Sotheby's Investor Briefing

WELL POSITIONED FOR CYCLICAL GROWTH OPPORTUNITY

.

#

.

#

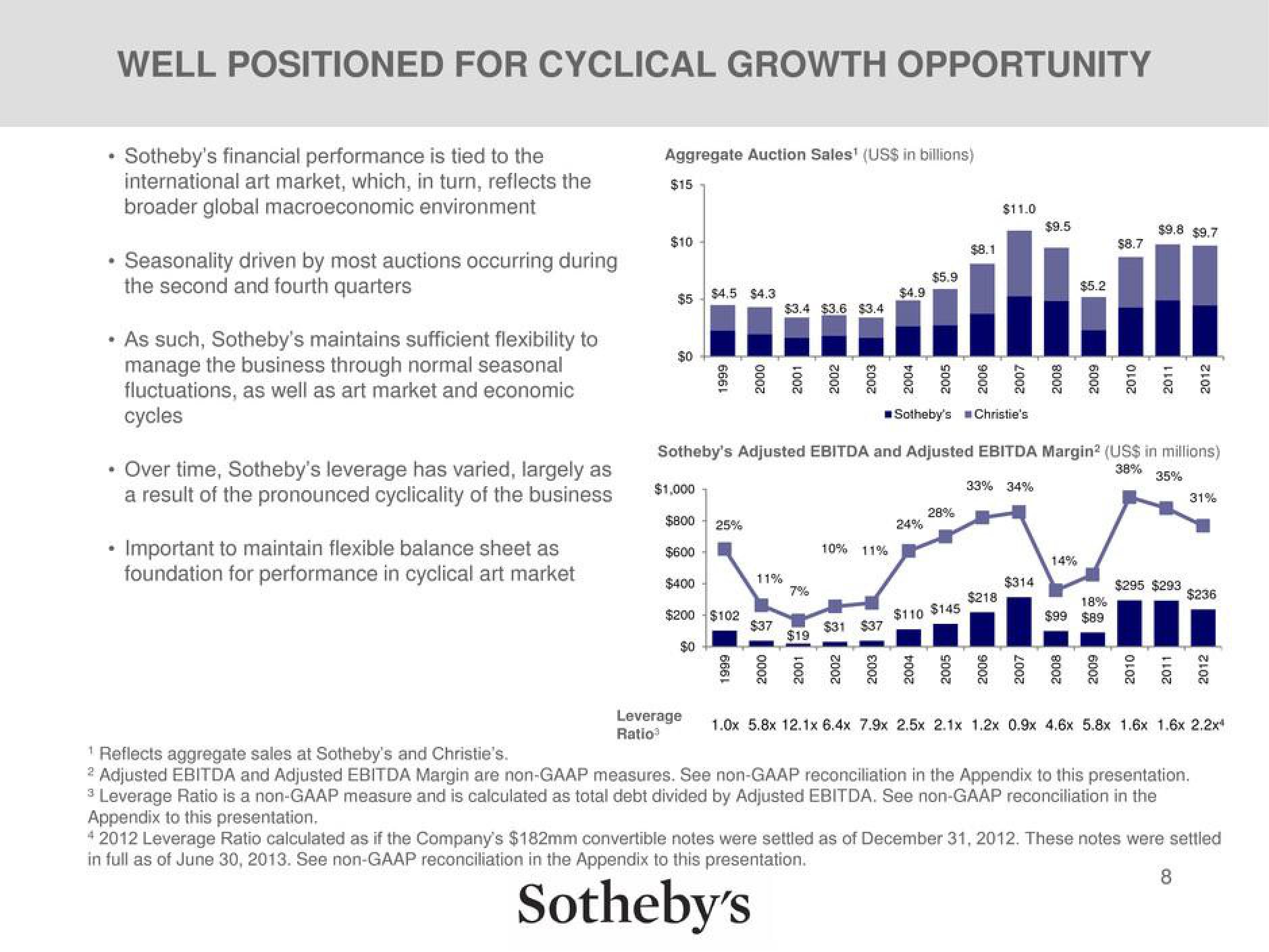

Sotheby's financial performance is tied to the

international art market, which, in turn, reflects the

broader global macroeconomic environment

Seasonality driven by most auctions occurring during

the second and fourth quarters

As such, Sotheby's maintains sufficient flexibility to

manage the business through normal seasonal

fluctuations, as well as art market and economic

cycles

Over time, Sotheby's leverage has varied, largely as

a result of the pronounced cyclicality of the business

• Important to maintain flexible balance sheet as

foundation for performance in cyclical art market

Aggregate Auction Sales¹ (US$ in billions)

$15

$10

$5

$0

$1,000

$800

$4.5 $4.3

8

6661

$0

$600

$400

$200 $102

25%

6661

Sotheby's Christie's

Sotheby's Adjusted EBITDA and Adjusted EBITDA Margin² (US$ in millions)

38%

35%

11%

$3.4 $3.6 $3.4

$37

7%

2000 €

2001

$19

10% 11%

$31 $37

$5.9

2002

2003 4

28%

$8.1

$110 $145

$11.0

33% 34%

$218

$9.5

$314

$5.2

14%

$8.7

18%

$99 $89

$9.8 $9.7

$295 $293

31%

$236

N

Leverage 1.0x 5.8x 12.1x 6.4x 7.9x 2.5x 2.1x 1.2x 0.9x 4.6x 5.8x 1.6x 1.6x 2.2x¹

Ratio

¹ Reflects aggregate sales at Sotheby's and Christie's.

2 Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. See non-GAAP reconciliation in the Appendix to this presentation.

3 Leverage Ratio is a non-GAAP measure and is calculated as total debt divided by Adjusted EBITDA. See non-GAAP reconciliation in the

Appendix to this presentation.

4 2012 Leverage Ratio calculated as if the Company's $182mm convertible notes were settled as of December 31, 2012. These notes were settled

8

in full as of June 30, 2013. See non-GAAP reconciliation in the Appendix to this presentation.

Sotheby'sView entire presentation