Kore Investor Presentation Deck

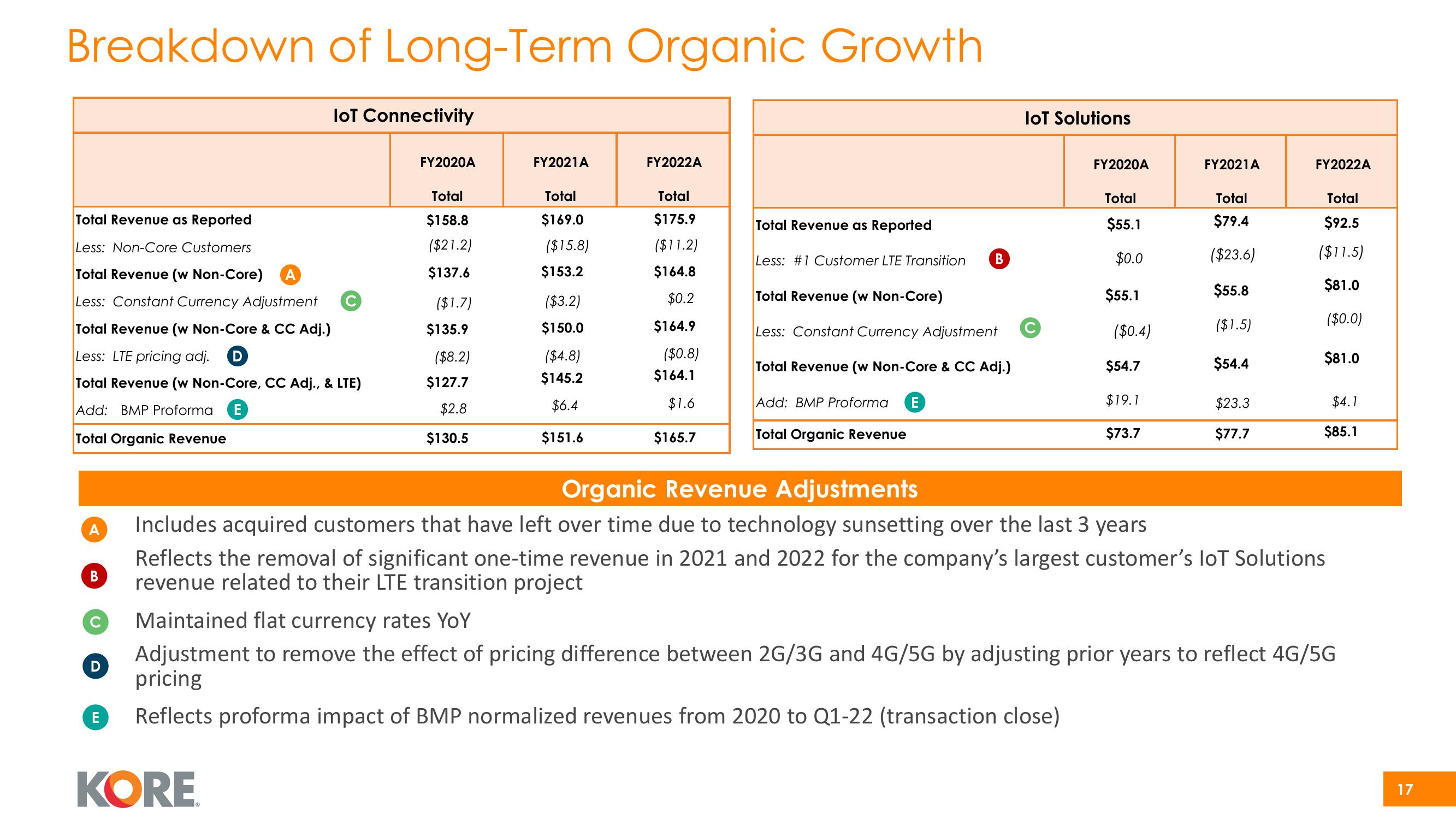

Breakdown of Long-Term Organic Growth

Total Revenue as Reported

Less: Non-Core Customers

Total Revenue (w Non-Core) A

Less: Constant Currency Adjustment

Total Revenue (w Non-Core & CC Adj.)

Less: LTE pricing adj. D

Total Revenue (w Non-Core, CC Adj., & LTE)

Add: BMP Proforma

E

Total Organic Revenue

A

B

D

E

IoT Connectivity

FY2020A

KORE

Total

$158.8

($21.2)

$137.6

($1.7)

$135.9

($8.2)

$127.7

$2.8

$130.5

FY2021A

Total

$169.0

($15.8)

$153.2

($3.2)

$150.0

($4.8)

$145.2

$6.4

$151.6

FY2022A

Total

$175.9

($11.2)

$164.8

$0.2

$164.9

($0.8)

$164.1

$1.6

$165.7

Total Revenue as Reported

Less: #1 Customer LTE Transition B

Total Revenue (w Non-Core)

Less: Constant Currency Adjustment

Total Revenue (w Non-Core & CC Adj.)

Add: BMP Proforma E

Total Organic Revenue

IoT Solutions

FY2020A

Total

$55.1

$0.0

$55.1

($0.4)

$54.7

$19.1

$73.7

FY2021A

Total

$79.4

($23.6)

$55.8

($1.5)

$54.4

$23.3

$77.7

FY2022A

Total

$92.5

($11.5)

$81.0

($0.0)

$81.0

$4.1

$85.1

Organic Revenue Adjustments

Includes acquired customers that have left over time due to technology sunsetting over the last 3 years

Reflects the removal of significant one-time revenue in 2021 and 2022 for the company's largest customer's loT Solutions

revenue related to their LTE transition project

Maintained flat currency rates YoY

Adjustment to remove the effect of pricing difference between 2G/3G and 4G/5G by adjusting prior years to reflect 4G/5G

pricing

Reflects proforma impact of BMP normalized revenues from 2020 to Q1-22 (transaction close)

17View entire presentation