SmileDirectClub Investor Presentation Deck

Gross Margin.

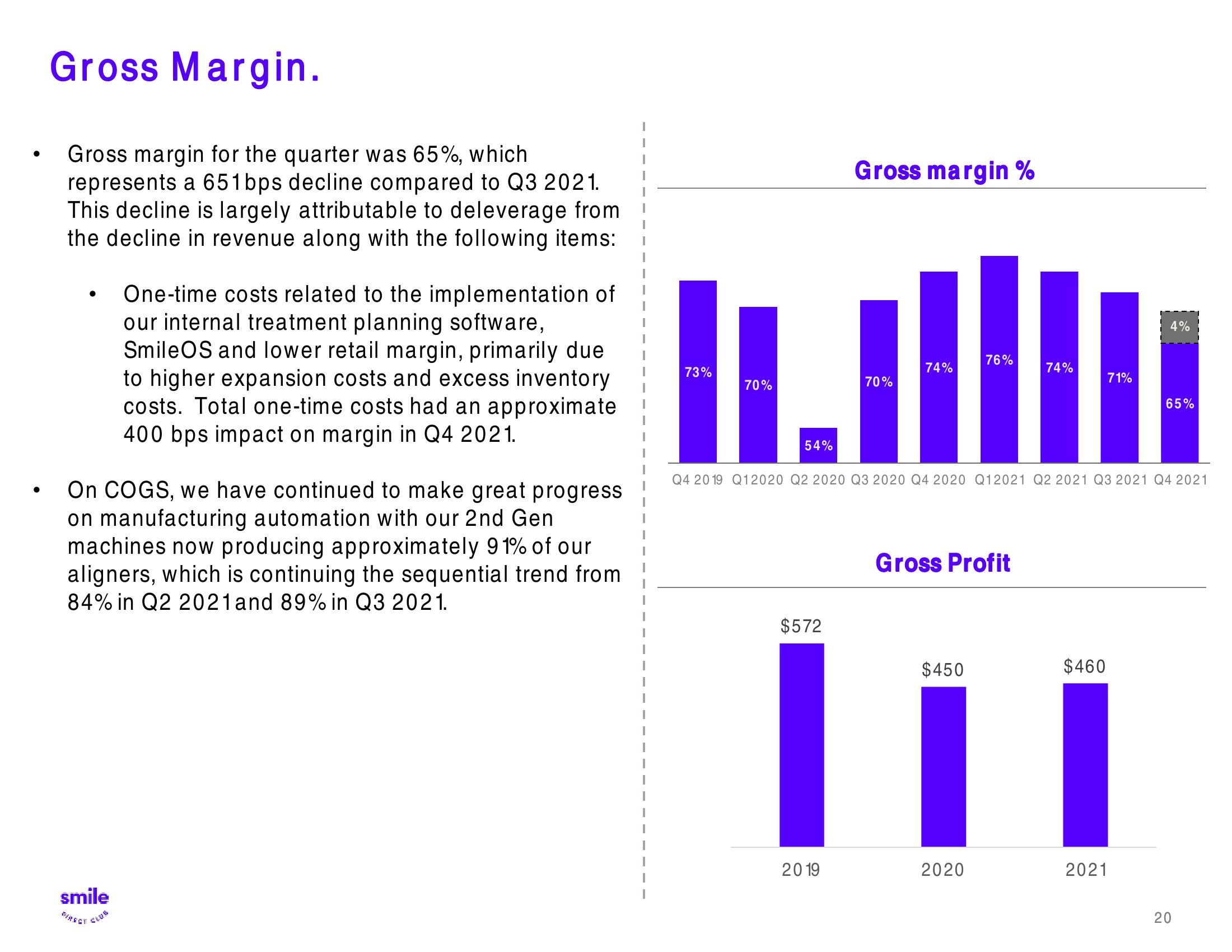

Gross margin for the quarter was 65%, which

represents a 651bps decline compared to Q3 2021.

This decline is largely attributable to deleverage from

the decline in revenue along with the following items:

On COGS, we have continued to make great progress

on manufacturing automation with our 2nd Gen

machines now producing approximately 91% of our

aligners, which is continuing the sequential trend from

84% in Q2 2021 and 89% in Q3 2021.

smile

One-time costs related to the implementation of

our internal treatment planning software,

SmileOS and lower retail margin, primarily due

to higher expansion costs and excess inventory

costs. Total one-time costs had an approximate

400 bps impact on margin in Q4 2021.

CLUB

73%

70%

54%

$572

Gross margin%

70%

2019

74%

76%

74%

Gross Profit

Q4 2019 Q12020 Q2 2020 Q3 2020 Q4 2020 Q12021 Q2 2021 Q3 2021 Q4 2021

71%

$450

III

2020

$460

4%

2021

65%

20View entire presentation