OppFi SPAC Presentation Deck

3

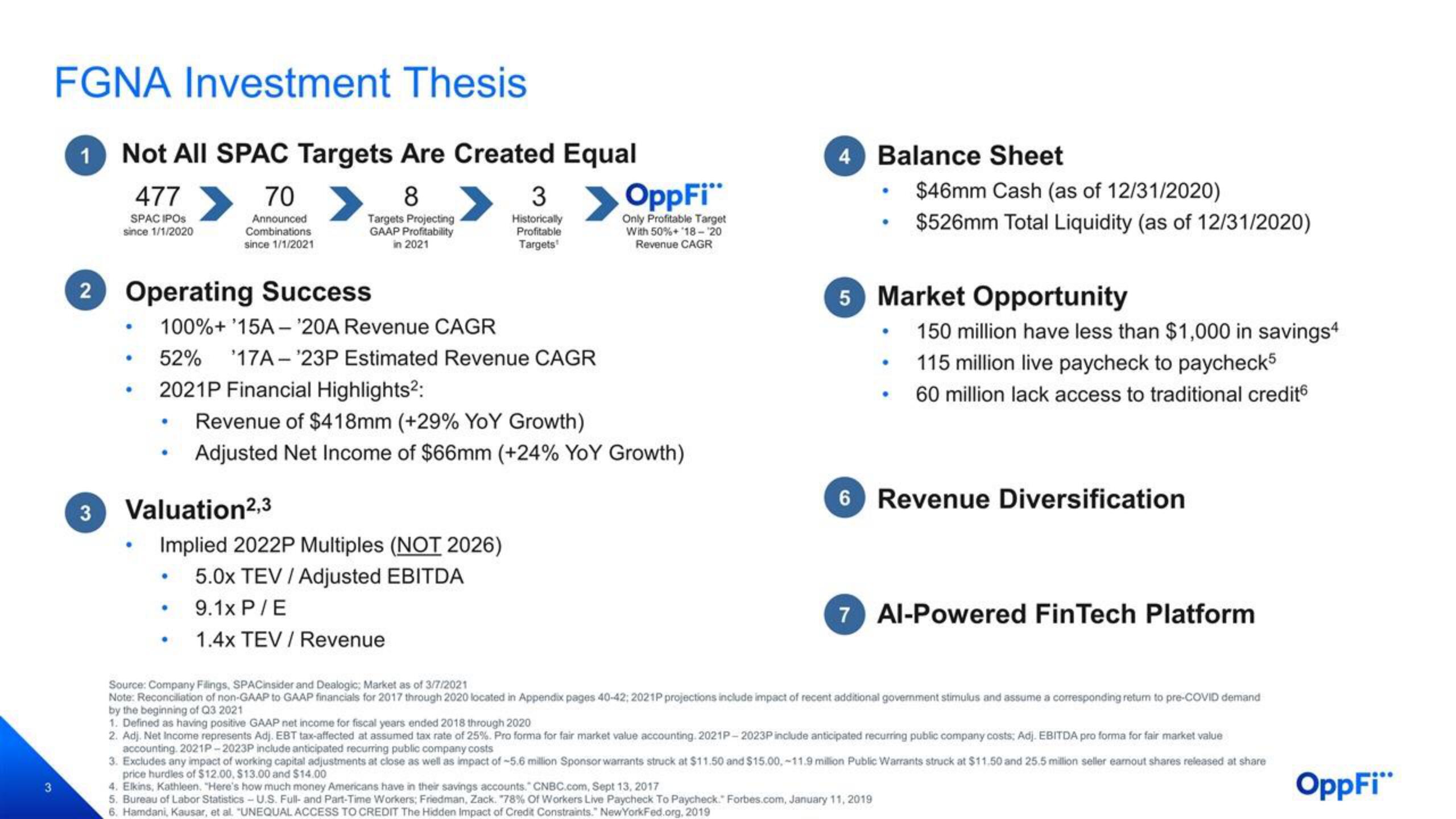

FGNA Investment Thesis

1

Not All SPAC Targets Are Created Equal

477

8

SPAC IPOS

since 1/1/2020

Targets Projecting

GAAP Profitability

in 2021

70

Announced

Combinations

since 1/1/2021

2 Operating Success

100%+ '15A '20A Revenue CAGR

52% 17A-23P Estimated Revenue CAGR

2021P Financial Highlights²:

3 Valuation²,3

●

3

Historically

Profitable

Targets

Implied 2022P Multiples (NOT 2026)

• 5.0x TEV/Adjusted EBITDA

9.1x P/E

1.4x TEV / Revenue

Revenue of $418mm (+29% YoY Growth)

Adjusted Net Income of $66mm (+24% YoY Growth)

OppFi"

Only Profitable Target

With 50% + 18-20

Revenue CAGR

4 Balance Sheet

$46mm Cash (as of 12/31/2020)

$526mm Total Liquidity (as of 12/31/2020)

5 Market Opportunity

150 million have less than $1,000 in savings4

115 million live paycheck to paycheck5

60 million lack access to traditional credit

6 Revenue Diversification

7 Al-Powered FinTech Platform

Source: Company Filings, SPACinsider and Dealogic; Market as of 3/7/2021

Note: Reconciliation of non-GAAP to GAAP financials for 2017 through 2020 located in Appendix pages 40-42; 2021P projections include impact of recent additional government stimulus and assume a corresponding return to pre-COVID demand

by the beginning of Q3 2021

1. Defined as having positive GAAP net income for fiscal years ended 2018 through 2020

2. Adj. Net Income represents Adj. EBT tax-affected at assumed tax rate of 25%. Pro forma for fair market value accounting. 2021P-2023P include anticipated recurring public company costs; Adj. EBITDA pro forma for fair market value

accounting. 2021P-2023P include anticipated recurring public company costs

4. Elkins, Kathleen. "Here's how much money Americans have in their savings accounts. CNBC.com, Sept 13, 2017

5. Bureau of Labor Statistics - U.S. Full- and Part-Time Workers; Friedman, Zack. "78% Of Workers Live Paycheck To Paycheck." Forbes.com, January 11, 2019

6. Hamdani, Kausar, et al. "UNEQUAL ACCESS TO CREDIT The Hidden Impact of Credit Constraints." New YorkFed.org, 2019

3. Excludes any impact of working capital adjustments at close as well as impact of -5.6 million Sponsor warrants struck at $11.50 and $15.00-11.9 milion Public Warrants struck at $11.50 and 25.5 million seller eamout shares released at share

price hurdles of $12.00, $13.00 and $14.00

OppFi"View entire presentation