Comcast Results Presentation Deck

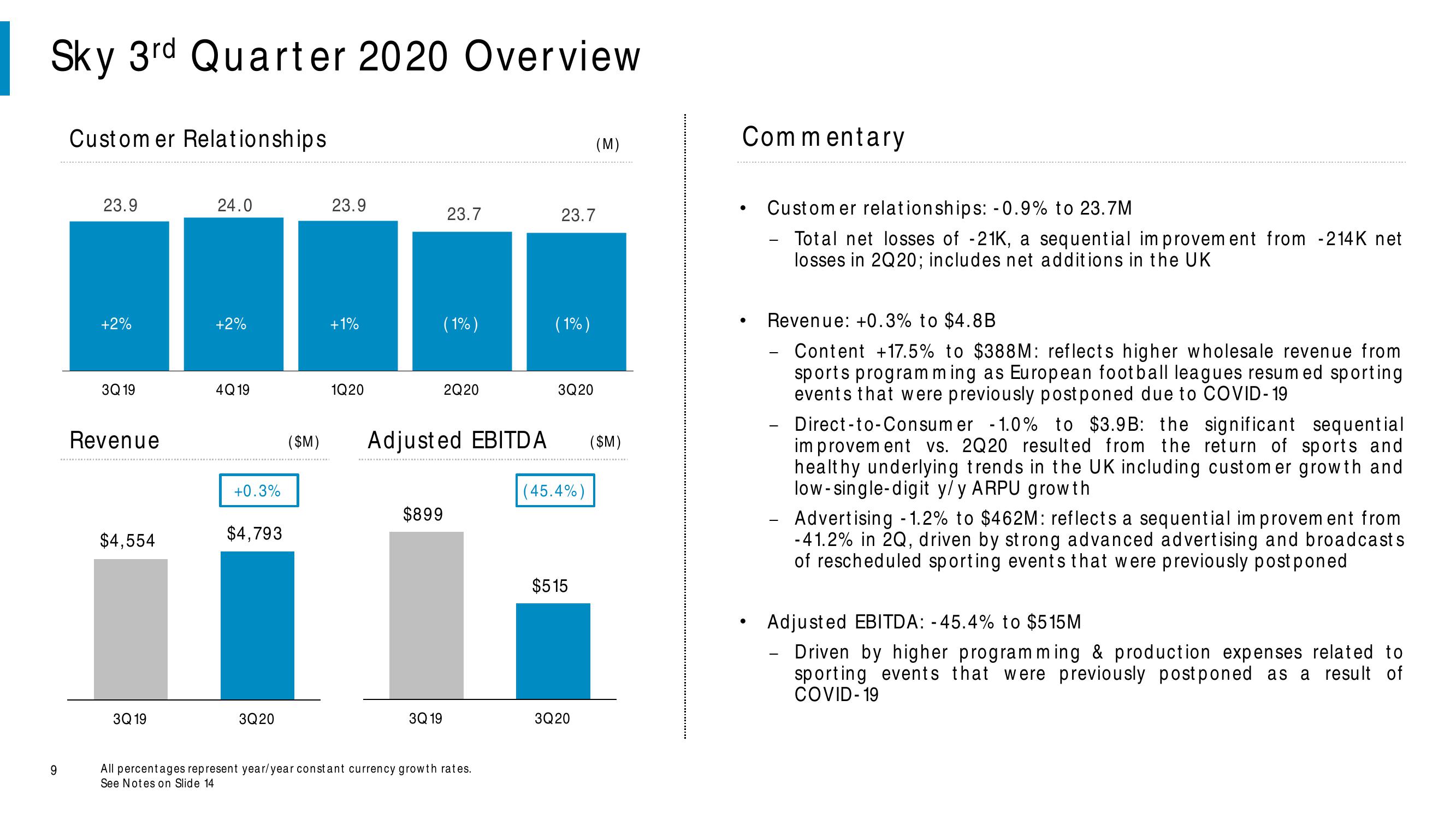

Sky 3rd Quarter 2020 Overview

9

Customer Relationships

23.9

+2%

3Q 19

Revenue

$4,554

3Q 19

24.0

+2%

4Q 19

+0.3%

$4,793

3Q20

23.9

+1%

1Q20

23.7

(1%)

3Q 19

2Q20

$899

All percentages represent year/year constant currency growth rates.

See Notes on Slide 14

23.7

(1%)

($M) Adjusted EBITDA ($M)

3Q20

(45.4%)

(M)

$515

3Q 20

Commentary

●

●

●

Customer relationships: -0.9% to 23.7M

Total net losses of -21K, a sequential improvement from -214K net

losses in 2Q20; includes net additions in the UK

Revenue: +0.3% to $4.8B

Content +17.5% to $388M: reflects higher wholesale revenue from

sports programming as European football leagues resumed sporting

events that were previously postponed due to COVID-19

-

Direct-to-Consumer -1.0% to $3.9B: the significant sequential

improvement vs. 2Q20 resulted from the return of sports and

healthy underlying trends in the UK including customer growth and

low-single-digit y/y ARPU growth

Advertising - 1.2% to $462M: reflects a sequential improvement from

-41.2% in 2Q, driven by strong advanced advertising and broadcasts

of rescheduled sporting events that were previously postponed

Adjusted EBITDA: -45.4% to $515M

Driven by higher programming & production expenses related to

sporting events that were previously postponed as a result of

COVID-19View entire presentation