Inovalon Results Presentation Deck

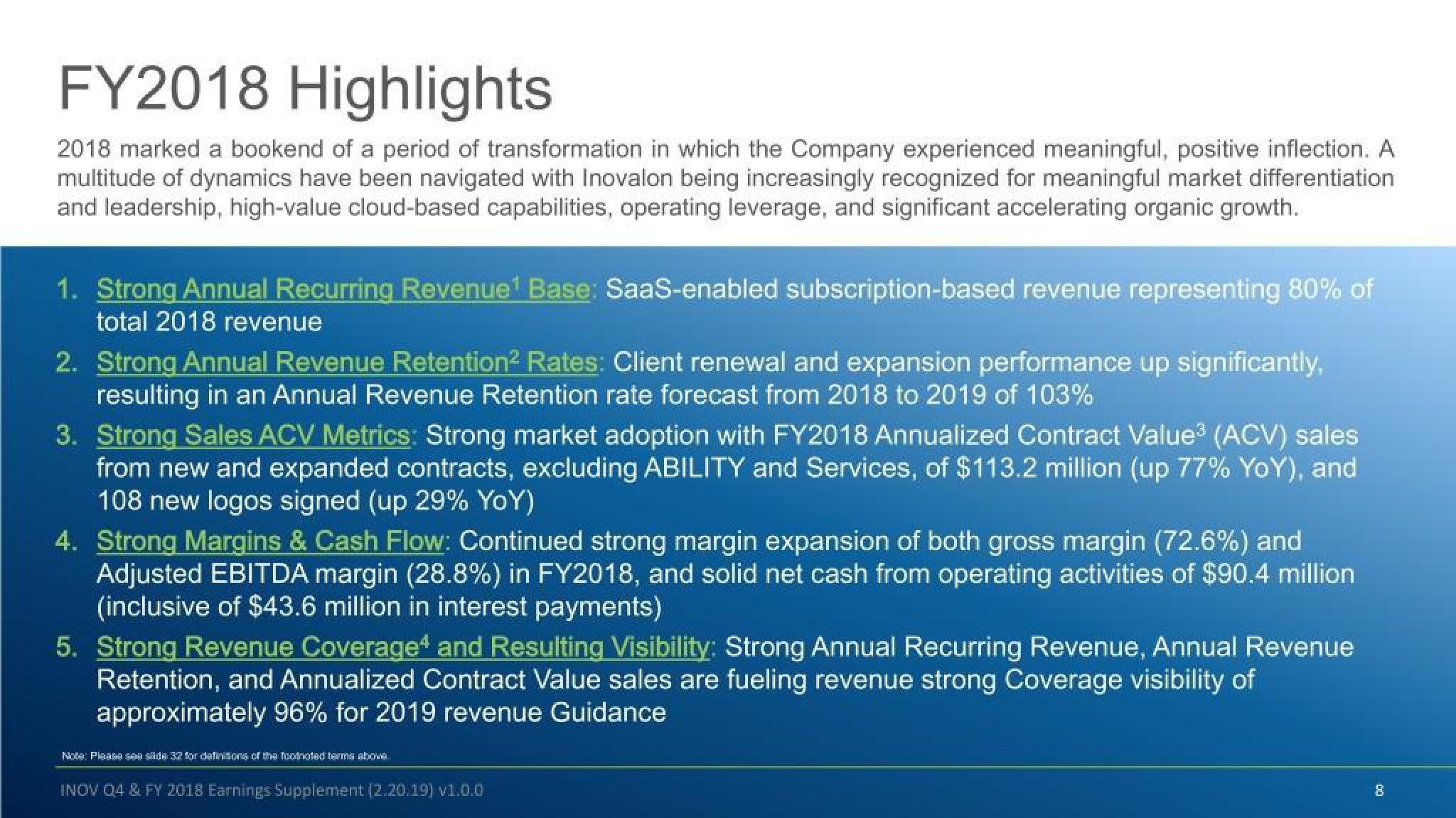

FY2018 Highlights

2018 marked a bookend of a period of transformation in which the Company experienced meaningful, positive inflection. A

multitude of dynamics have been navigated with Inovalon being increasingly recognized for meaningful market differentiation

and leadership, high-value cloud-based capabilities, operating leverage, and significant accelerating organic growth.

1. Strong Annual Recurring Revenue¹ Base: SaaS-enabled subscription-based revenue representing 80% of

total 2018 revenue

2. Strong Annual Revenue Retention² Rates: Client renewal and expansion performance up significantly,

resulting in an Annual Revenue Retention rate forecast from 2018 to 2019 of 103%

3. Strong Sales ACV Metrics: Strong market adoption with FY2018 Annualized Contract Value³ (ACV) sales

from new and expanded contracts, excluding ABILITY and Services, of $113.2 million (up 77% YoY), and

108 new logos signed (up 29% YoY)

4. Strong Margins & Cash Flow: Continued strong margin expansion of both gross margin (72.6%) and

Adjusted EBITDA margin (28.8%) in FY2018, and solid net cash from operating activities of $90.4 million

(inclusive of $43.6 million in interest payments)

5. Strong Revenue Coverage and Resulting Visibility: Strong Annual Recurring Revenue, Annual Revenue

Retention, and Annualized Contract Value sales are fueling revenue strong Coverage visibility of

approximately 96% for 2019 revenue Guidance

Note: Please see side 32 for definitions of the footnoted terms above

INOV Q4 & FY 2018 Earnings Supplement (2.20.19) v1.0.0

8View entire presentation