Experian ESG Presentation Deck

Executive Summary

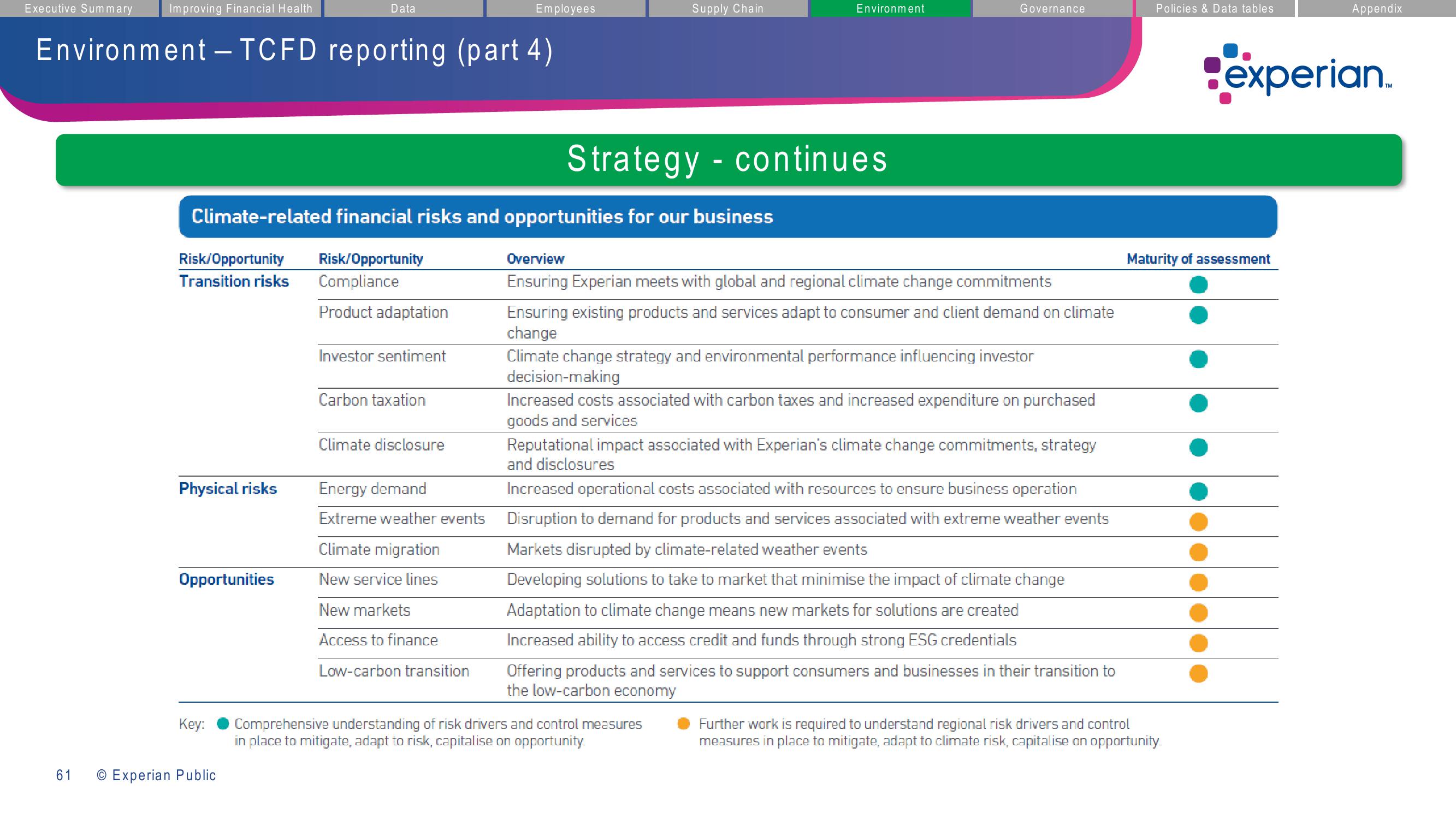

Environment - TCFD reporting (part 4)

61

Improving Financial Health

Risk/Opportunity

Transition risks

Physical risks

Opportunities

Climate-related financial risks and opportunities for our business

Risk/Opportunity

Compliance

Product adaptation

Key:

Data

O Experian Public

Investor sentiment

Carbon taxation

Climate disclosure

Employees

Energy demand

Extreme weather events

Climate migration

New service lines

New markets

Access to finance

Low-carbon transition

Supply Chain

Strategy - continues

Environment

Governance

Overview

Ensuring Experian meets with global and regional climate change commitments

Comprehensive understanding of risk drivers and control measures

in place to mitigate, adapt to risk, capitalise on opportunity.

Ensuring existing products and services adapt to consumer and client demand on climate

change

Climate change strategy and environmental performance influencing investor

decision-making

Increased costs associated with carbon taxes and increased expenditure on purchased

goods and services

Reputational impact associated with Experian's climate change commitments, strategy

and disclosures

Increased operational costs associated with resources to ensure business operation

Disruption to demand for products and services associated with extreme weather events

Markets disrupted by climate-related weather events

Developing solutions to take to market that minimise the impact of climate change

Adaptation to climate change means new markets for solutions are created

Increased ability to access credit and funds through strong ESG credentials

Offering products and services to support consumers and businesses in their transition to

the low-carbon economy

Policies & Data tables

Maturity of assessment

Further work is required to understand regional risk drivers and control

measures in place to mitigate, adapt to climate risk, capitalise on opportunity.

Appendix

experian.View entire presentation