Evercore Investment Banking Pitch Book

Financial Analysis

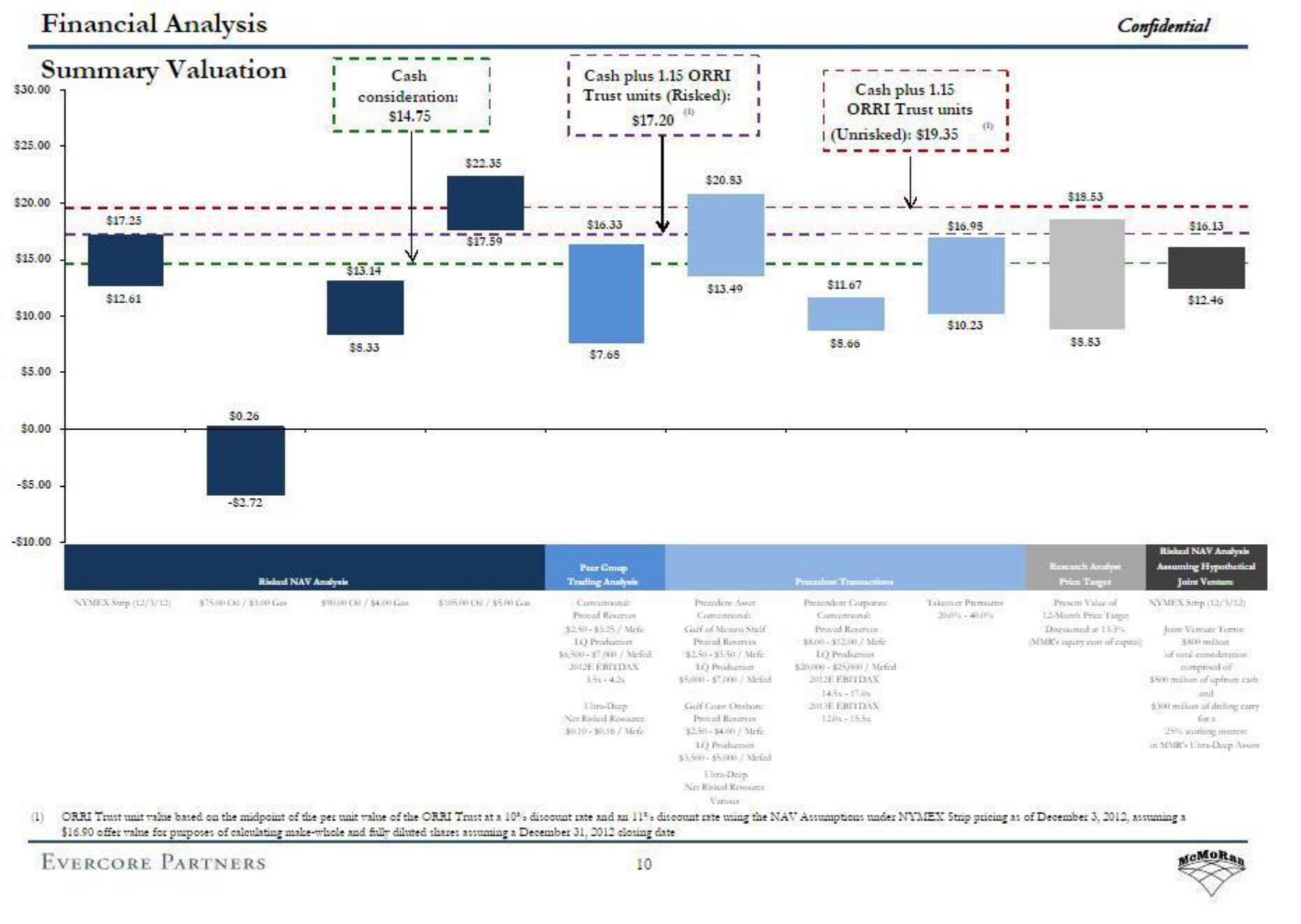

Summary Valuation

$30.00

$25.00

$20.00

$15.00

$10.00

$5.00

$0.00

-$5.00

-$10.00

$17.25

(L)

$12.61

NYMEX Strip (12/1/12)

1

I

$0.26

-$2.72

1

I

I

Cash

consideration:

$14.75

$13.14

Rinloed NAV Analywin

$75.000/$300 Gav

$8.33

59000C/54.00

$22.35

$10500/350 Ga

I Cash plus 1.15 ORRI

I Trust units (Risked):

$17.20

(1)

I

I-

$16.33

$7.68

Peer Group

Trating Analyvin

Proved Reserves

$2.50-$3.25/Mefe

I) Prodamon

$6,500-$700/Mefed

2612EEBIDAX

Ner Rod ReLICE

$010-058/Mefe

$20.83

$13.49

Przedem Ar

Gulf of Micro Shaif

Prod Reserves

$250-$3.50/Mefe

LC) Product

Gulf C Ossbon

Proved Reserv

$250-54.00/Mefic

1) Produ

1

Cash plus 1.15

ORRI Trust units

1

| (Unrisked): $19.35

$11.67

$5.66

Procasten Train

Pretendent Corporac

Can

Pred Reserves

$800-3:200/Mele

LQ Produm

$2000-$250/ Mefed

2012E EBITDAX

145-17.0x

2016 EBTIDAX

120-155

$16.98

$10.23

Takeover Prem

$18.53

$8.83

Confidential

Rich Analys

Price Target

Prom Value of

12-More Pric Lange

Documed a 133%

(MMR's uryce of capital

$16.13

Lira-Deep

Ner Rished Revo

Vans

ORRI Trust it raine based on the midpoint of the per unit value of the ORRI Trust at a 10% discount rate and an 11% discount rate using the NAV Assumptions under NYMEX Staip pricing as of December 3, 2012, assuming a

$16.90 offer value for purposes of calculating make-whole and fally diluted shares assuming a December 31, 2012 closing date

EVERCORE PARTNERS

10

$12.46

Rinked NAV Analyxi

Assuming Hypothetical

Jain Venture

NYMEX Smp (12/1/12)

Jan Venne Vime

of min condon

imprid of

$50 min af upinam cad

$3000m of decling carry

wurking in

in MMR's Lia-Deup Asses

MCMoRanView entire presentation