Mesirow Private Equity

■

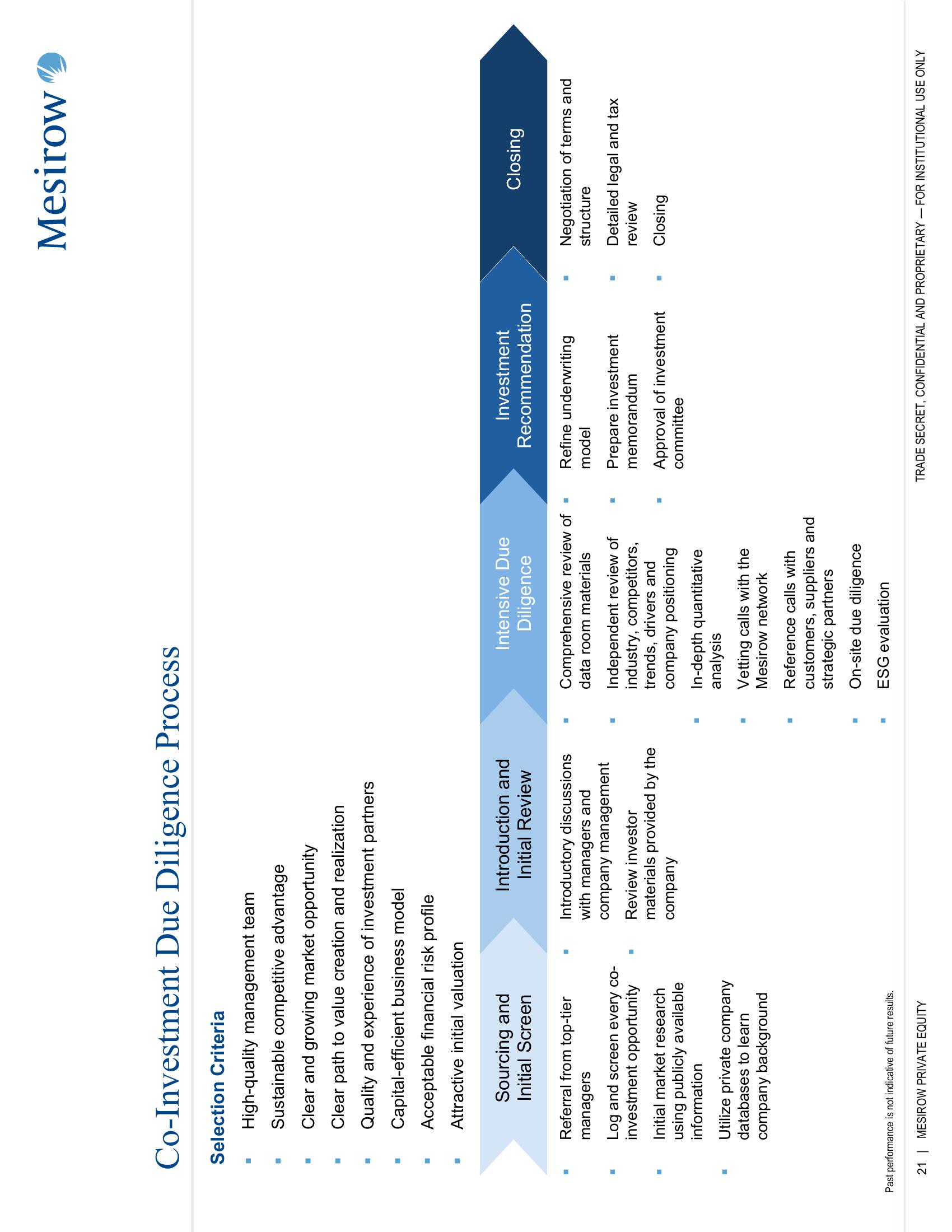

Co-Investment Due Diligence Process

■

H

Selection Criteria

■

■

High-quality management team

Sustainable competitive advantage

Clear and growing market opportunity

Clear path to value creation and realization

Quality and experience of investment partners

Capital-efficient business model

Acceptable financial risk profile

Attractive initial valuation

Sourcing and

Initial Screen

Referral from top-tier

managers

Log and screen every co-

investment opportunity

Initial market research

using publicly available

information

Utilize private company

databases to learn

company background

Past performance is not indicative of future results.

21 | MESIROW PRIVATE EQUITY

Introduction and

Initial Review

Introductory discussions

with managers and

company management

Review investor

materials provided by the

company

■

Intensive Due

Diligence

Comprehensive review of

data room materials

Independent review of

industry, competitors,

trends, drivers and

company positioning

In-depth quantitative

analysis

Vetting calls with the

Mesirow network

Reference calls with

customers, suppliers and

strategic partners

On-site due diligence

ESG evaluation

■

H

Investment

Recommendation

Refine underwriting

model

Prepare investment

memorandum

Approval of investment

committee

■

Mesirow

Closing

Negotiation of terms and

structure

Detailed legal and tax

review

Closing

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation