Sonos Results Presentation Deck

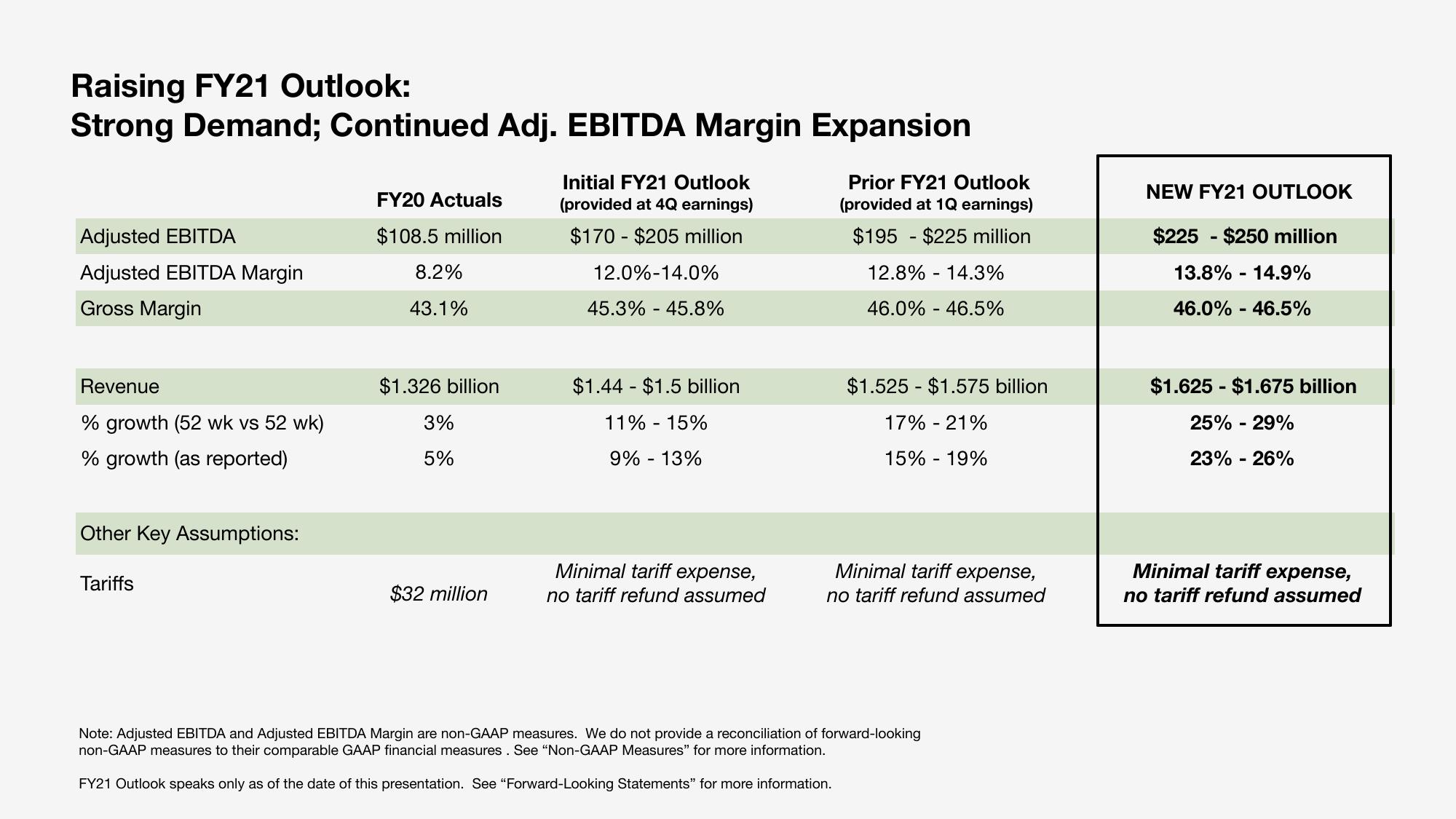

Raising FY21 Outlook:

Strong Demand; Continued Adj. EBITDA Margin Expansion

Adjusted EBITDA

Adjusted EBITDA Margin

Gross Margin

Revenue

% growth (52 wk vs 52 wk)

% growth (as reported)

Other Key Assumptions:

Tariffs

FY20 Actuals

$108.5 million

8.2%

43.1%

$1.326 billion

3%

5%

$32 million

Initial FY21 Outlook

(provided at 4Q earnings)

$170 - $205 million

12.0%-14.0%

45.3% - 45.8%

$1.44 $1.5 billion

11% - 15%

9% -13%

Minimal tariff expense,

no tariff refund assumed

Prior FY21 Outlook

(provided at 1Q earnings)

$195 $225 million

12.8% 14.3%

46.0% - 46.5%

$1.525 $1.575 billion

17% -21%

15% - 19%

Minimal tariff expense,

no tariff refund assumed

Note: Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. We do not provide a reconciliation of forward-looking

non-GAAP measures to their comparable GAAP financial measures. See "Non-GAAP Measures" for more information.

FY21 Outlook speaks only as of the date of this presentation. See "Forward-Looking Statements" for more information.

NEW FY21 OUTLOOK

$225

$250 million

-

13.8% 14.9%

46.0% - 46.5%

$1.625 $1.675 billion

25% -29%

23% -26%

Minimal tariff expense,

no tariff refund assumedView entire presentation