Cannae SPAC Presentation Deck

Paysafe:

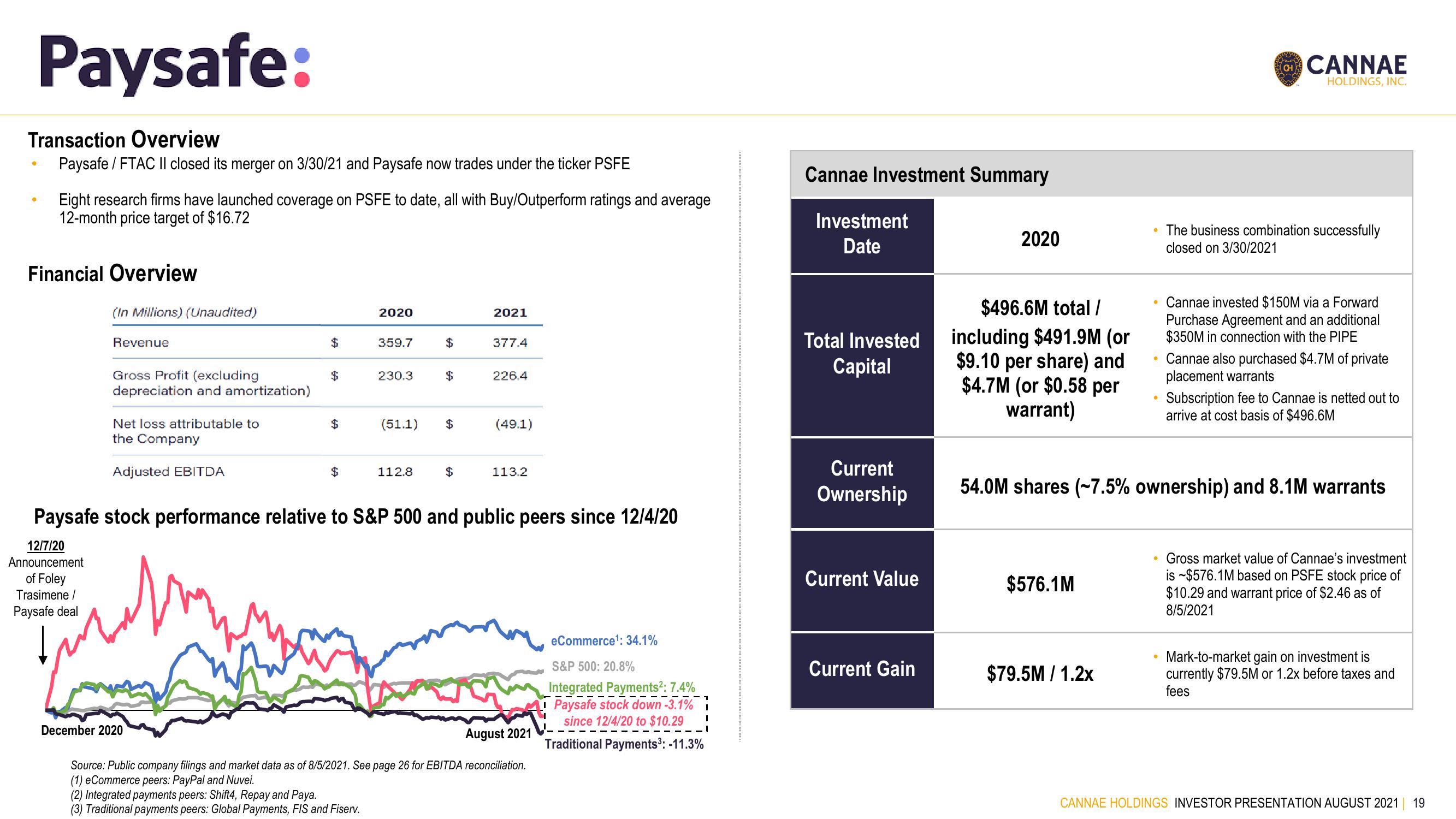

Transaction Overview

Paysafe/FTAC II closed its merger on 3/30/21 and Paysafe now trades under the ticker PSFE

0

Eight research firms have launched coverage on PSFE to date, all with Buy/Outperform ratings and average

12-month price target of $16.72

Financial Overview

(In Millions) (Unaudited)

Revenue

Gross Profit (excluding

depreciation and amortization)

Net loss attributable to

the Company

Adjusted EBITDA

$

December 2020

$

2020

359.7

(2) Integrated payments peers: Shift4, Repay and Paya.

(3) Traditional payments peers: Global Payments, FIS and Fiserv.

230.3

$

112.8

$

(51.1) $

$

2021

377.4

226.4

(49.1)

Paysafe stock performance relative to S&P 500 and public peers since 12/4/20

12/7/20

Announcement

of Foley

Trasimene /

Paysafe deal

113.2

August 2021

Source: Public company filings and market data as of 8/5/2021. See page 26 for EBITDA reconciliation.

(1) eCommerce peers: PayPal and Nuvei.

eCommerce¹: 34.1%

S&P 500: 20.8%

Integrated Payments²: 7.4%

Paysafe stock down -3.1% 1

since 12/4/20 to $10.29

Traditional Payments³: -11.3%

Cannae Investment Summary

Investment

Date

Total Invested

Capital

Current

Ownership

Current Value

Current Gain

2020

$496.6M total /

including $491.9M (or

$9.10 per share) and

$4.7M (or $0.58 per

warrant)

$576.1M

CH

$79.5M / 1.2x

CANNAE

HOLDINGS, INC.

The business combination successfully

closed on 3/30/2021

Cannae invested $150M via a Forward

Purchase Agreement and an additional

$350M in connection with the PIPE

Cannae also purchased $4.7M of private

placement warrants

54.0M shares (~7.5% ownership) and 8.1M warrants

Subscription fee to Cannae is netted out to

arrive at cost basis of $496.6M

Gross market value of Cannae's investment

is -$576.1M based on PSFE stock price of

$10.29 and warrant price of $2.46 as of

8/5/2021

Mark-to-market gain on investment is

currently $79.5M or 1.2x before taxes and

fees

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 | 19View entire presentation