J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

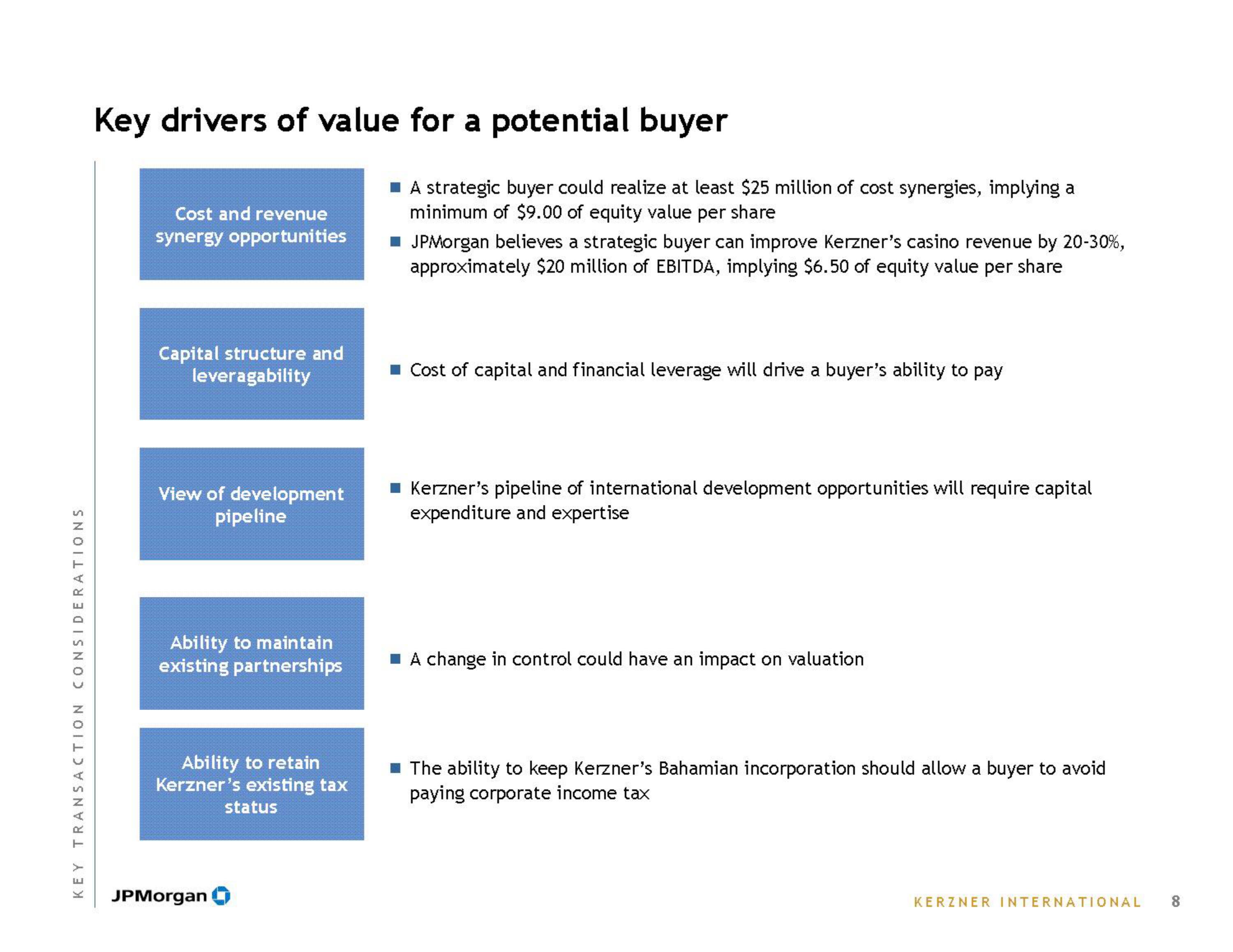

Key drivers of value for a potential buyer

Cost and revenue

synergy opportunities

Capital structure and

leveragability

View of development

pipeline

Ability to maintain

existing partnerships

Ability to retain

Kerzner's existing tax

status

JPMorgan

A strategic buyer could realize at least $25 million of cost synergies, implying a

minimum of $9.00 of equity value per share

■ JPMorgan believes a strategic buyer can improve Kerzner's casino revenue by 20-30%,

approximately $20 million of EBITDA, implying $6.50 of equity value per share

■ Cost of capital and financial leverage will drive a buyer's ability to pay

■ Kerzner's pipeline of international development opportunities will require capital

expenditure and expertise

■ A change in control could have an impact on valuation

■ The ability to keep Kerzner's Bahamian incorporation should allow a buyer to avoid

paying corporate income tax

KERZNER INTERNATIONAL

8View entire presentation