Melrose Investor Presentation Deck

(N)

N>

GKN AEROSPACE

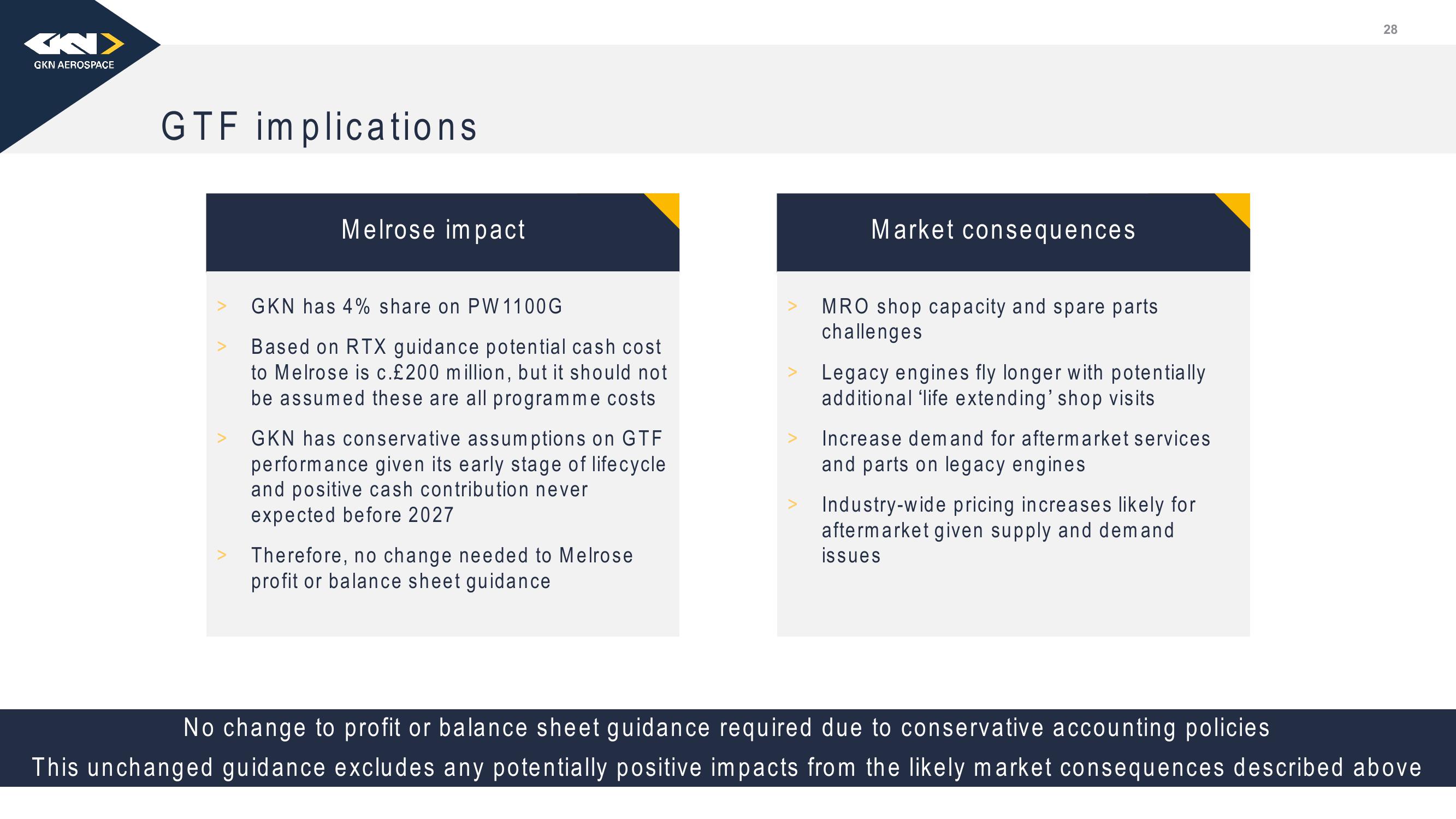

GTF implications

Melrose impact

GKN has 4% share on PW1100G

Based on RTX guidance potential cash cost

to Melrose is c.£200 million, but it should not

be assumed these are all programme costs

GKN has conservative assumptions on GTF

performance given its early stage of lifecycle

and positive cash contribution never

expected before 2027

Therefore, no change needed to Melrose

profit or balance sheet guidance

Market consequences

MRO shop capacity and spare parts

challenges

Legacy engines fly longer with potentially

additional 'life extending' shop visits

Increase demand for aftermarket services

and parts on legacy engines

Industry-wide pricing increases likely for

aftermarket given supply and demand

issues

28

No change to profit or balance sheet guidance required due to conservative accounting policies

This unchanged guidance excludes any potentially positive impacts from the likely market consequences described aboveView entire presentation