OpenText Investor Presentation Deck

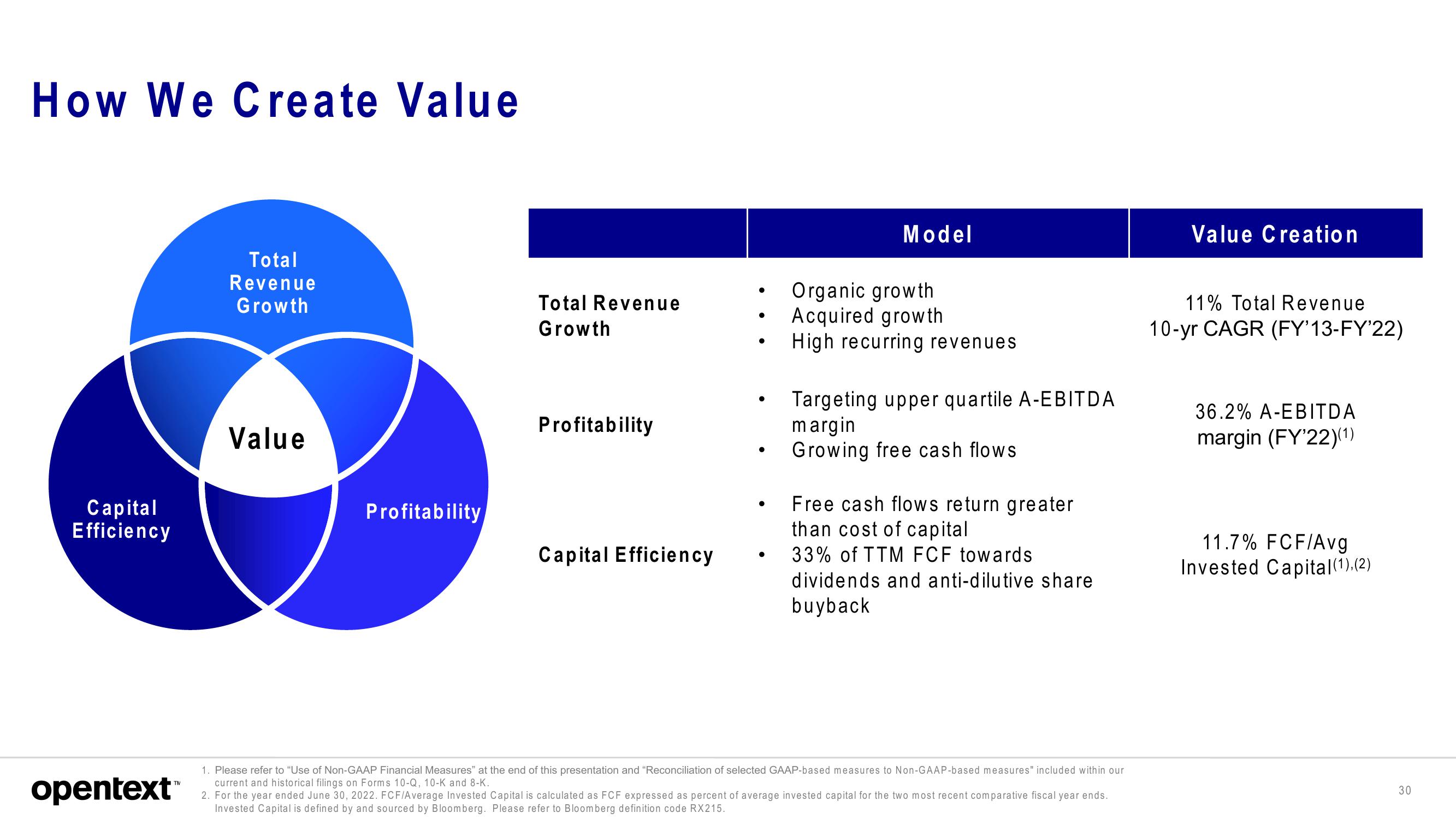

How We Create Value

Capital

Efficiency

opentext

TN

Total

Revenue

Growth

Value

Profitability

Total Revenue

Growth

Profitability

Capital Efficiency

●

●

●

●

●

Model

Organic growth

Acquired growth

High recurring revenues

Targeting upper quartile A-EBITDA

margin

Growing free cash flows.

Free cash flows return greater

than cost of capital

33% of TTM FCF towards

dividends and anti-dilutive share

buyback

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our

current and historical filings on Forms 10-Q, 10-K and 8-K.

2. For the year ended June 30, 2022. FCF/Average Invested Capital is calculated as FCF expressed as percent of average invested capital for the two most recent comparative fiscal year ends.

Invested Capital is defined by and sourced by Bloomberg. Please refer to Bloomberg definition code RX215.

Value Creation

11% Total Revenue

10-yr CAGR (FY'13-FY'22)

36.2% A-EBITDA

margin (FY'22)(1)

11.7% FCF/Avg

Invested Capital(1).(2)

30View entire presentation