Q2 2018 Fixed Income Investor Conference Call

Liquidity

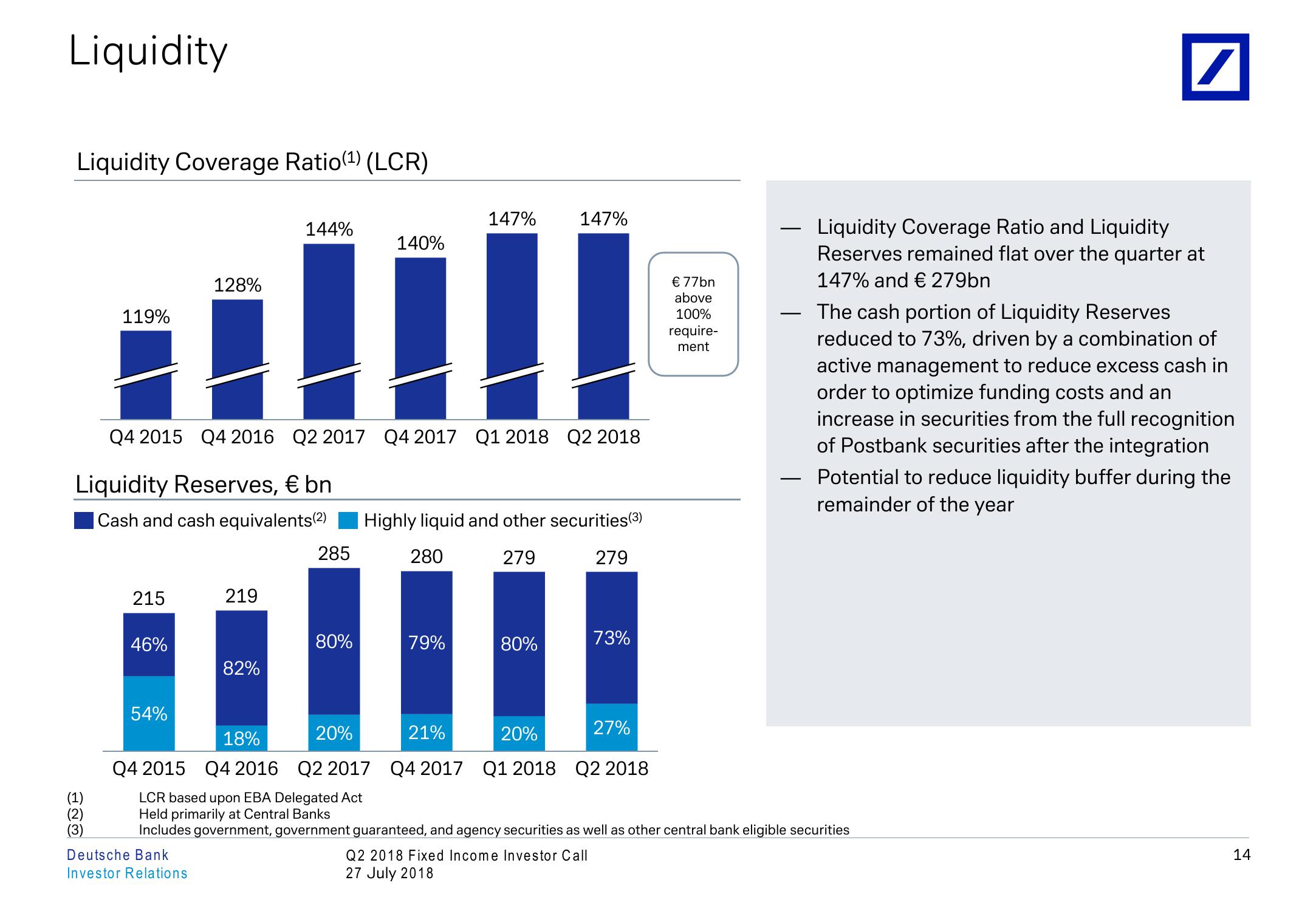

Liquidity Coverage Ratio (1) (LCR)

128%

119%

147%

147%

144%

140%

Q4 2015 Q4 2016 Q2 2017 Q4 2017 Q1 2018 Q2 2018

Liquidity Reserves, € bn

| Cash and cash equivalents(2)

Highly liquid and other securities (3)

285

280

279

279

215

219

46%

80%

79%

80%

73%

82%

54%

18%

20%

21%

20%

27%

☑

€ 77bn

above

100%

require-

ment

―

Liquidity Coverage Ratio and Liquidity

Reserves remained flat over the quarter at

147% and € 279bn

The cash portion of Liquidity Reserves

reduced to 73%, driven by a combination of

active management to reduce excess cash in

order to optimize funding costs and an

increase in securities from the full recognition

of Postbank securities after the integration

Potential to reduce liquidity buffer during the

remainder of the year

Q4 2015 Q4 2016 Q2 2017 Q4 2017 Q1 2018 Q2 2018

LCR based upon EBA Delegated Act

Held primarily at Central Banks

Includes government, government guaranteed, and agency securities as well as other central bank eligible securities

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

14View entire presentation