Bank of America Results Presentation Deck

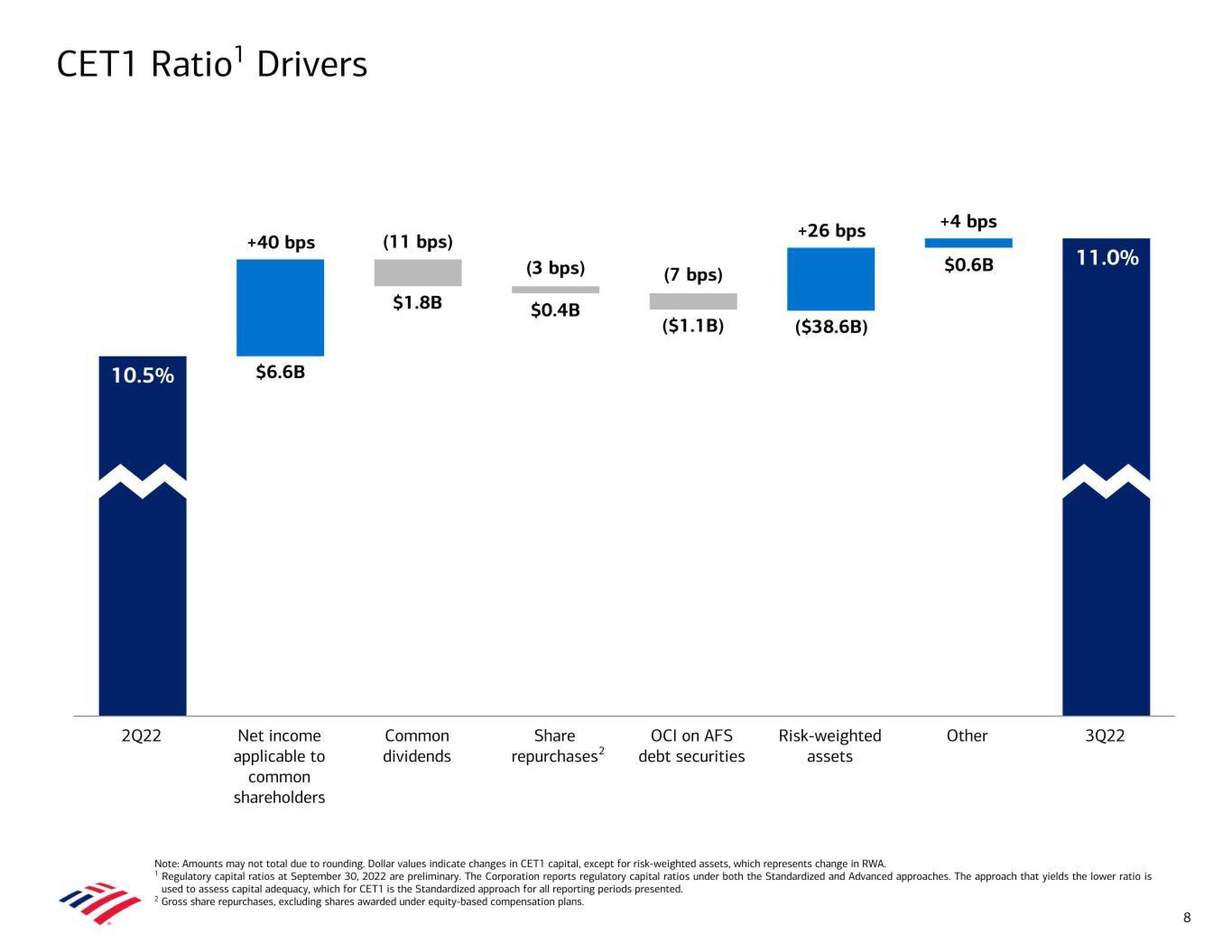

CET1 Ratio¹ Drivers

10.5%

2Q22

ill

+40 bps

$6.6B

Net income

applicable to

common

shareholders

(11 bps)

$1.8B

Common

dividends

(3 bps)

$0.4B

Share

repurchases²

(7 bps)

($1.1B)

OCI on AFS

debt securities

+26 bps

($38.6B)

Risk-weighted

assets

+4 bps

$0.6B

Other

11.0%

3Q22

Note: Amounts may not total due to rounding. Dollar values indicate changes in CET1 capital, except for risk-weighted assets, which represents change in RWA.

1

Regulatory capital ratios at September 30, 2022 are preliminary. The Corporation reports regulatory capital ratios under both the Standardized and Advanced approaches. The approach that yields the lower ratio is

used to assess capital adequacy, which for CET1 is the Standardized approach for all reporting periods presented.

2 Gross share repurchases, excluding shares awarded under equity-based compensation plans.

8View entire presentation