Better SPAC Presentation Deck

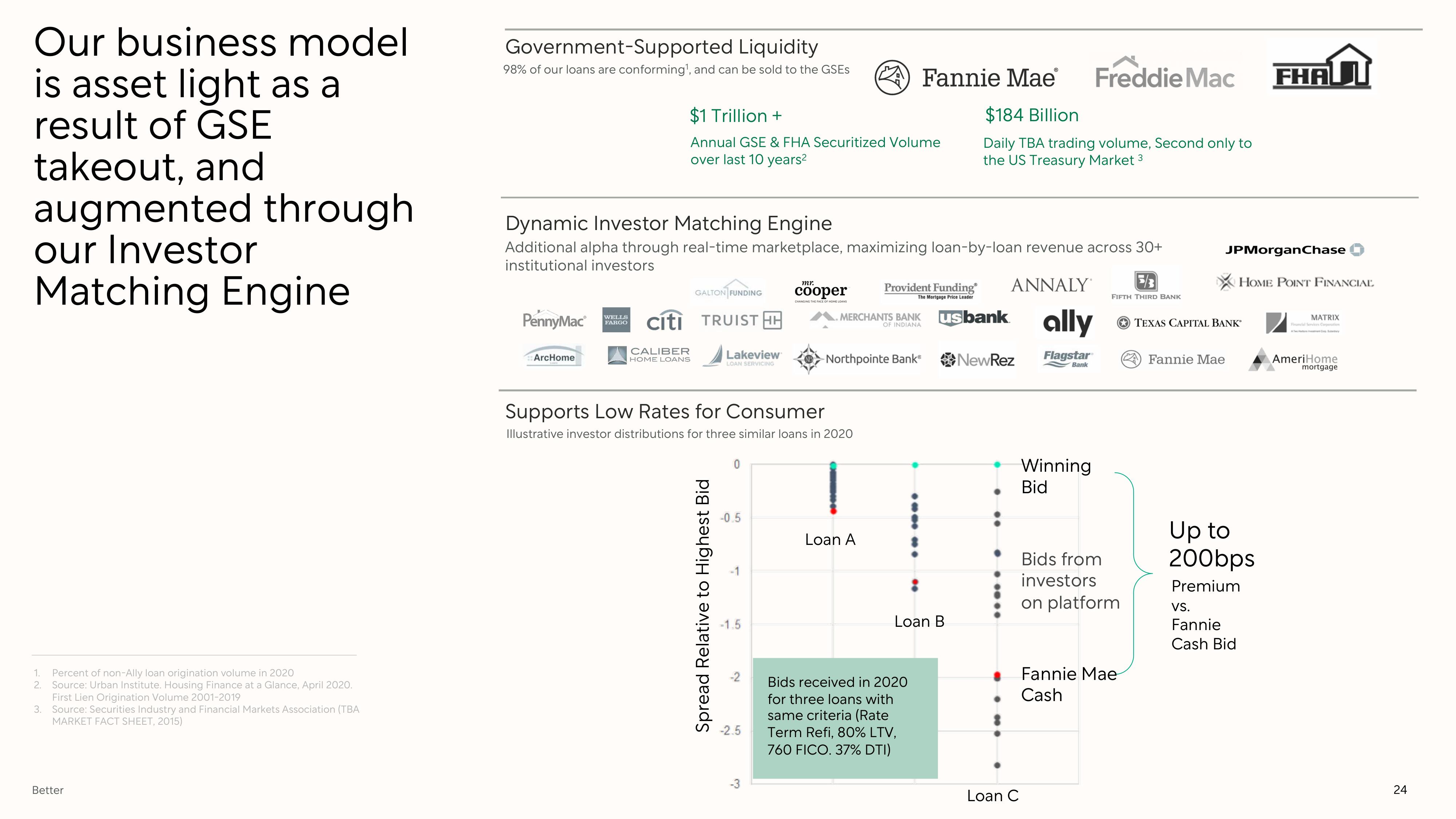

Our business model

is asset light as a

result of GSE

takeout, and

augmented through

our Investor

Matching Engine

1. Percent of non-Ally loan origination volume in 2020

2. Source: Urban Institute. Housing Finance at a Glance, April 2020.

First Lien Origination Volume 2001-2019

3. Source: Securities Industry and Financial Markets Association (TBA

MARKET FACT SHEET, 2015)

Better

Government-Supported Liquidity

98% of our loans are conforming¹, and can be sold to the GSES

PennyMac®

Dynamic Investor Matching Engine

Additional alpha through real-time marketplace, maximizing loan-by-loan revenue across 30+

institutional investors

ANNALY

ally

Flagstar

Bank

ArcHome

WELLS

FARGO

$1 Trillion +

Annual GSE & FHA Securitized Volume

over last 10 years²

GALTON FUNDING cooper

Citi TRUIST

CALIBER

HOME LOANS

Lakeview

LOAN SERVICING

Spread Relative to Highest Bid

Supports Low Rates for Consumer

Illustrative investor distributions for three similar loans in 2020

-0.5

-1.5

-2.5

-3

MERCHANTS BANK

OF INDIANA

-Northpointe Bank

Fannie Mae Freddie Mac

$184 Billion

Daily TBA trading volume, Second only to

the US Treasury Market 3

Provident Funding

The Mortgage Price Leader

Loan A

Bids received in 2020

for three loans with

same criteria (Rate

Term Refi, 80% LTV,

760 FICO. 37% DTI)

usbank

Loan B

NewRez

Loan C

Winning

Bid

5/3

FIFTH THIRD BANK

Bids from

investors

on platform

Fannie Mae

Cash

JPMorgan Chase

HOME POINT FINANCIAL

TEXAS CAPITAL BANK

Fannie Mae

Up to

200bps

Premium

FHAU

VS.

Fannie

Cash Bid

MATRIX

AmeriHome

mortgage

24View entire presentation