Sonos Results Presentation Deck

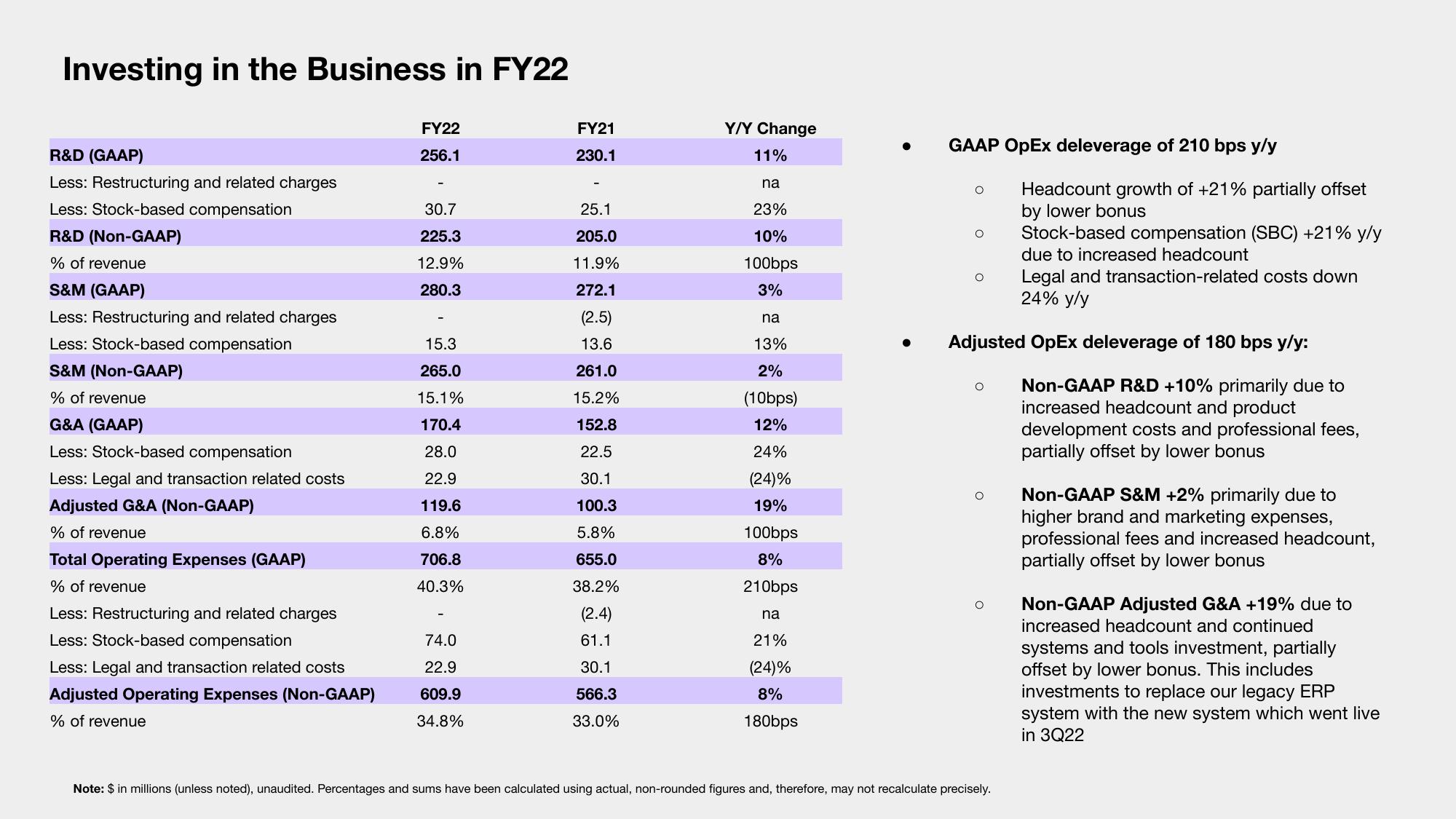

Investing in the Business in FY22

R&D (GAAP)

Less: Restructuring and related charges

Less: Stock-based compensation

R&D (Non-GAAP)

% of revenue

S&M (GAAP)

Less: Restructuring and related charges

Less: Stock-based compensation

S&M (Non-GAAP)

% of revenue

G&A (GAAP)

Less: Stock-based compensation

Less: Legal and transaction related costs

Adjusted G&A (Non-GAAP)

% of revenue

Total Operating Expenses (GAAP)

% of revenue

Less: Restructuring and related charges

Less: Stock-based compensation

Less: Legal and transaction related costs

Adjusted Operating Expenses (Non-GAAP)

% of revenue

FY22

256.1

30.7

225.3

12.9%

280.3

15.3

265.0

15.1%

170.4

28.0

22.9

119.6

6.8%

706.8

40.3%

74.0

22.9

609.9

34.8%

FY21

230.1

25.1

205.0

11.9%

272.1

(2.5)

13.6

261.0

15.2%

152.8

22.5

30.1

100.3

5.8%

655.0

38.2%

(2.4)

61.1

30.1

566.3

33.0%

Y/Y Change

11%

na

23%

10%

100bps

3%

na

13%

2%

(10bps)

12%

24%

(24)%

19%

100bps

8%

210bps

na

21%

(24)%

8%

180bps

GAAP OpEx deleverage of 210 bps y/y

O

O

O

O

Headcount growth of +21% partially offset

by lower bonus

Stock-based compensation (SBC) +21% y/y

due to increased headcount

Adjusted OpEx deleverage of 180 bps y/y:

Non-GAAP R&D +10% primarily due to

increased headcount and product

development costs and professional fees,

partially offset by lower bonus

Legal and transaction-related costs down

24% y/y

Note: $ in millions (unless noted), unaudited. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

O Non-GAAP S&M +2% primarily due to

higher brand and marketing expenses,

professional fees and increased headcount,

partially offset by lower bonus

Non-GAAP Adjusted G&A +19% due to

increased headcount and continued

systems and tools investment, partially

offset by lower bonus. This includes

investments to replace our legacy ERP

system with the new system which went live

in 3Q22View entire presentation