

2008-2013

Total MOIC

2.4X

2.1X

2.0X

2.2X

1.9X

1.8X

8View entire presentation