UBS Results Presentation Deck

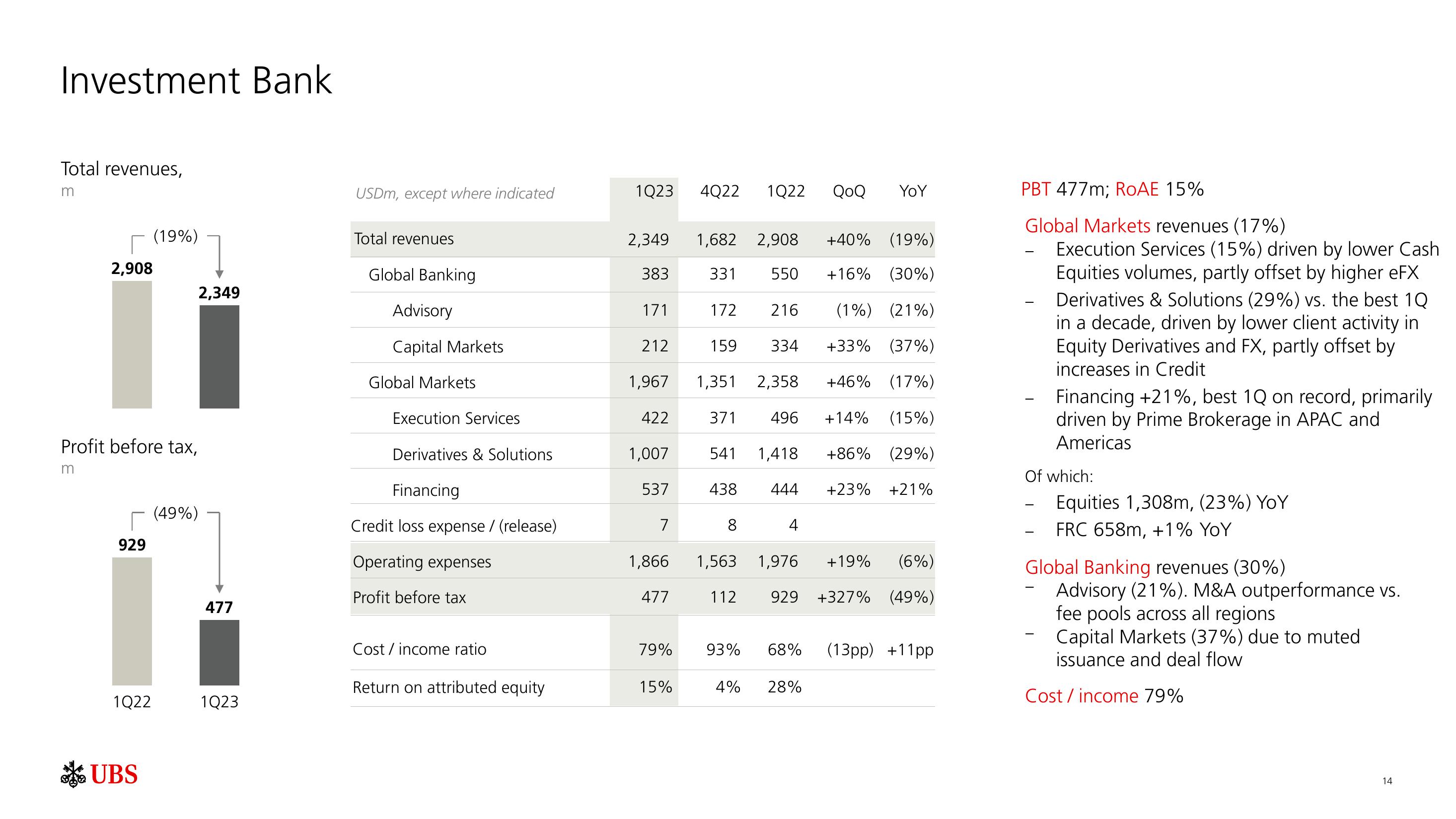

Investment Bank

Total revenues,

m

2,908

929

Profit before tax,

m

1Q22

(19%)

UBS

2,349

(49%)

477

1Q23

USDm, except where indicated

Total revenues

Global Banking

Advisory

Capital Markets

Global Markets

Execution Services

Derivatives & Solutions

Financing

Credit loss expense / (release)

Operating expenses

Profit before tax

Cost / income ratio

Return on attributed equity

1Q23 4Q22 1Q22 QoQ

2,349

383

171

212

1,967

422

1,007

537

7

1,866

477

79%

15%

172

331 550

1,682 2,908 +40% (19%)

+16% (30%)

216 (1%) (21%)

+33% (37%)

+46% (17%)

371 496 +14% (15%)

541 1,418 +86% (29%)

438

444 +23% +21%

1,351 2,358

159

8

334

93%

4

YoY

1,563 1,976

+19%

(6%)

112 929 +327% (49%)

68% (13pp) +11pp

4% 28%

PBT 477m; ROAE 15%

Global Markets revenues (17%)

Execution Services (15%) driven by lower Cash

Equities volumes, partly offset by higher eFX

Derivatives & Solutions (29%) vs. the best 1Q

in a decade, driven by lower client activity in

Equity Derivatives and FX, partly offset by

increases in Credit

Financing +21%, best 1Q on record, primarily

driven by Prime Brokerage in APAC and

Americas

Of which:

Equities 1,308m, (23%) YoY

FRC 658m, +1% YoY

Global Banking revenues (30%)

Advisory (21%). M&A outperformance vs.

fee pools across all regions

Capital Markets (37%) due to muted

issuance and deal flow

Cost/income 79%

14View entire presentation