Dynatrace Results Presentation Deck

FY23 Guidance Summary

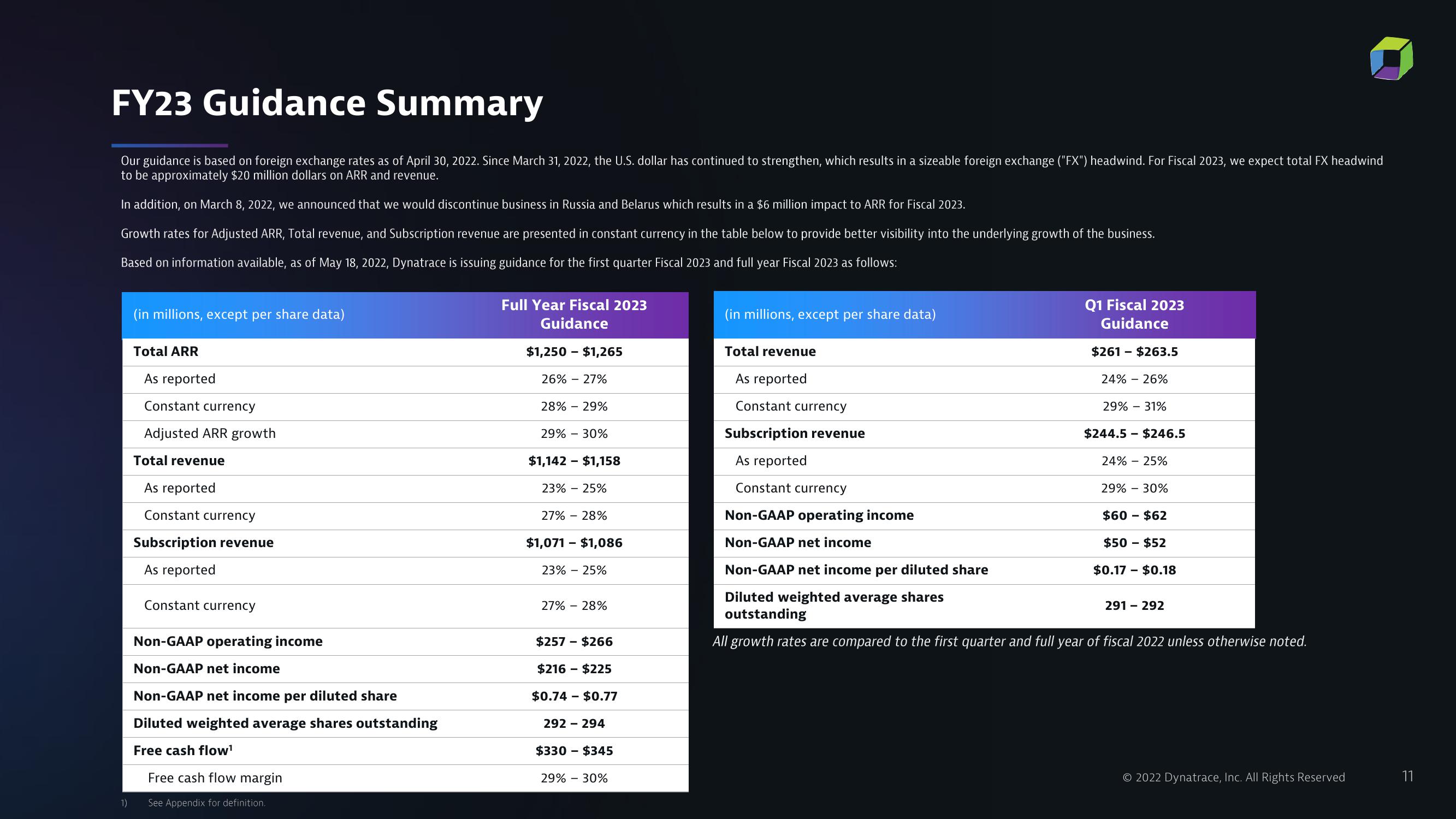

Our guidance is based on foreign exchange rates as of April 30, 2022. Since March 31, 2022, the U.S. dollar has continued to strengthen, which results in a sizeable foreign exchange ("FX") headwind. For Fiscal 2023, we expect total FX headwind

to be approximately $20 million dollars on ARR and revenue.

In addition, on March 8, 2022, we announced that we would discontinue business in Russia and Belarus which results in a $6 million impact to ARR for Fiscal 2023.

Growth rates for Adjusted ARR, Total revenue, and Subscription revenue are presented in constant currency in the table below to provide better visibility into the underlying growth of the business.

Based on information available, as of May 18, 2022, Dynatrace is issuing guidance for the first quarter Fiscal 2023 and full year Fiscal 2023 as follows:

1)

(in millions, except per share data)

Total ARR

As reported

Constant currency

Adjusted ARR growth

Total revenue

As reported

Constant currency

Subscription revenue

As reported

Constant currency

Non-GAAP operating income

Non-GAAP net income

Non-GAAP net income per diluted share

Diluted weighted average shares outstanding

Free cash flow¹

Free cash flow margin

See Appendix for definition.

Full Year Fiscal 2023

Guidance

$1,250 $1,265

26% - 27%

28% -29%

29% - 30%

$1,142 $1,158

23% - 25%

27% -28%

$1,071 - $1,086

23% - 25%

27% -28%

$257 $266

$216 - $225

$0.74

$0.77

292 - 294

$330 $345

29% - 30%

(in millions, except per share data)

Total revenue

As reported

Constant currency

Subscription revenue

As reported

Constant currency

Non-GAAP operating income

Non-GAAP net income

Q1 Fiscal 2023

Guidance

$261 $263.5

24% -26%

29% - 31%

$244.5 $246.5

24% - 25%

29% - 30%

$60 - $62

$50 - $52

Non-GAAP net income per diluted share

Diluted weighted average shares

outstanding

All growth rates are compared to the first quarter and full year of fiscal 2022 unless otherwise noted.

$0.17

$0.18

291 - 292

© 2022 Dynatrace, Inc. All Rights ReservedView entire presentation