Eutelsat Investor Presentation Deck

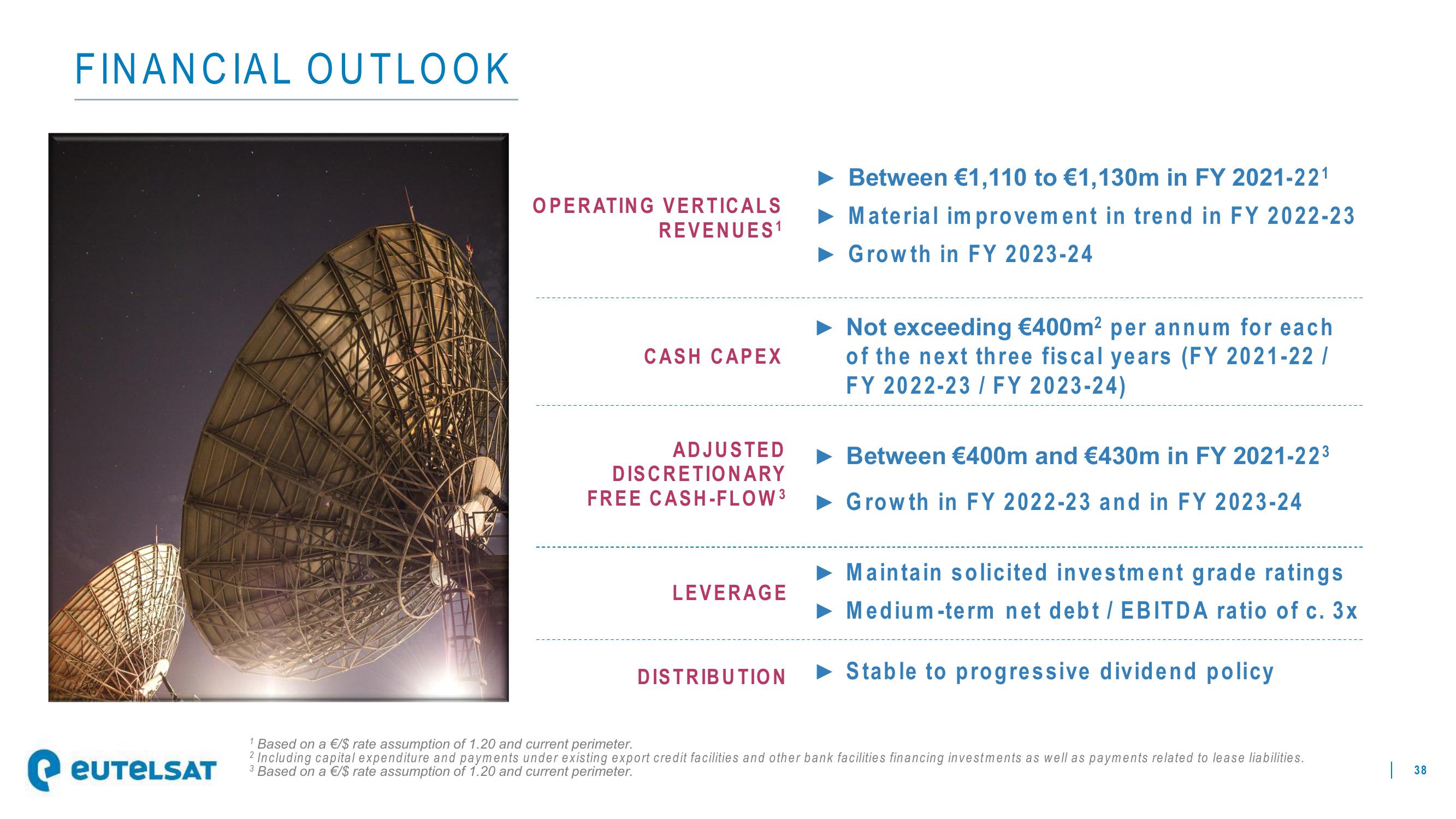

FINANCIAL OUTLOOK

▸ EUTELSAT

OPERATING VERTICALS

REVENUES ¹

CASH CAPEX

LEVERAGE

► Between €1,110 to €1,130m in FY 2021-221

Material improvement in trend in FY 2022-23

Growth in FY 2023-24

ADJUSTED

Between €400m and €430m in FY 2021-22³

DISCRETIONARY

FREE CASH-FLOW ³ ► Growth in FY 2022-23 and in FY 2023-24

DISTRIBUTION

Not exceeding €400m² per annum for each

of the next three fiscal years (FY 2021-22/

FY 2022-23 / FY 2023-24)

Maintain solicited investment grade ratings

► Medium-term net debt / EBITDA ratio of c. 3x

► Stable to progressive dividend policy

1 Based on a €/$ rate assumption of 1.20 and current perimeter.

2 Including capital expenditure and payments under existing export credit facilities and other bank facilities financing investments as well as payments related to lease liabilities.

3 Based on a €/$ rate assumption of 1.20 and current perimeter.

38View entire presentation