2nd Quarter 2021 Investor Presentation

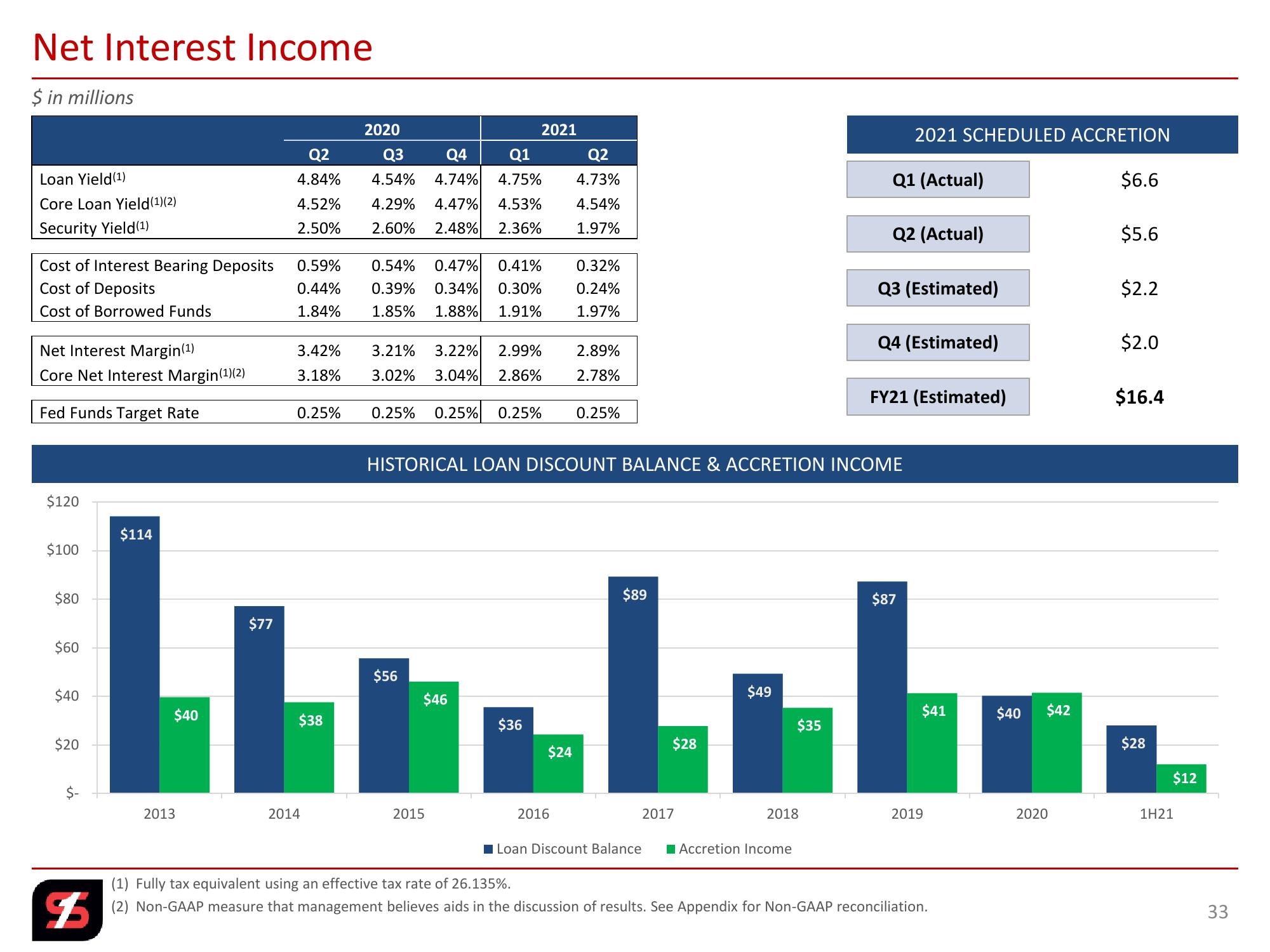

Net Interest Income

$ in millions

2020

2021

2021 SCHEDULED ACCRETION

Q2

Q3

Q4

Q1

Q2

Loan Yield(1)

4.84% 4.54% 4.74% 4.75%

4.73%

Q1 (Actual)

$6.6

Core Loan Yield (1)(2)

Security Yield(1)

4.52% 4.29% 4.47%

2.50% 2.60% 2.48%

4.53%

4.54%

2.36%

1.97%

Q2 (Actual)

$5.6

Cost of Interest Bearing Deposits

0.59%

0.54% 0.47%

0.41%

0.32%

Cost of Deposits

0.44%

0.39% 0.34%

0.30%

0.24%

Q3 (Estimated)

$2.2

Cost of Borrowed Funds

1.84%

1.85% 1.88% 1.91%

1.97%

Net Interest Margin (1)

3.42%

Core Net Interest Margin (1)(2)

3.18%

3.21% 3.22% 2.99% 2.89%

3.02% 3.04% 2.86% 2.78%

Q4 (Estimated)

$2.0

FY21 (Estimated)

$16.4

Fed Funds Target Rate

0.25%

0.25% 0.25% 0.25% 0.25%

$120

$114

$100

$80

$60

$77

HISTORICAL LOAN DISCOUNT BALANCE & ACCRETION INCOME

$89

887

$87

$40

$40

$38

$20

$56

$46

$36

$28

$24

$49

$41

$35

440

$42

$28

$-

$12

2013

2014

2015

2016

2017

2018

2019

2020

1H21

■Loan Discount Balance

Accretion Income

F

(1) Fully tax equivalent using an effective tax rate of 26.135%.

(2) Non-GAAP measure that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

33View entire presentation