Trian Partners Activist Presentation Deck

Big Picture: P&G Investments Have Not Generated Returns For Many Years

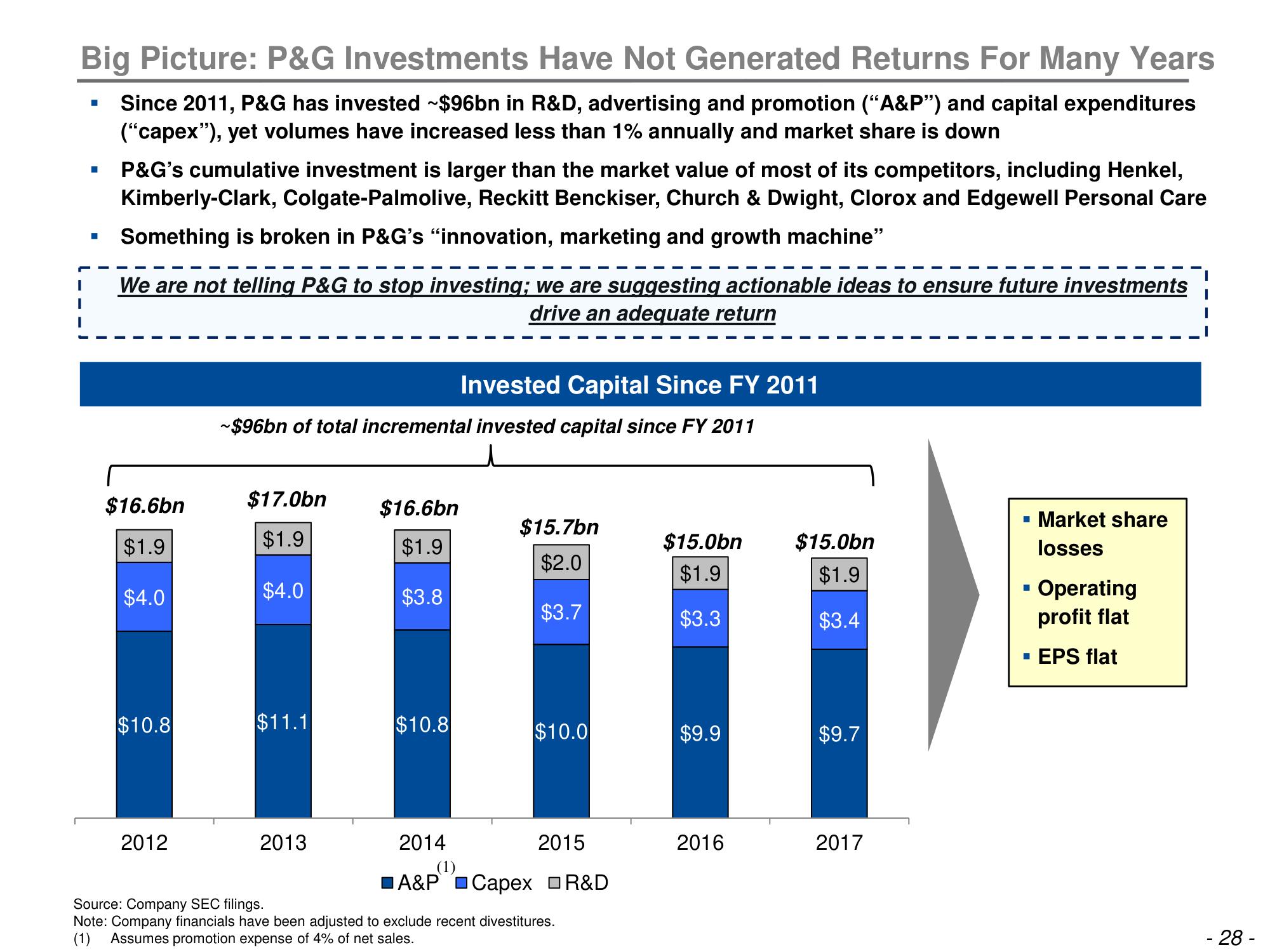

Since 2011, P&G has invested ~$96bn in R&D, advertising and promotion (“A&P”) and capital expenditures

("capex"), yet volumes have increased less than 1% annually and market share is down

I

■

■

P&G's cumulative investment is larger than the market value of most of its competitors, including Henkel,

Kimberly-Clark, Colgate-Palmolive, Reckitt Benckiser, Church & Dwight, Clorox and Edgewell Personal Care

Something is broken in P&G's "innovation, marketing and growth machine"

We are not telling P&G to stop investing; we are suggesting actionable ideas to ensure future investments

drive an adequate return

$16.6bn

$1.9

$4.0

$10.8

2012

~$96bn of total incremental invested capital since FY 2011

$17.0bn

$1.9

$4.0

$11.1

2013

$16.6bn

$1.9

$3.8

$10.8

Invested Capital Since FY 2011

2014

$15.7bn

$2.0

$3.7

$10.0

2015

(1)

A&P Capex □R&D

Source: Company SEC filings.

Note: Company financials have been adjusted to exclude recent divestitures.

(1) Assumes promotion expense of 4% of net sales.

$15.0bn

$1.9

$3.3

$9.9

2016

$15.0bn

$1.9

$3.4

$9.7

2017

▪ Market share

losses

▪ Operating

profit flat

EPS flat

■

I

- 28-View entire presentation