Blackwells Capital Activist Presentation Deck

BW

1

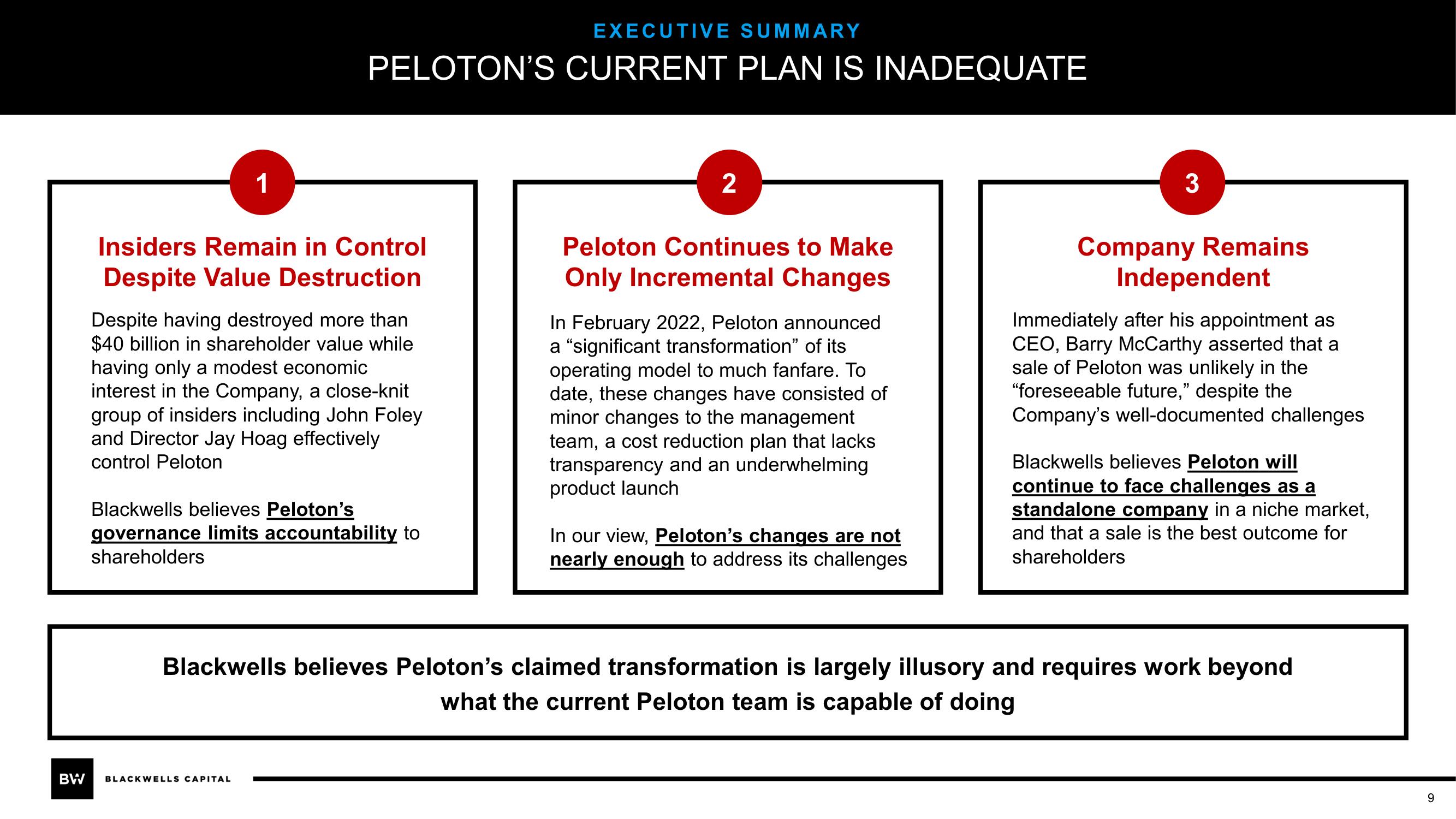

EXECUTIVE SUMMARY

PELOTON'S CURRENT PLAN IS INADEQUATE

Insiders Remain in Control

Despite Value Destruction

Despite having destroyed more than

$40 billion in shareholder value while

having only a modest economic

interest in the Company, a close-knit

group of insiders including John Foley

and Director Jay Hoag effectively

control Peloton

Blackwells believes Peloton's

governance limits accountability to

shareholders

BLACKWELLS CAPITAL

2

Peloton Continues to Make

Only Incremental Changes

In February 2022, Peloton announced

a "significant transformation" of its

operating model to much fanfare. To

date, these changes have consisted of

minor changes to the management

team, a cost reduction plan that lacks

transparency and an underwhelming

product launch

In our view, Peloton's changes are not

nearly enough to address its challenges

3

Company Remains

Independent

Immediately after his appointment as

CEO, Barry McCarthy asserted that a

sale of Peloton was unlikely in the

"foreseeable future," despite the

Company's well-documented challenges

Blackwells believes Peloton will

continue to face challenges as a

standalone company in a niche market,

and that a sale is the best outcome for

shareholders

Blackwells believes Peloton's claimed transformation is largely illusory and requires work beyond

what the current Peloton team is capable of doing

9View entire presentation