AT&T Results Presentation Deck

1Q21 Capital Allocation and

Liquidity Update

9

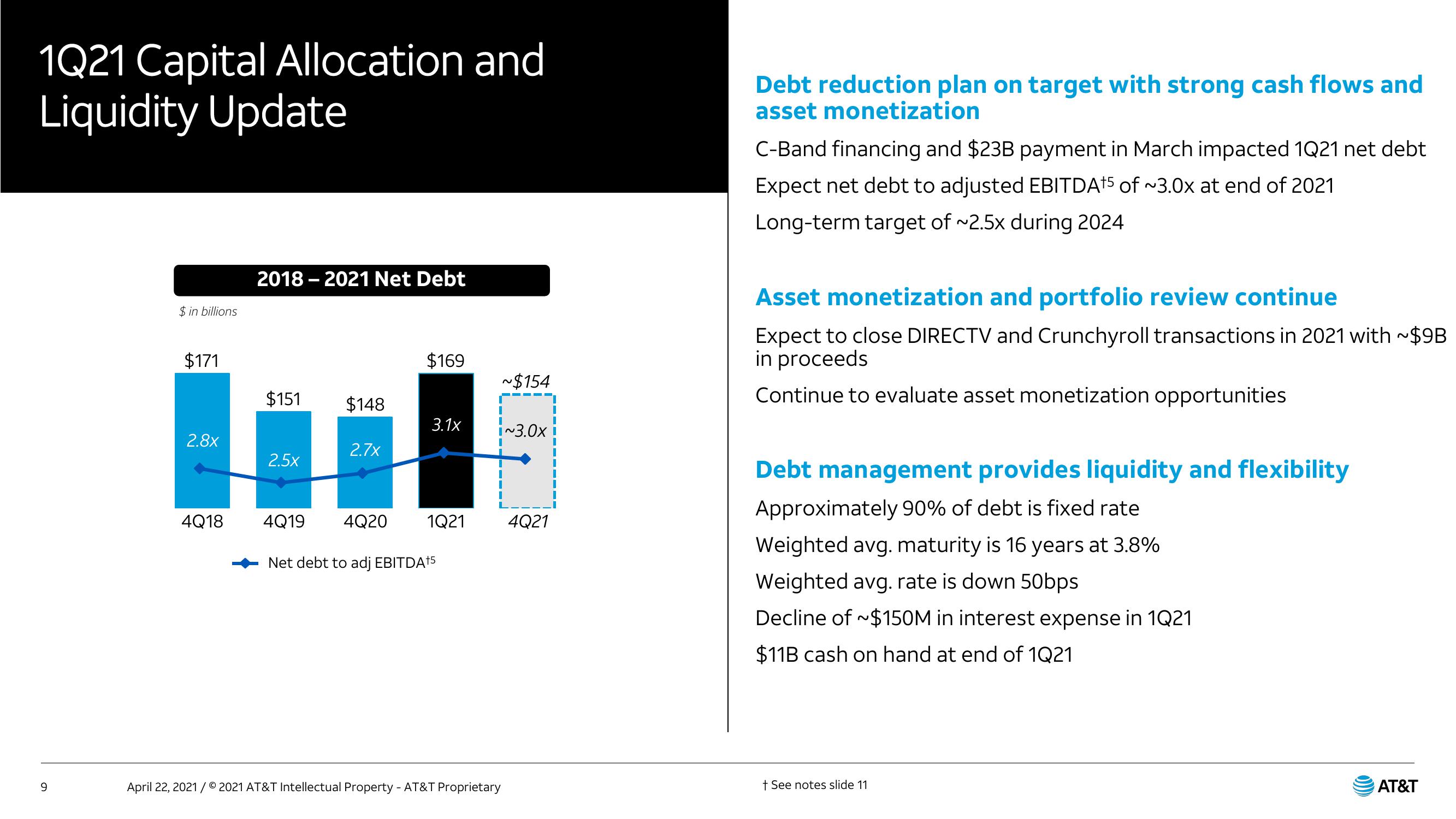

$ in billions

$171

2.8x

4Q18

2018-2021 Net Debt

$151

2.5x

$148

2.7x

$169

3.1x

4Q19 4Q20 1Q21

Net debt to adj EBITDA¹5

April 22, 2021/ © 2021 AT&T Intellectual Property - AT&T Proprietary

~$154

~3.0x

4Q21

1

|

1

Debt reduction plan on target with strong cash flows and

asset monetization

C-Band financing and $23B payment in March impacted 1Q21 net debt

Expect net debt to adjusted EBITDA15 of ~3.0x at end of 2021

Long-term target of ~2.5x during 2024

Asset monetization and portfolio review continue

Expect to close DIRECTV and Crunchyroll transactions in 2021 with ~$9B

in proceeds

Continue to evaluate asset monetization opportunities

Debt management provides liquidity and flexibility

Approximately 90% of debt is fixed rate

Weighted avg. maturity is 16 years at 3.8%

Weighted avg. rate is down 50bps

~

Decline of $150M in interest expense in 1Q21

$11B cash on hand at end of 1Q21

+ See notes slide 11

AT&TView entire presentation