Tradeweb Results Presentation Deck

Asset

Class

Rates

Total

Credit

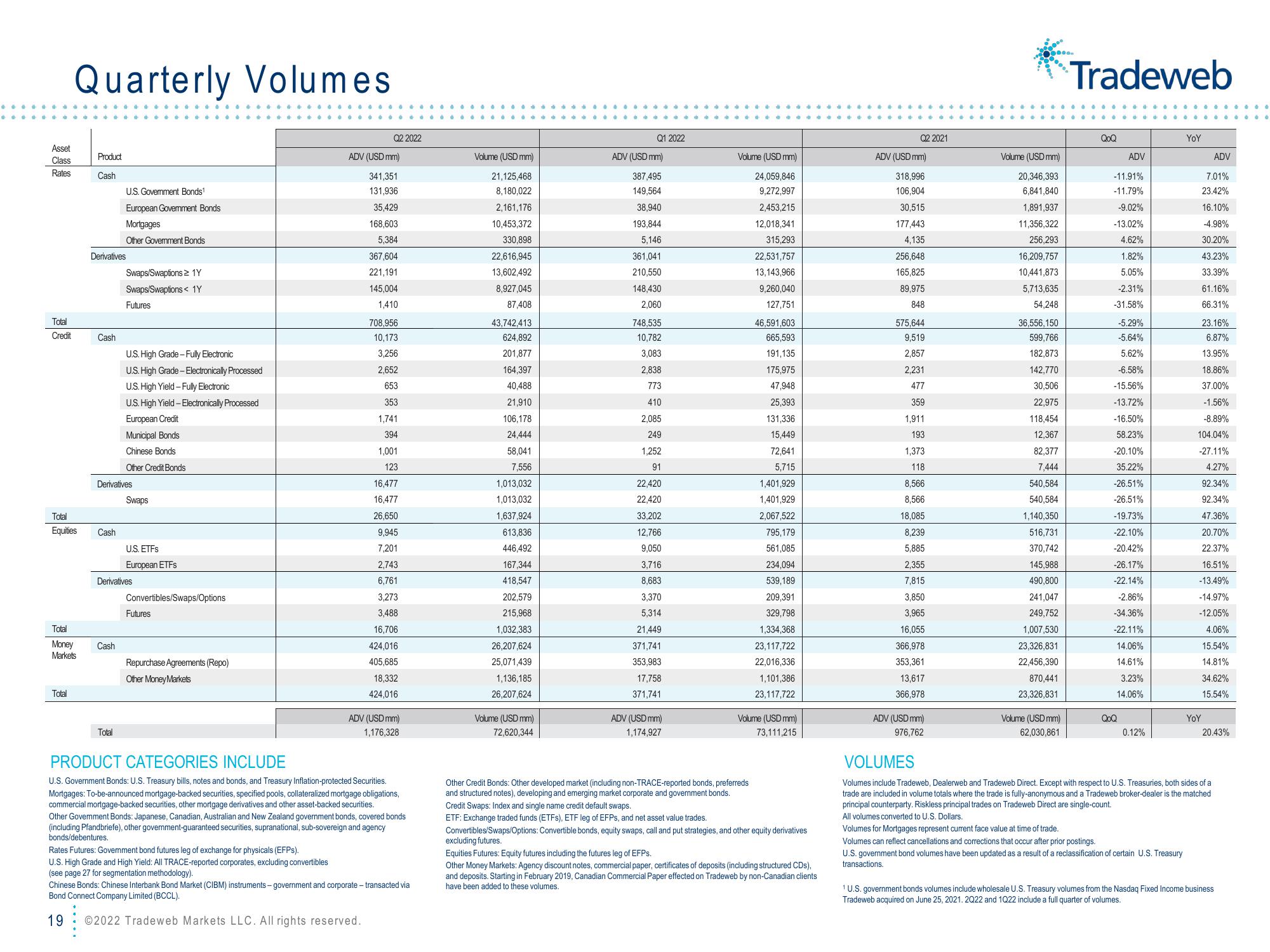

Quarterly Volumes

Total

Equities

Total

Money

Markets

Total

Product

Cash

Derivatives

Cash

Cash

U.S. Government Bonds¹

European Government Bonds

Mortgages

Other Goverment Bonds

Cash

Swaps/Swaptions> 1Y

Swaps/Swaptions 1Y

Derivatives

Total

Futures

U.S. High Grade - Fully Electronic

U.S. High Grade - Electronically Processed

U.S. High Yield-Fully Electronic

U.S. High Yield - Electronically Processed

European Credit

Municipal Bonds

Chinese Bonds

Other Credit Bonds

Swaps

Derivatives

U.S. ETFS

European ETFs

Convertibles/Swaps/Options

Futures

Repurchase Agreements (Repo)

Other Money Markets

Q2 2022

ADV (USD mm)

341,351

131,936

35,429

168,603

5,384

367,604

221,191

145,004

1,410

708,956

10,173

3,256

2,652

653

353

1,741

394

1,001

123

16,477

16,477

26,650

9,945

7,201

2,743

6,761

3,273

3,488

16,706

424,016

405,685

18,332

424,016

ADV (USD mm)

1,176,328

PRODUCT CATEGORIES INCLUDE

U.S. Government Bonds: U.S. Treasury bills, notes and bonds, and Treasury Inflation-protected Securities.

Mortgages: To-be-announced mortgage-backed securities, specified pools, collateralized mortgage obligations,

commercial mortgage-backed securities, other mortgage derivatives and other asset-backed securities.

