Bausch+Lomb Results Presentation Deck

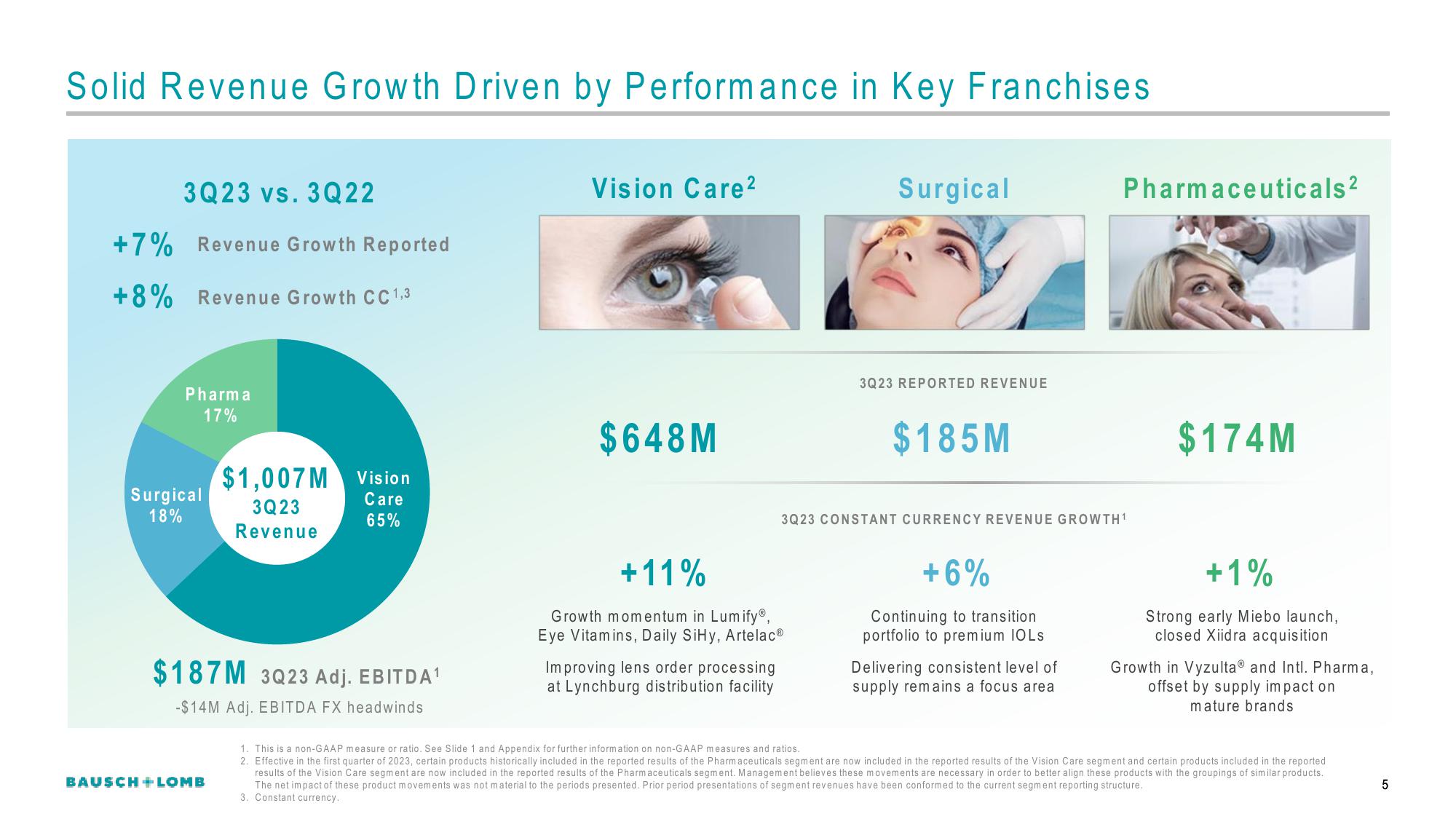

Solid Revenue Growth Driven by Performance in Key Franchises

3Q23 vs. 3Q22

+7% Revenue Growth Reported

+8% Revenue Growth CC ¹,3

Pharma

17%

Surgical

18%

$1,007 M Vision

Care

65%

BAUSCH+ LOMB

3Q23

Revenue

$187M 3023 Adj. EBITDA¹

-$14M Adj. EBITDA FX headwinds

Vision Care²

$648M

Surgical

+11%

Growth momentum in Lumify®,

Eye Vitamins, Daily SiHy, Artelac®

Improving lens order processing

at Lynchburg distribution facility

3Q23 REPORTED REVENUE

$185M

3Q23 CONSTANT CURRENCY REVENUE GROWTH ¹

Pharmaceuticals ²

+6%

Continuing to transition

portfolio to premium IOLS

Delivering consistent level of

supply remains a focus area

$174M

+1%

Strong early Miebo launch,

closed Xiidra acquisition

Growth in VyzultaⓇ and Intl. Pharma,

offset by supply impact on

mature brands

1. This is a non-GAAP measure or ratio. See Slide 1 and Appendix for further information on non-GAAP measures and ratios.

2. Effective in the first quarter of 2023, certain products historically included in the reported results of the Pharmaceuticals segment are now included in the reported results of the Vision Care segment and certain products included in the reported

results of the Vision Care segment are now included in the reported results of the Pharmaceuticals segment. Management believes these movements are necessary in order to better align these products with the groupings of similar products..

The net impact of these product movements was not material to the periods presented. Prior period presentations of segment revenues have been conformed to the current segment reporting structure.

3. Constant currency.

5View entire presentation