Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

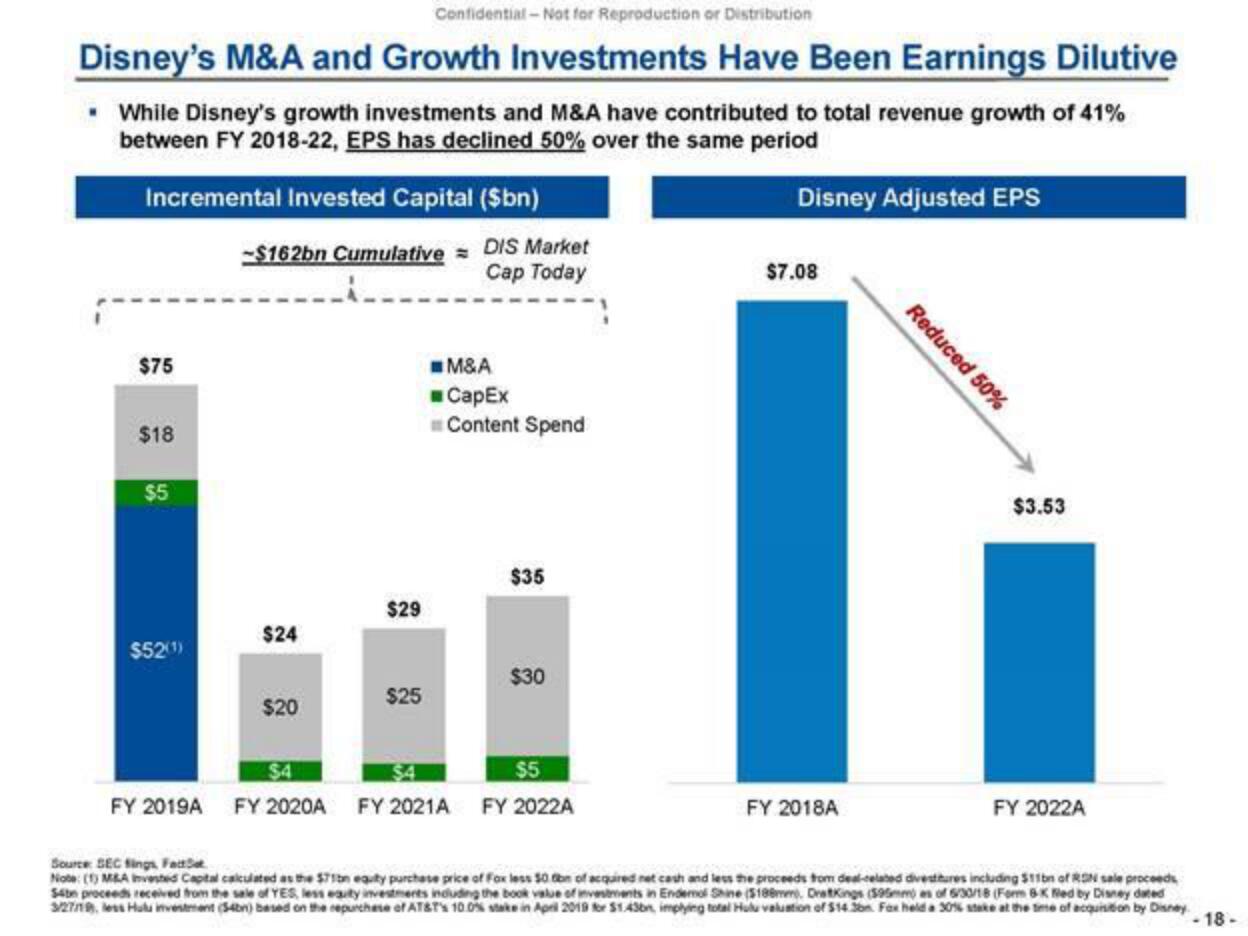

Disney's M&A and Growth Investments Have Been Earnings Dilutive

While Disney's growth investments and M&A have contributed to total revenue growth of 41%

between FY 2018-22, EPS has declined 50% over the same period

Incremental Invested Capital ($bn)

$75

$18

$5

$52(1)

-$162bn Cumulative = DIS Market

Cap Today

$24

$20

$29

$25

M&A

CapEx

Content Spend

$35

$30

$4

$5

FY 2019A FY 2020A FY 2021A FY 2022A

Disney Adjusted EPS

$7.08

FY 2018A

Reduced 50%

$3.53

FY 2022A

Source SEC fings, Facto

Note: (1) M&A invested Capital calculated as the $71bn equity purchase price of Fox less 50 ton of acquired net cash and less the proceeds from deal-related divestitures including $11bn of RON sale proceeds

54bn proceeds received from the sale of YES, less eauty investments including the book value of investments in Endemol Shine ($188mm. DratKings ($95mm) as of 6/30/18 (Form 6K Ned by Disney dated

3/27/19, less Hulu investment (54bn) based on the repurchase of AT&T's 10.0% stake in April 2019 for $1.43bn, implying total Hulu valuation of $14.36 Fax held a 30% stake at the time of acquisition by Disney

-18-View entire presentation