Other vemment Bonds: Japanese, Canadian, Australian and New Zealand government bonds, covered bonds

(including Pfandbriefe), other government-guaranteed securities, supranational, sub-sovereign and agency

bonds/debentures.

Rates Futures: Govemment bond futures leg of exchange for physicals (EFPs).

U.S. High Grade and High Yield: All TRACE-reported corporates, excluding convertibles

(see page 27 for segmentation methodology).

Chinese Bonds: Chinese Interbank Bond Market (CIBM) instruments-government and corporate - transacted via

Bond Connect Company Limited (BCCL).

19 2022 Tradeweb Markets LLC. All rights reserved.

Volume (USD mm)

21,125,468

8,180,022

2,161,176

10,453,372

330,898

22,616,945

13,602,492

8,927,045

87,408

43,742,413

624,892

201,877

164,397

40,488

21,910

106,178

24,444

58.041

7,556

1,013,032

1,013,032

1,637,924

613,836

446,492

167,344

418,547

202,579

215,968

1,032,383

26,207,624

25,071,439

1,136,185

26,207,624

Volume (USD mm)

72,620,344

Q1 2022

ADV (USD mm)

387,495

149,564

38,940

193,844

5,146

361,041

210,550

148,430

2,060

748,535

10,782

3,083

2,838

773

410

2,085

249

1,252

91

22,420

22,420

33,202

12,766

9,050

3,716

8,683

3,370

5,314

21,449

371,741

353,983

17,758

371,741

ADV (USD mm)

1,174,927

Volume (USD mm)

24,059,846

9,272,997

2,453,215

12,018,341

315,293

22,531,757

13,143,966

9,260,040

127,751

46,591,603

665,593

191,135

175,975

47,948

25,393

131,336

15,449

72,641

5,715

Other Credit Bonds: Other developed market (including non-TRACE-reported bonds, preferreds

and structured notes), developing and emerging market corporate and government bonds.

Credit Swaps: Index and single name credit default swaps.

ETF: Exchange traded funds (ETFs), ETF leg of EFPs, and net asset value trades.

1,401,929

1,401,929

2,067,522

795,179

561,085

234,094

539,189

209,391

329,798

1,334,368

23,117,722

22,016,336

1,101,386

23,117,722

Volume (USD mm)

73,111,215

Convertibles/Swaps/Options: Convertible bonds, equity swaps, call and put strategies, and other equity derivatives

excluding futures.

Equities Futures: Equity futures including the futures leg of EFPs.

Other Money Markets: Agency discount notes, commercial paper, certificates of deposits (including structured CDs),

and deposits. Starting in February 2019, Canadian Commercial Paper effected on Tradeweb by non-Canadian clients

have been added to these volumes.

Q2 2021

ADV (USD mm)

318,996

106,904

30,515

177,443

4,135

256,648

165,825

89,975

848

575,644

9,519

2,857

2,231

477

359

1,911

193

1,373

118

8,566

8,566

18,085

8,239

5,885

2,355

7,815

3,850

3,965

16,055

366,978

353,361

13,617

366,978

ADV (USD mm)

976,762

Volume (USD mm)

20,346,393

6,841,840

1,891,937

11,356,322

256,293

16,209,757

10,441,873

5,713,635

54,248

36,556,150

599,766

182,873

142,770

30,506

22,975

118,454

12,367

82,377

7,444

540,584

540,584

1,140,350

516,731

370,742

145,988

490,800

241,047

249,752

1,007,530

23,326,831

22,456,390

870,441

23,326,831

Volume (USD mm)

62,030,861

Tradeweb

QoQ

ADV

-11.91%

-11.79%

-9.02%

-13.02%

4.62%

1.82%

5.05%

-2.31%

-31.58%

-5.29%

-5.64%

5.62%

-6.58%

-15.56%

-13.72%

-16.50%

58.23%

-20.10%

35.22%

-26.51%

-26.51%

-19.73%

-22.10%

-20.42%

-26.17%

-22.14%

-2.86%

-34.36%

-22.11%

14.06%

14.61%

3.23%

14.06%

QoQ

0.12%

YoY

Volumes for Mortgages represent current face value at time of trade.

Volumes can reflect cancellations and corrections that occur after prior postings.

U.S. government bond volumes have been updated as a result of a reclassification of certain U.S. Treasury

transactions.

ADV

7.01%

23.42%

16.10%

-4.98%

30.20%

43.23%

33.39%

61.16%

66.31%

23.16%

6.87%

13.95%

18.86%

37.00%

-1.56%

-8.89%

104.04%

-27.11%

4.27%

92.34%

92.34%

47.36%

20.70%

22.37%

16.51%

-13.49%

-14.97%

-12.05%

4.06%

15.54%

14.81%

34.62%

15.54%

YoY

20.43%

VOLUMES

Volumes include Tradeweb, Dealerweb and Tradeweb Direct. Except with respect to U.S. Treasuries, both sides of a

trade are included in volume totals where the trade is fully-anonymous and a Tradeweb broker-dealer is the matched

principal counterparty. Riskless principal trades on Tradeweb Direct are single-count.

All volumes converted to U.S. Dollars.

¹ U.S. government bonds volumes include wholesale U.S. Treasury volumes from the Nasdaq Fixed Income business

Tradeweb acquired on June 25, 2021. 2Q22 and 1Q22 include a full quarter of volumes.View entire presentation